Do you need money urgently for your personal needs?

Are you looking for a loan that is flexible, hassle-free, and fast?

If yes, then you should consider Fullerton Personal Loan.

Fullerton Personal Loan is a loan option that can help you meet your various personal expenses such as:

- Medical emergencies

- Home renovation

- Wedding

- Education

- Travel

- And more

Fullerton India is one of the leading NBFCs in India that offers personal loans to salaried and self-employed individuals.

With Fullerton Personal Loan, you can enjoy:

- Instant approval and disbursal within 24 hours

- Attractive interest rates starting from 11.99% p.a.

- Flexible repayment options ranging from 12 to 60 months

- Loan amount up to 25 lakh

- Minimal documentation and paperless process

- Online application and tracking

Sounds good, right?

In this article, I will show you how to apply for Fullerton Personal Loan online, what are the eligibility criteria and documents required, and what are the interest rates and charges applicable.

Let’s get started.

How to Apply for Fullerton Personal Loan Online

Applying for Fullerton Personal Loan online is simple and convenient.

You have two options to apply for Fullerton Personal Loan online:

- Apply it yourself by following these steps:

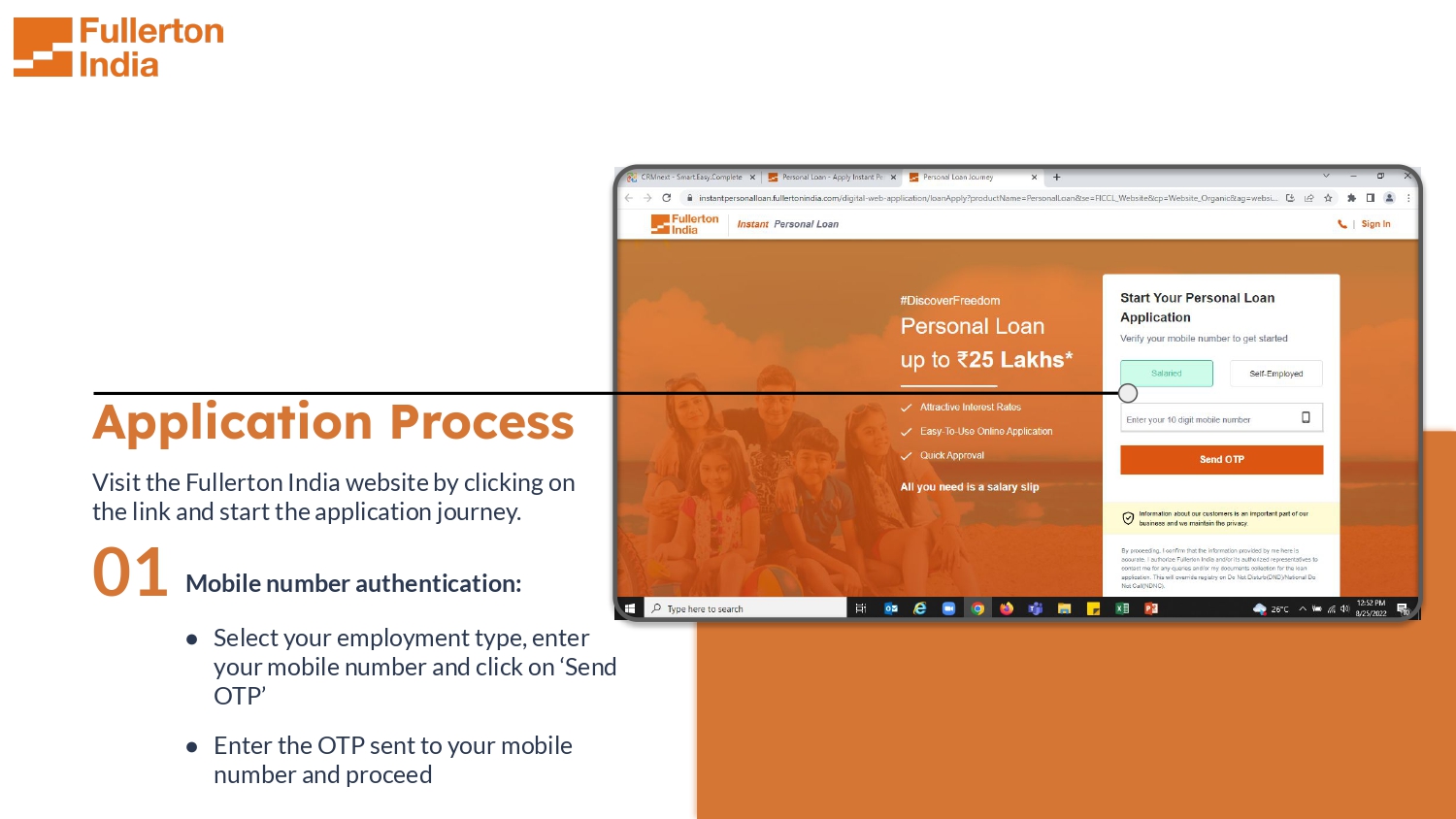

- Visit the official website of Fullerton India by clicking on this link and start the application journey.

- Authenticate your mobile number by selecting your employment type, entering your mobile number and clicking on “Send OTP”. Enter the OTP sent to your mobile number and proceed.

- Fill your basic details such as name as per your PAN, gender, PAN number, date of birth, etc., and click on “Unlock Your Offers”.

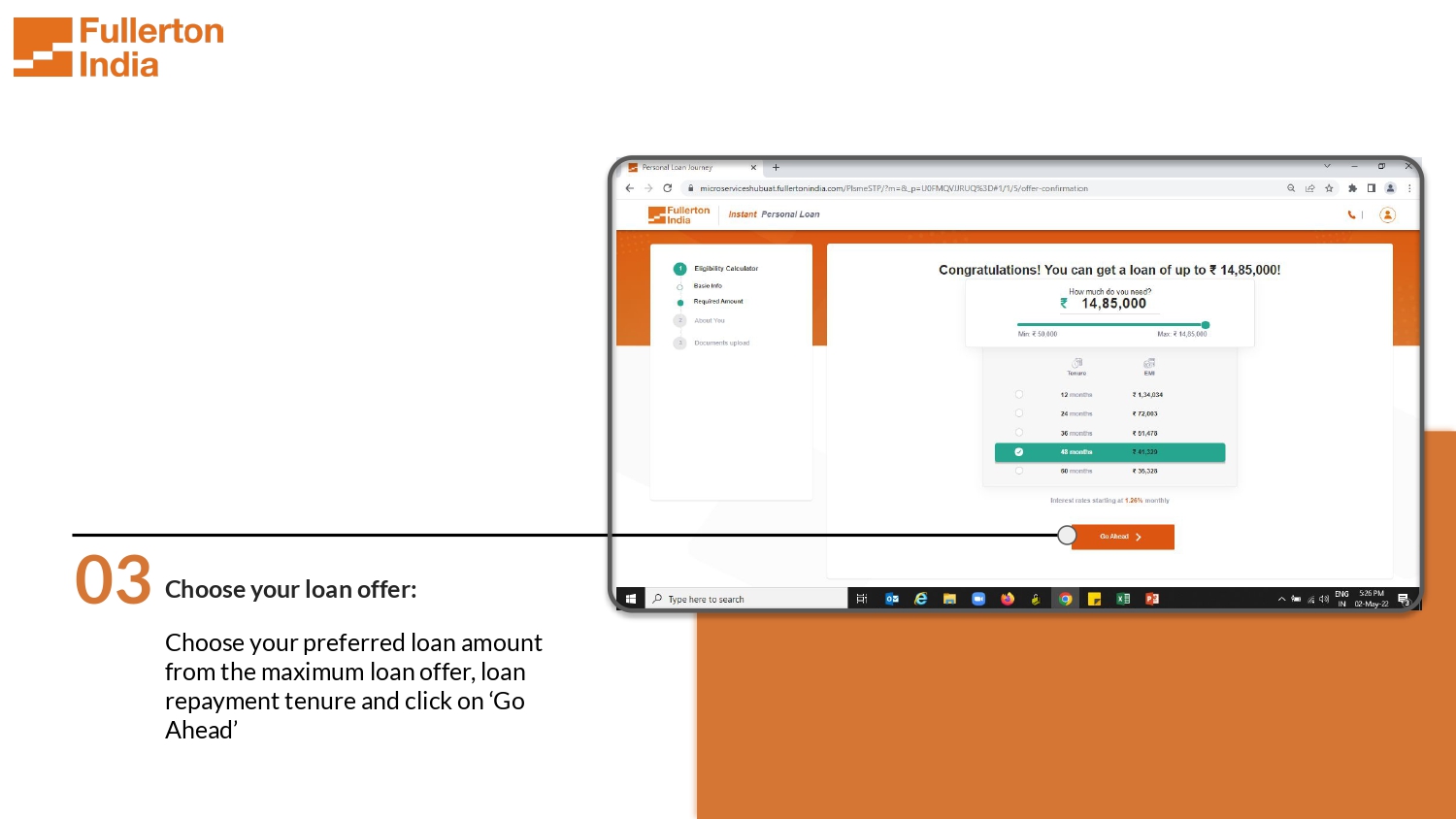

- Choose your preferred loan amount from the maximum loan offer, loan repayment tenure and click on “Go Ahead”.

- Enter your personal details such as marital status, email address, current address, etc., and click on “Save & Proceed”.

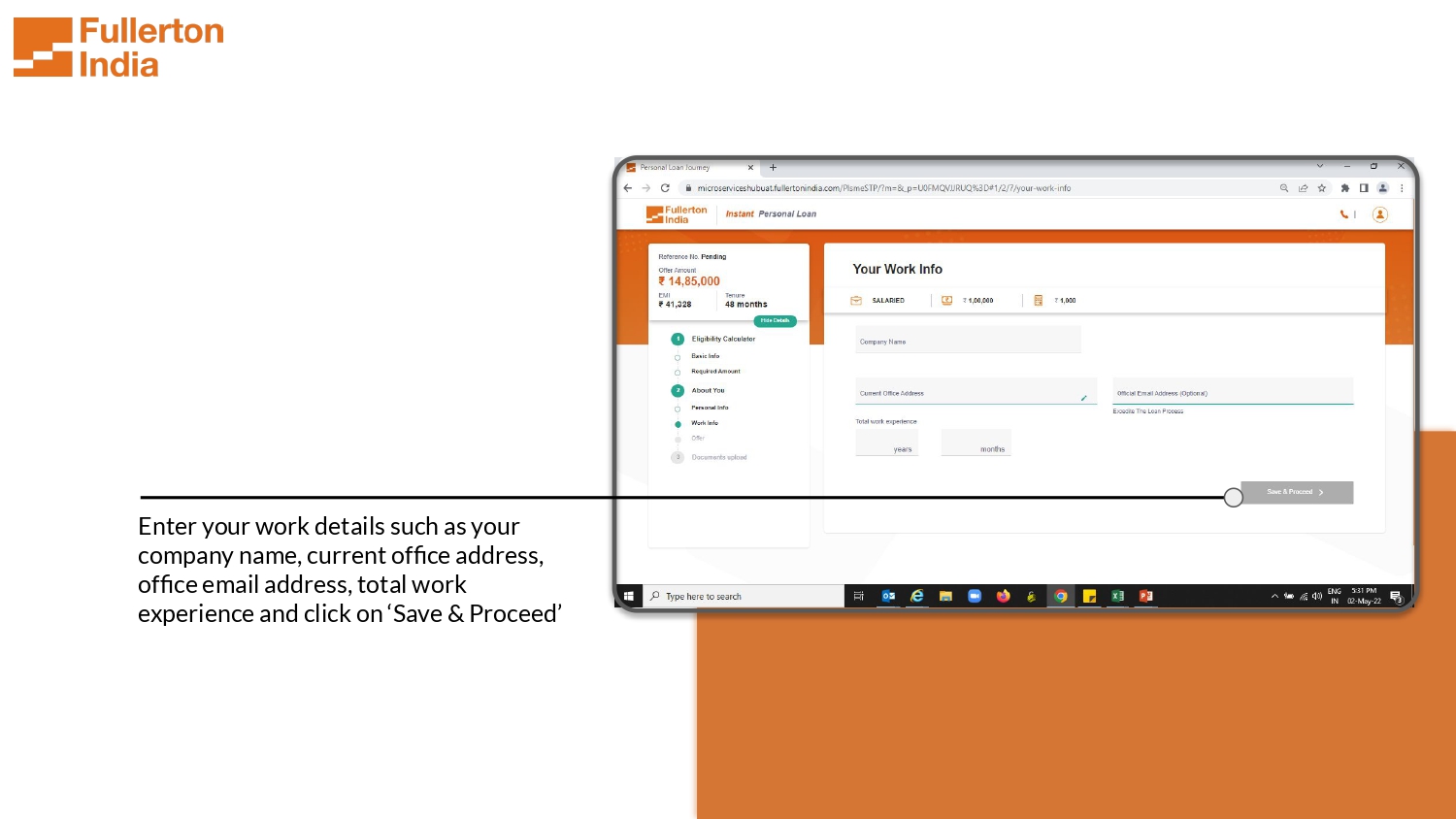

- Enter your work details such as your company name, current office address, office email address, total work experience and click on “Save & Proceed”.

- Upload the required documents such as identity proof, address proof, income proof, bank statement, etc., and submit.

- Wait for the verification call from Fullerton India representative.

- Once your application is approved, you will receive an SMS or email confirmation with your loan agreement and details.

- Sign the loan agreement online and get the loan amount disbursed to your bank account within 24 hours.

- Apply through experienced and qualified advisors of rapidloans.in by Clicking Here or Below Link. We will guide you through the entire process and help you get the best deal on Fullerton Personal Loan.

That’s it.

You can also track your loan status with your mobile number on the website or app.

You can also contact Fullerton India customer care number at 1800-103-6001 for any queries or assistance.

Eligibility Criteria for Fullerton Personal Loan

Before you apply for Fullerton Personal Loan online, you need to check if you meet the eligibility criteria.

The eligibility criteria for Fullerton Personal Loan are based on:

- Age

- Income

- Occupation

- Credit score

Here are the details:

| Criteria | Salaried | Self-employed |

|---|---|---|

| Age | 21-60 years | 21-65 years |

| Income | Rs. 15,000 per month | Rs. 2 lakh per annum |

| Credit score | 650 or above | 650 or above |

You also need to have a stable source of income and a good repayment history.

Documents Required for Fullerton Personal Loan

To apply for Fullerton Personal Loan online, you need to submit some documents to verify your identity, address, income, and bank details.

The documents required for Fullerton Personal Loan are:

- Identity proof: Any one of the following

- PAN card

- Aadhaar card

- Passport

- Voter ID card

- Driving license

- Address proof: Any one of the following

- Aadhaar card

- Passport

- Voter ID card

- Driving license

- Utility bills

- Rent agreement

- Income proof: Depending on your occupation

- Salaried: Salary slips for last 3 months

- Self-employed: Income tax returns for last 2 years

- Both: Bank statement for last 6 months

You can upload these documents online while filling the application form.

You can also download your loan statement and NOC from Fullerton India website or app.

Interest Rates and Charges for Fullerton Personal Loan

The interest rates and charges for Fullerton Personal Loan depend on various factors such as:

- Your credit profile

- Your loan amount

- Your loan tenure

- Your relationship with Fullerton India

The interest rates and charges for Fullerton Personal Loan are:

| Interest rates | 11.99% – 36% Per annum |

| Processing fee | Up to 6.5% of loan amount (min Rs. 1,000, max Rs. 10,000) |

| Prepayment fee | 0% to 7% of outstanding principal (depending on tenure and amount prepaid) |

| Late payment fee | 2% per month on overdue amount |

You can use the Fullerton India EMI calculator to estimate your monthly EMI based on your loan amount, interest rate, and tenure.

You can also compare the interest rates and charges of Fullerton Personal Loan with other lenders on various websites.

Conclusion

Fullerton Personal Loan is a convenient and flexible option for fulfilling your personal needs.

You can apply for Fullerton Personal Loan online in a few minutes and get the money in your bank account within 24 hours.

You can also enjoy attractive interest rates and flexible repayment options with Fullerton Personal Loan.

If you are interested in applying for Fullerton Personal Loan online, you can visit the official website of Fullerton India and fill the online application form.

Or you can call the Fullerton India customer care number at 1800-103-6001 for any queries or assistance.

Fullerton India is one of the leading NBFCs in India that offers various financial products and services such as personal loans, business loans, home loans, etc.

So, what are you waiting for?

Apply for Fullerton Personal Loan online today

and get your personal needs fulfilled.

I hope this blog article helps you understand Fullerton Personal Loan better.

If you have any feedback or suggestions, please let me know in the comments below.😊

FAQs

What is the minimum and maximum loan amount that I can get from Fullerton Personal Loan?

The minimum loan amount that you can get from Fullerton Personal Loan is Rs. 50,000 and the maximum loan amount is Rs. 25 lakh, depending on your eligibility and credit profile.

How can I track my Fullerton India Personal Loan status by mobile number?

You can track your Fullerton Personal Loan status by visiting the official website of Fullerton India and clicking on “Track Application” button. You need to enter your mobile number or application number and click on “Submit” button. You will see your loan status on the screen. You can also track your loan status by calling the Fullerton India customer care number at 1800-103-6001 or by using the Fullerton India app on your smartphone.

Can I prepay or foreclose my Fullerton India Personal Loan?

Yes, you can prepay or foreclose your Fullerton Personal Loan after paying a minimum of 6 EMIs. You need to pay a prepayment fee of 0% to 7% of the outstanding principal amount, depending on the tenure and the amount prepaid. You need to contact the Fullerton India customer care number at 1800-103-6001 or visit the nearest branch to initiate the prepayment or foreclosure process.

How can I download my Fullerton Personal Loan statement and NOC?

You can download your Fullerton Personal Loan statement and NOC by visiting the official website of Fullerton India and clicking on “Customer Login” button. You need to enter your username and password and click on “Login” button. You will see your loan details on the dashboard. You can click on “Download Statement” or “Download NOC” button to download your loan statement and NOC respectively. You can also download your loan statement and NOC by using the Fullerton India app on your smartphone.

How can I contact Fullerton personal loan customer care?

You can contact Fullerton personal loan customer care by phone, email, branch, website, or app. You can find the contact details on the official website of Fullerton India. You will get a response within 24 to 48 working hours.