There are a plethora of gold loan companies in India, all competing for your attention and your golden jewelry.

From traditional banks to new-age fintech startups, the options can be overwhelming. But fear not, as I have done the research for you and narrowed it down to the 5 best gold loan companies in India.

5 Best Gold Loan Companies in India

Gold loan has been an important aspect of Indian finance for centuries, and for good reason.

In a country where gold is not only a status symbol but also considered an auspicious metal, it makes perfect sense to use it as collateral for a loan.

In India, there are plenty of gold loan companies to choose from, but which ones are the best? Here are the top 5 gold loan companies in India:

SBI Gold Loan

If you’re looking for a reliable and trustworthy gold loan provider, look no further than the State Bank of India. With interest rates as low as 7.50% p.a., SBI gold loan is one of the most affordable options on the market. Plus, the loan amount can go up to Rs. 50 lakh, which is enough to fund your wildest dreams.

Pros: Low-interest rates, high loan amount, and flexible repayment options.

Cons: You need to have gold ornaments verified for quality and quantity to be eligible for the loan.

IIFL Gold Loan

If you’re in a rush and need cash fast, IIFL Gold Loan might be the right choice for you. With loan disbursal time as low as 30 minutes, you can get your money in a jiffy. Plus, the interest rates start at just 9.24% p.a., which is quite reasonable.

Pros: Quick loan disbursal, reasonable interest rates, and customized schemes.

Cons: Limited loan tenure.

Manappuram Online Gold Loan

If you need a large amount of money and don’t mind paying a slightly higher interest rate, Manappuram Gold Loan might be the way to go. You can get a loan of up to Rs. 1.5 crore, which is a pretty hefty sum. Plus, they offer different schemes to meet your requirements.

Pros: High loan amount, different schemes, and low-interest rates for certain schemes. Cons: High-interest rates for certain schemes.

Muthoot Finance Gold Loan

Muthoot Finance is one of the most popular gold loan companies in India, and for a good reason. With interest rates starting at just 12% p.a., they offer affordable loans to people from all walks of life. Plus, the loan tenure can go up to 36 months, giving you plenty of time to repay the loan.

Pros: Low-interest rates, high loan amount, and long loan tenure.

Cons: None, really.

Rupeek Gold Loan

Last but not least, we have Rupeek Gold Loan. With loan amounts starting at just Rs. 5,000, Rupeek offers a more affordable option for people who don’t need a large amount of money. Plus, they offer doorstep service, which is a nice touch.

Pros: Affordable loan amount, doorstep service, and reasonable interest rates.

Cons: Limited loan tenure.

Comparison of Top 5 Gold Loan Companies

To help you get a clear idea of the differences between the top 5 gold loan companies in India, we’ve put together this handy comparison table:

| Bank/NBFC | Interest Rates | Loan Amount | Loan Tenure | Processing Fee |

|---|---|---|---|---|

| SBI Gold Loan | 7.50% onwards | Rs. 20,000 to Rs. 50 lakh | Up to 36 months | Nil (if applied through YONO), otherwise 0.25% + GST, Min. Rs. 250 + GST |

| IIFL Gold loan | 9.24% onwards | Rs. 3,000 onwards | 3 to 11 months | 1 % onwards |

| Manappuram Gold Loan | Up to 29% p.a. | Rs. 1,000 to Rs. 1.5 crore | Minimum 3 months | Rs. 10 at the time of loan settlement, Additional Processing Fee on Repledge- 0.07% of New Pledge Value |

| Muthoot Finance Gold Loan | 12% onwards | Rs. 1,500 to No Limit | 7 days to 36 months | 0.25% to 1% of the loan amount |

| Rupeek Gold Loan | Starting at 0.79% per month | Rs. 5,000 to Rs. 1 crore | 3 to 36 months | 0.05% to 4.99% of the loan amount |

Our Suggestion

Out of all the gold loan companies, Manappuram Gold Loan stands out due to its maximum loan amount of Rs. 1.5 crore and the option to choose between the ‘High Loan to Value’ and ‘Low Interest Rate’ schemes. The interest rate of up to 29% p.a. might seem a bit high, but it is still a good option for those who need a larger amount of money. Plus, the additional processing fee on repledge is only 0.07% of the new pledge value, which is relatively low compared to other companies. So, if you are looking for a larger loan amount with flexible schemes, Manappuram Gold Loan is the way to go.

Frequently Asked Questions

What is a Gold Loan?

A gold loan is a secured loan where gold jewelry or coins are pledged as collateral in exchange for funds from a lender.

Do I need to be an existing customer of the bank to take gold loan?

No, you do not need to be an existing customer of the bank to take a gold loan.

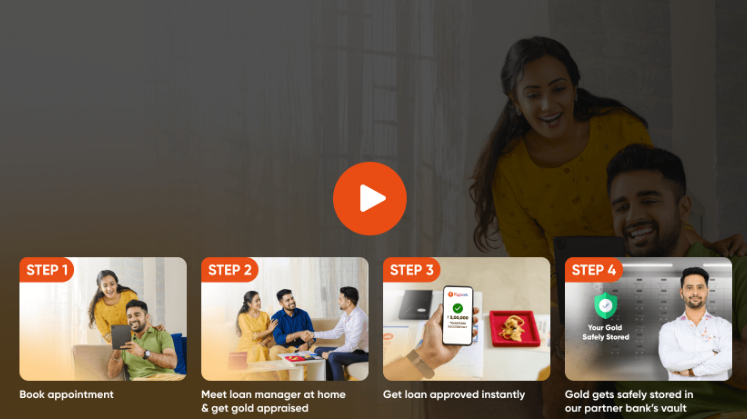

How can I avail of a gold loan?

You can avail of a gold loan by visiting a bank or NBFC that offers this service, submitting the required documents, and pledging your gold as collateral.

What are the advantages of taking a gold loan?

The advantages of taking a gold loan include lower interest rates, faster processing times, and the ability to get a loan without a credit history or income proof.

Who can Avail this Gold Loan?

Any individual who owns gold jewelry or coins can avail of a gold loan.

Is taking a gold loan Safe?

Taking a gold loan is generally safe as long as you choose a reputable lender and understand the terms and conditions of the loan agreement.

What is not accepted for gold loan?

Items that are not accepted for a gold loan include gold bars, biscuits, and coins that are not recognized by the government.

What are the risks in gold loan?

The risks in a gold loan include the possibility of losing the pledged gold if you are unable to repay the loan according to the agreed terms.

Is gold loan better than selling gold?

Whether a gold loan or selling gold is better depends on your individual needs and circumstances. Selling gold may provide immediate cash, but a gold loan allows you to retain ownership of the gold.