Are you an investor looking to make the most out of your investments? If so, you need a Demat account.

A Demat account allows you to store your investments like shares, mutual funds, ETFs, and more in electronic form without any physical paperwork. It not only provides convenience but also offers various advantages over offline trading. So,

Where Do You Open a Demat Account?

You need a reliable platform that can simplify the onboarding process and offer competitive brokerage rates. That’s where Angel One comes in.

Angel One is a leading platform for opening Demat accounts in India. With over 13 million happy customers, Angel One provides a fully digitized onboarding process that allows you to open a Demat account in just a few simple steps.

Plus, with their user-friendly platforms (Android/iOS apps or desktop), you can start investing right away.

Here are some of the reasons,

Why You Should Open Angel One Demat Account?

If you’re looking to invest in stocks, mutual funds, ETFs, or any other securities, opening a Demat account is crucial.

Here are the advantages or Benefits of Angel One Demat account:

- Trust: Angel One has been providing reliable investment services to millions of customers since 1987.

- Quick Onboarding: With a fully digitized onboarding process, opening a Demat account with Angel One is quick and hassle-free. All you need to do is provide your personal details, bank details, and KYC details.

- Simplified Trading: Angel One offers user-friendly platforms for trading on Android, iOS, or desktop, making investing a breeze.

- Advisory: Angel One’s investment advisory engine, ARQ prime, provides rule-based advice to help you make informed investment decisions.

- Competent Brokerage: Angel One offers ₹0 brokerage on equity delivery with no hidden charges and a flat fee of ₹20 per order for intraday, F&O, currencies, and commodities. Plus, there are no account maintenance charges for the first year.

With Angel One, opening a Demat account is not only easy but also comes with numerous investment options.

You can invest in stocks, IPOs, F&O, mutual funds, commodities, US stocks, intraday trading, debt market/bonds, and ETFs.

The Angel One app’s user-friendly interface makes investing even more convenient.

How to Open Angel One Demat Account ?

Opening a Demat account with Angel One is a simple and hassle-free process that can be completed online. Here is a step-by-step guide to help you get started:

- Visit the Angel One website or download the Angel One app by clicking here.

- Click on the “Open Demat Account” button on the homepage.

- Fill up your personal details such as name, email ID, mobile number, and city of residence.

- Verify your mobile number by entering the OTP received on your registered mobile number.

- Enter your PAN card details.

- Enter your bank details such as account number, IFSC code, and branch name.

- Provide your Aadhaar card details for eKYC verification.

- Upload scanned copies of your PAN card, Aadhaar card, and a passport-sized photograph.

- Review and confirm the details provided.

- Once your application is processed and approved, you will receive your Demat account details on your registered email ID.

At Angel One, the onboarding process is fully digitized, making it quick and hassle-free. You can complete the entire process in just a few minutes, without the need for any physical documentation.

Please note that the KYC process is mandatory for all Demat account holders. It is required by the Securities and Exchange Board of India (SEBI) to verify the identity and address of investors. You can complete the KYC process online by providing your Aadhaar card details and uploading scanned copies of the necessary documents.

Investment Options with Angel One Demat Account

When you open a Demat account with Angel One, you gain access to a wide range of investment options. Here are some of the investment options available on the Angel One platform:

Stocks

Angel One provides access to all major stock exchanges in India, allowing you to buy and sell stocks of your choice with ease. With ARQ Prime’s recommendations, you can make informed decisions and increase your chances of making profitable trades.

IPOs

Angel One also allows you to apply for Initial Public Offerings (IPOs) online, making the process simple and hassle-free.

F&O (Futures & Options)

F&O is a popular investment option among traders who are looking to profit from price fluctuations in the market. Angel One provides access to F&O trading across all major exchanges in India.

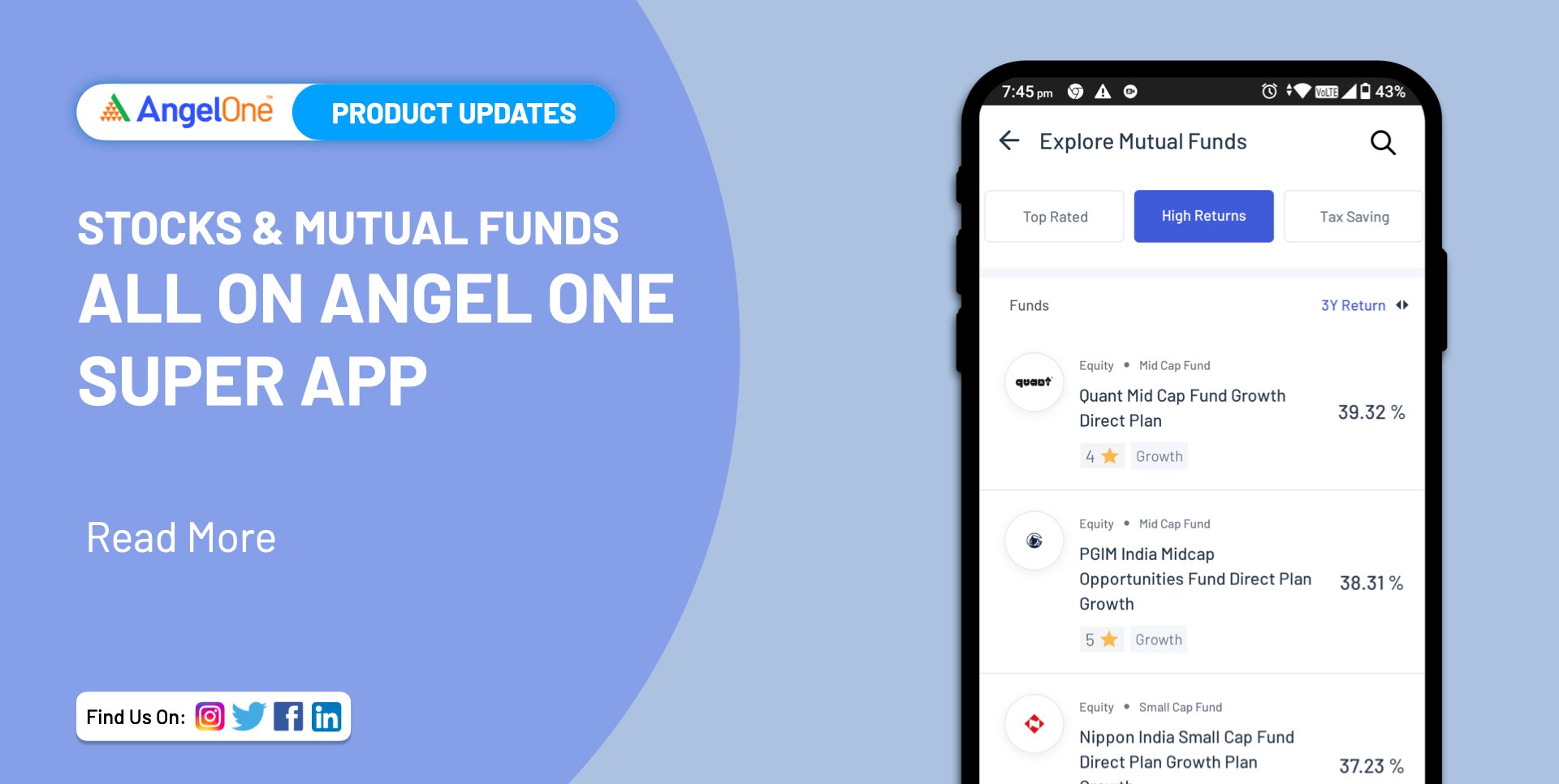

Mutual Funds

Angel One provides a platform for investing in mutual funds from a wide range of asset management companies (AMCs), allowing you to diversify your portfolio and achieve your financial goals.

Commodities

Angel One allows you to invest in commodities such as gold, silver, crude oil, and more. You can also trade in commodity futures and options.

US Stocks

Angel One provides access to the US stock market, allowing you to invest in some of the world’s largest companies like Apple, Amazon, and Google.

Intraday Trading

Intraday trading is a type of trading where you buy and sell stocks within the same day to make quick profits. Angel One allows you to engage in intraday trading with ease.

Debt Market/Bonds

Angel One also provides a platform for investing in debt instruments such as bonds, fixed deposits, and other debt market instruments.

ETFs (Exchange Traded Funds)

ETFs are a type of investment fund that are traded on stock exchanges like individual stocks. Angel One provides access to a wide range of ETFs, allowing you to diversify your portfolio and minimize risk.

With Angel One’s diverse investment options, you can build a well-diversified portfolio that aligns with your financial goals and risk appetite.

What is a Demat account is and how it works ?

A Demat account is a type of account that allows investors to hold and trade securities in an electronic form.

This means that instead of physically holding share certificates, investors can hold their shares in electronic form.

This not only makes it easier to buy and sell securities but also eliminates the risk of theft or loss of physical certificates.

Demat accounts have come a long way since they were introduced in the late 1990s. Back then, investors had to submit physical share certificates to their brokers every time they wanted to buy or sell shares.

This was a cumbersome and time-consuming process.

With the advent of Demat accounts, this process has been streamlined, making it faster and more convenient for investors to trade in securities.

So, if you’re looking to invest in securities, opening a Demat account is a must.

And with Angel One, you can open a Demat account quickly and easily, with a range of investment options to choose from.

Advantages of Opening a Demat Account

Now that we’ve covered the importance of having a Demat account and how to open one with Angel One, let’s discuss the benefits of having a Demat account in general.

Convenience

With a Demat account, you no longer have to worry about physical share certificates or long transfer processes. All of your investments are stored electronically and can be easily accessed online.

Restrictions with Offline Trading

Without a Demat account, you are restricted from participating in electronic trading platforms such as the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE).

Auto Sync

With a Demat account, all of your investments are automatically synced to your trading account, making it easy to buy, sell, and track your investments in real-time.

Security

Demat accounts provide an added layer of security by storing your investments electronically and reducing the risk of theft, loss, or damage to physical certificates.

Accessibility

With online access to your Demat account, you can track your investments, view your portfolio, and make trades from anywhere in the world, at any time.

Zero Balance Account Opening

Lastly, many Demat account providers, including Angel One, offer zero balance account opening, which means you can start investing with minimal capital and no additional fees.

Overall, opening a Demat account is a smart investment decision that provides numerous benefits for investors.

Conclusion

Opening a Demat account with Angel One offers a host of advantages that can make investing in the stock market a breeze.

From simplified trading and investment advisory services to a user-friendly app and competitive brokerage rates, Angel One has established itself as a reliable and trusted platform for investors.

With a fully digitized onboarding process and zero maintenance charges for the first year, opening a Demat account with Angel One is hassle-free and affordable.

So, if you’re looking to invest in the stock market, it’s time to consider opening a Demat account with Angel One.

Take advantage of the platform’s various investment options and investment advisory engine to make informed decisions and grow your portfolio.

Open your Demat account with Angel One today and start your journey towards financial freedom!

FAQS

What is a Demat account?

A Demat account is an electronic account that holds shares and securities in a dematerialized or digital form.

What are the benefits of opening a Demat account with Angel One?

Angel One offers a range of benefits, including a quick onboarding process, simplified trading, investment advisory engine, and competitive brokerage rates.

What are the charges for opening a Demat account with Angel One?

Angel One charges ₹0 account maintenance fees for the first year, and ₹20 per order for Intraday, F&O, Currencies & Commodities.

What investment options are available with Angel One?

Angel One offers a wide range of investment options, including stocks, IPOs, F&O, mutual funds, commodities, US stocks, intraday trading, debt market/bonds, and ETFs.

What is the minimum balance requirement for opening a Demat account with Angel One?

Angel One offers a zero balance account opening facility, which means there is no minimum balance requirement.

How do I open a Demat account with Angel One?

You can open a Demat account with Angel One by visiting their website, filling in your details and completing the KYC process.

What documents are required to open a Demat account with Angel One?

You will need to provide your PAN card, Aadhaar card, and a cancelled cheque or bank statement for verification purposes.

Is my investment safe with Angel One?

Yes, Angel One is a SEBI-registered brokerage firm that follows all the regulatory guidelines and offers robust security measures to keep your investments safe.

Can I trade on the Angel One platform using a mobile app?

Yes, Angel One offers a mobile app called Angel Broking that allows you to trade and manage your investments on-the-go.