Are you looking for a credit card that offers you amazing rewards, discounts, and benefits without any annual fee? If yes, then you might want to check out the HSBC Visa Platinum Credit Card.

This card is one of the best credit cards from HSBC that gives you instant recognition and exclusive privileges.

Whether you want to save money on dining, shopping, entertainment, travel, or fuel, this card has something for everyone.

In this article, I’m going to give you a detailed review of this card and show you all the features, benefits, fees, charges, and application process that you need to know.

By the time you finish reading this article, you’ll have a clear idea of whether this card is a good fit for you or not.

Are you ready? So let’s get started!

Features of HSBC Visa Platinum Credit Card

The HSBC Visa Platinum Credit Card has some amazing features that make it stand out from other credit cards. Here are some of them:

- No annual fee: You don’t have to pay any joining or annual fee for this card. This means you can enjoy all the benefits of this card without any extra cost.

- Rewards program: You can earn reward points for every purchase you make with this card. You get 2 reward points for every INR 150 spent. You also get 5X rewards on subsequent purchases made after crossing spend amount of INR 400,000 in an anniversary year up to a maximum 15,000 accelerated reward points.

- Cashback offers: You can get 10% cashback up to INR 2,000 on all transactions made within first 30 days of card issuance. You can also get 1.5% cashback on all online spends (excluding transfer of funds to online wallet) and 1% on all other spends with the HSBC Cashback Credit Card.

- Fuel surcharge waiver: You can save up to INR 3,000 per year on fuel surcharge at any petrol pump across India. The minimum transaction amount should be INR 400 and the maximum waiver per month is INR 250.

- Travel benefits: You can enjoy access to airport lounges and golf courses across India and abroad. You can also get discounts on flights and hotels with Cleartrip and MakeMyTrip. You can also convert your reward points into air miles with InterMiles, British Airways and Singapore Airlines.

- Insurance cover: You can get complimentary insurance cover for air accident, baggage loss, flight delay, loss of passport and personal accident with this card. The insurance cover is provided by ICICI Lombard General Insurance Company Limited.

Benefits of HSBC Visa Platinum Credit Card

The HSBC Visa Platinum Credit Card not only offers you great features but also some amazing benefits that enhance your lifestyle. Here are some of them:

- Savings on dining, shopping and entertainment: You can get up to 15% off at over 1,000 restaurants across India with the HSBC Dining Privileges program. You can also get up to 10% off at over 100 online stores with the HSBC SmartBuy program. You can also get up to INR 500 off on movie tickets every month with BookMyShow.

- Access to airport lounges and golf courses: You can get 3 complimentary airport lounge access at domestic & international lounges or 3 AirDine (meal) vouchers per year with this card. You can also enjoy discounted green fees and dedicated 24-hour golf concierge service at over 30 golf courses in India and over 300 golf courses worldwide.

- Discounts on flights and hotels: You can get up to INR 2,800 instant savings on domestic flights and hotels with Cleartrip. You can also get up to INR 10,000 instant discount on international flights and hotels with MakeMyTrip.

- Enhanced security and convenience: You can enjoy contactless payments with your card using the Visa Paywave technology. You can also use your card for online transactions with the Verified by Visa service. You can also manage your card account online or through mobile banking.

- Customer service and online banking: You can get 24×7 customer support through phone banking or email. You can also access your card account online or through mobile banking. You can also pay your bills, transfer funds, redeem rewards, and more with ease.

Fees and Charges of HSBC Visa Platinum Credit Card

The HSBC Visa Platinum Credit Card has no joining or annual fee but it does have some other fees and charges that you should be aware of. Here are some of them:

- Joining fee: Nil

- Renewal fee: Nil

- Interest rate: 3.3% per month (39.6% per annum)

- Cash advance fee: 2.5% of the transaction amount (subject to a minimum of INR 300)

- Late payment fee: 50% of the minimum amount due (subject to a minimum of INR 400 and a maximum of INR 750)

- Overlimit fee: 2.5% of the overlimit amount (subject to a minimum of INR 500)

- Foreign currency transaction fee: 3.5% of the transaction amount

ALSO READ: AU Swipe Up Credit Card: Upgrade Your Existing Credit Card and Get a Higher Credit Limit instantly

Eligibility Criteria for HSBC Visa Platinum Credit Card

Before you apply for the HSBC Visa Platinum Credit Card, you need to make sure that you meet the eligibility criteria set by the bank. The eligibility criteria are as follows:

- You must be at least 18 years of age

- You must have a minimum annual income of INR 300,000

- You must have a good credit history and score

- You must be a resident of India or a non-resident Indian (NRI)

If you meet these criteria, you can proceed with the application process online or offline. You will also need to provide some documents to prove your identity, address, income, and other details. The documents required are:

- PAN card

- Aadhaar card

- Income proof (such as salary slip, income tax returns, Form 16, etc.)

- Address proof (such as passport, voter ID, driving license, utility bill, etc.)

You can upload these documents online or submit them at the nearest HSBC branch. Once your application is verified and approved, you will receive your credit card within 7 working days.

How to Apply for HSBC Visa Platinum Credit Card

If you are interested in applying for the HSBC Visa Platinum Credit Card, you can do so online or offline. Here are the steps to follow:

Online

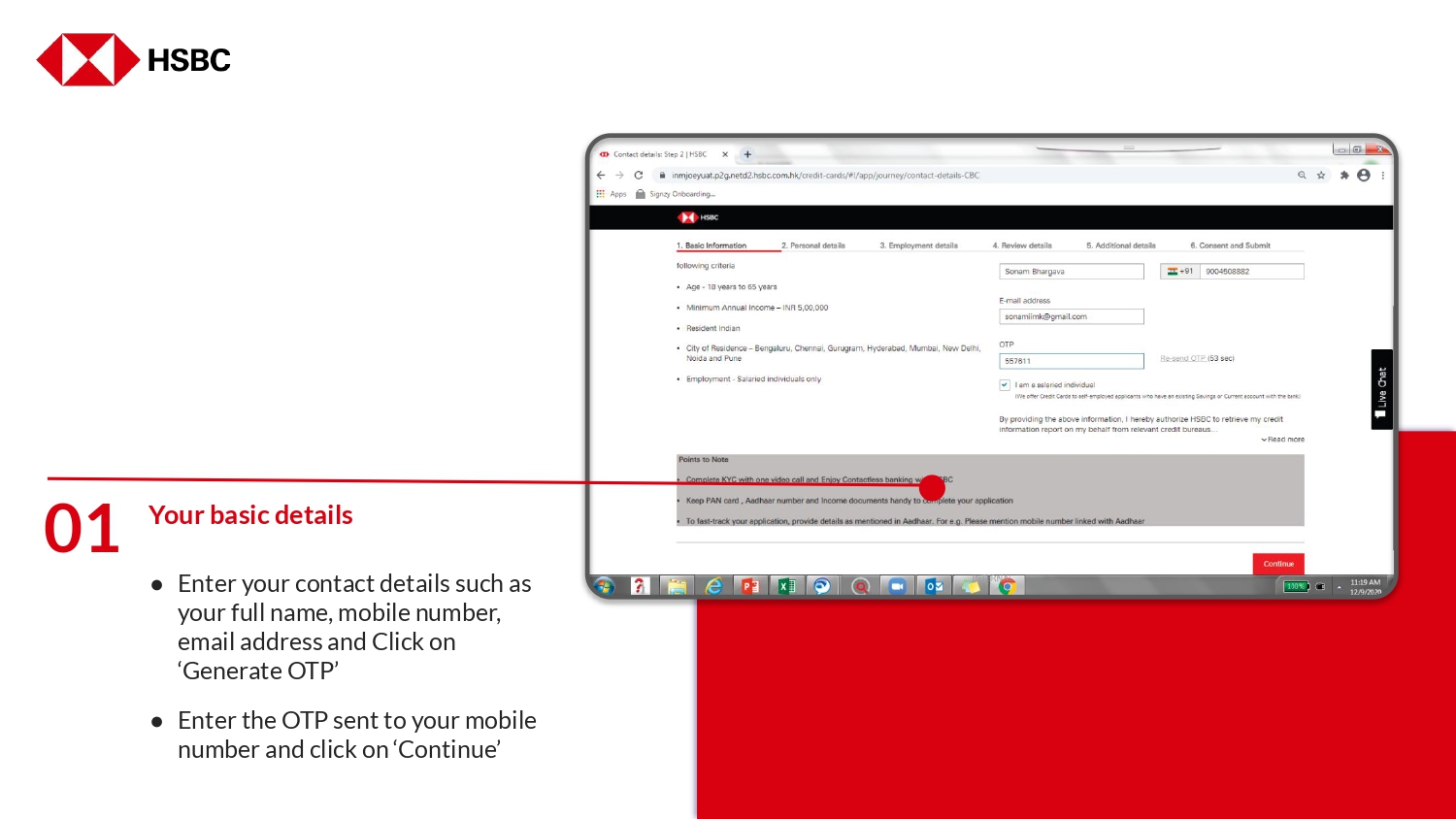

Step 1: Your Basic Information

- Click Here or below button to visit persnalised page for HSBC Visa Platinum Credit Card.

- Enter your contact details such as your full name, mobile number, email address and click on “Generate OTP”.

- Enter the OTP sent to your mobile number and click on “Continue”.

- Enter your personal details such as your PAN number and verify it. Then enter your nationality, residential status, marital status, etc. and click on “Continue”.

Step 2: Your Employment Details

- Enter your employment status and click on “Continue”.

- Note: If you proceed with the application manually or do not have access to internet banking then skip this step and upload your income documents later.

- Enter your gross annual income, nature of organisation, designation, company name, company address, etc. and click on “Continue”.

Step 3: Review the Details

- Review all the details you have provided and click on “Continue”.

- Accept the terms & conditions and click on “Continue”.

Step 4: Complete your KYC

- Enter additional details such as your mother’s full name, father’s full name, choice of credit card usage, reason for availing the credit card, name to be printed on the credit card, bank name, branch location, account number, electronic statements, correspondence address, etc.

- Enter your details such as bank name, card number, bank card expiry date, amount to be transferred, tenure and click on “Continue”.

Step 5: Complete your KYC

- HSBC team will contact you within 5 working days of issuing your HSBC credit card.

- Upload latest 2 months salary slip/bank statement with salary credits.

- Click on “Complete my KYC” to complete your video KYC.

Note: a) You will also receive SMS/Email from hsbc@Signzy.com, with the link to initiate Video KYC. b) You can schedule your video KYC appointment later at your convenience. c) HSBC Bank representative will be available from Monday to Saturday 9am to 8pm except bank holidays.

Offline

- Visit your nearest HSBC branch and ask for a credit card application form.

- Fill in the form with your personal and income details and attach your documents such as PAN card, Aadhaar card, income proof, address proof, etc.

- Submit the form and documents to the branch executive and get a reference number.

- You will receive a call from HSBC to verify your details and eligibility.

- Once your application is approved, you will receive your credit card within 7 working days.

Click here to apply for HSBC Visa Platinum Credit Card now!

get 3 complimentary airport lounge access or meal vouchers per year!

Conclusion

The HSBC Visa Platinum Credit Card is a great credit card for those who want to enjoy multiple benefits and rewards without paying any annual fee.

It offers you savings on dining, shopping, entertainment, travel, and fuel. It also gives you access to airport lounges and golf courses.

It also provides you with insurance cover and enhanced security.

If you are looking for a credit card that offers you all these features and benefits, then you should definitely consider applying for the HSBC Visa Platinum Credit Card.

You can apply online or offline and get your card within 7 working days.

So what are you waiting for? Apply for the HSBC Visa Platinum Credit Card today and enjoy a world of incredible experiences!

FAQs

What are the benefits of HSBC Visa Platinum Credit Card?

The HSBC Visa Platinum Credit Card offers you a range of benefits such as no joining or annual fee, 10% cashback up to INR 2,000 on all transactions made within first 30 days of card issuance, 2 reward points for every INR 150 spent and 5X rewards on subsequent purchases made after crossing spend amount of INR 400,000 in an anniversary year up to a maximum 15,000 accelerated reward points, air miles conversion on InterMiles, British Airways and Singapore Airlines, fuel surcharge waiver up to INR 3,000 per year, access to airport lounges and golf courses, discounts on dining, shopping, entertainment, travel and more, complimentary insurance cover for air accident, baggage loss, flight delay, loss of passport and personal accident, zero-liability for lost cards and emergency card replacement.

How can I apply for HSBC Visa Platinum Credit Card?

You can apply for HSBC Visa Platinum Credit Card online or offline. To apply online, you can visit the HSBC website and fill in your personal and contact details, upload your documents, and complete your video KYC. To apply offline, you can visit your nearest HSBC branch and fill in a credit card application form, attach your documents, and submit it to the branch executive.

What are the eligibility criteria for HSBC Visa Platinum Credit Card?

To be eligible for HSBC Visa Platinum Credit Card, you need to meet the following criteria: you must be at least 18 years of age, you must have a minimum annual income of INR 400,000, you must have a good credit history and score, and you must be a resident of India or a non-resident Indian (NRI).

What are the fees and charges for HSBC Visa Platinum Credit Card?

The HSBC Visa Platinum Credit Card has no joining or annual fee but it does have some other fees and charges that you should be aware of. Some of them are: interest rate of 3.3% per month (39.6% per annum), cash advance fee of 2.5% of the transaction amount (subject to a minimum of INR 300), late payment fee of 50% of the minimum amount due (subject to a minimum of INR 400 and a maximum of INR 750), overlimit fee of 2.5% of the overlimit amount (subject to a minimum of INR 500), foreign currency transaction fee of 3.5% of the transaction amount.

How can I redeem my reward points on HSBC Visa Platinum Credit Card?

You can redeem your reward points on HSBC Visa Platinum Credit Card for various options such as gift vouchers, merchandise, air miles, donations, etc. You can redeem your reward points online through the HSBC Rewards Catalogue or by calling the HSBC Phone Banking numbers. You can also convert your reward points into air miles with InterMiles, British Airways and Singapore Airlines.

How can I access airport lounges and golf courses with HSBC Visa Platinum Credit Card?

You can access airport lounges and golf courses with HSBC Visa Platinum Credit Card by using your card as a membership card. You can get 3 complimentary airport lounge access at domestic & international lounges or 3 AirDine (meal) vouchers per year with this card. You can also enjoy discounted green fees and dedicated 24-hour golf concierge service at over 30 golf courses in India and over 300 golf courses worldwide.

How can I contact HSBC Customer Care for any queries or issues related to my HSBC Visa Platinum Credit Card?

You can contact HSBC for any queries or issues related to your HSBC Visa Platinum Credit Card by calling the HSBC Phone Banking numbers or by sending an email to hsbc@hsbc.co.in. You can also visit your nearest HSBC branch or write to the following address:

The Manager Customer Care Centre HSBC P.O.Box No.5080 Chennai – 600028