ICICI Pay Later is a digital credit product that offers you a pre-approved credit limit of up to Rs. 50,000.

You can use it to pay for your online and offline purchases without using your debit card or credit card. You can also enjoy zero interest for up to 45 days and pay back the amount in one go before the due date.

ICICI Pay Later is a convenient and flexible way to manage your cash flow and expenses. You can use it for various types of payments, such as utility bills, online shopping, recharge, travel, etc. You can also track your transactions and balance on the ICICI Bank app or website.

To use ICICI Pay Later, you need to have an existing ICICI Bank Savings Account and meet the eligibility criteria.

You also need to apply and activate ICICI PayLater account online by following some simple steps.

In this article, I will guide you through the process of applying and activating ICICI Pay Later account online.

Eligibility Criteria for ICICI Pay Later

To apply for ICICI Pay Later, you need to meet the following eligibility criteria:

- You should be an existing ICICI Bank customer with a Savings Account.

- You should have a good credit history and a satisfactory relationship with the bank.

- You should meet the income requirements as per the bank’s policy.

To check your eligibility status for ICICI PayLater, you can visit the official website of ICICI Bank and log in with your Internet Banking credentials. Alternatively, you can also check your eligibility status on the iMobile app by tapping on the ‘Pay Later’ icon on the home screen.

Please note that the bank offers Pay Later facility on an invite-only basis and that you will receive an invite pop-up on your Internet Banking or Mobile Banking app if you are eligible.

Steps to Apply for ICICI Pay Later

If you are eligible for ICICI PayLater, you can apply for it online by following these steps:

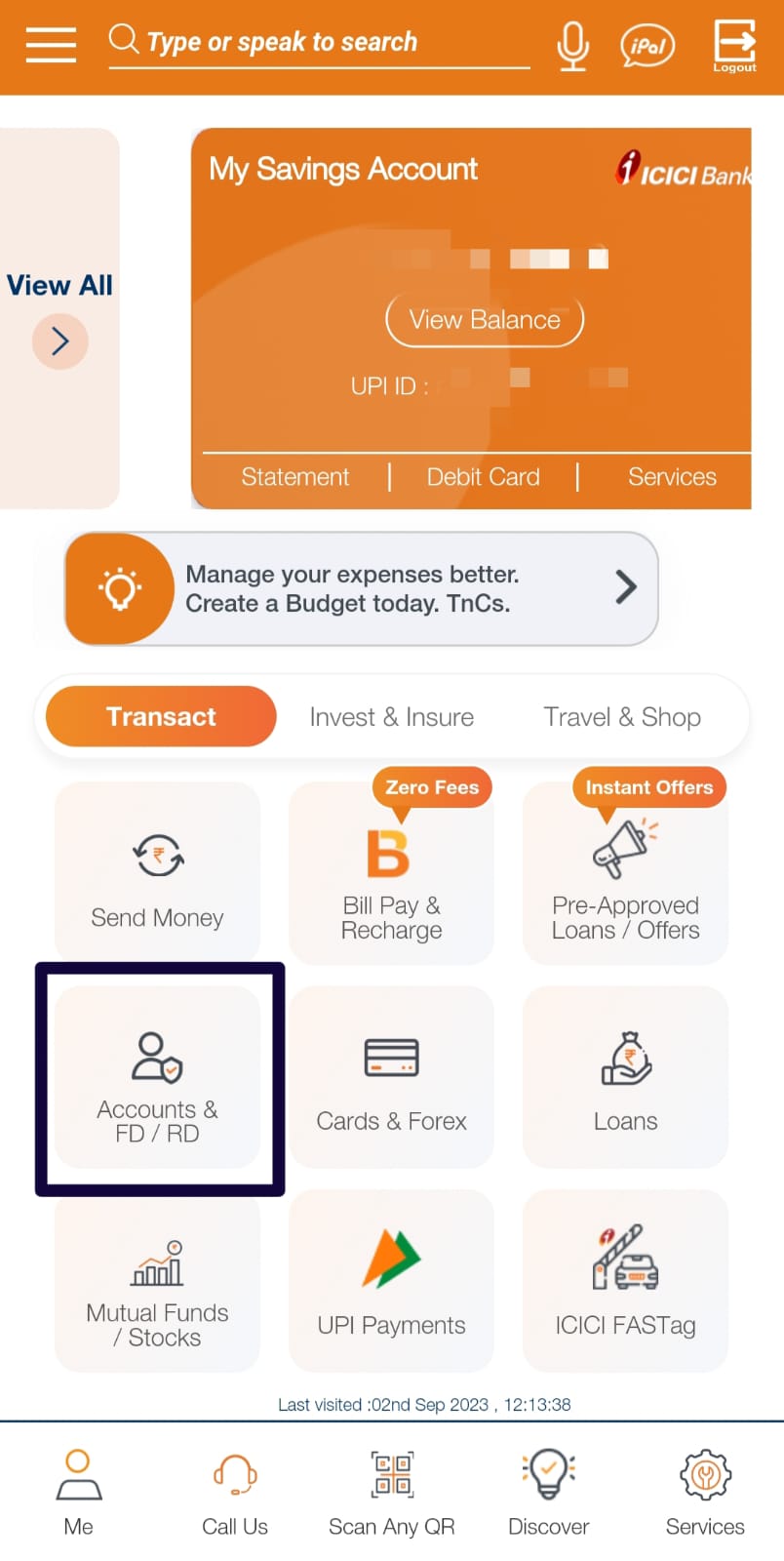

Step 1 :- Log in to the iMobile app on your smartphone and click on “Accounts & Deposits” tab as shown in below image. You can see ICICI PayLater option.

Step 2 :- Tap on the arrow near ‘Pay Later’ icon on the home screen to get an option of “Activate Now”, Click on it.

Step 3 :- You will be asked to agree to the terms and conditions of ICICI Pay Later. Read them carefully and click on ‘I Agree’ or ‘Confirm’ to accept them.

Step 4:- Now, Choose your Savings Account and setup auto debit for pay later.

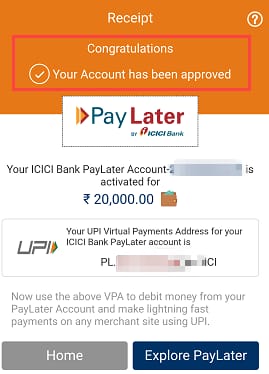

Step 5 :- You will receive an OTP (One Time Password) on your registered mobile number. Enter the OTP and click on ‘Submit’ or ‘Verify’ to complete the application process. You will see a confirmation message on your screen that your application for ICICI Pay Later has been successful.

You can now see your available Credit Limit and UPI ID to make any payment through UPI seamlessly.

How to Activate ICICI Pay Later

After applying for ICICI Pay Later, you need to activate it online by following these steps:

- Create a UPI (Unified Payments Interface) ID for your ICICI Pay Later account. You can do this by logging in to your Internet Banking account or iMobile app and going to the ‘Pay Later’ section. There you will see an option to create a UPI ID. Choose a UPI ID of your choice and click on ‘Create’.

- Link your UPI ID to your ICICI Pay Later account. You can do this by going to any UPI app (such as Google Pay, PhonePe, etc.) and adding your UPI ID as a payment option. You will need to verify your UPI ID by entering your UPI PIN.

- Set a UPI PIN for your ICICI Pay Later account. You can do this by going to the ‘Pay Later’ section on your Internet Banking account or iMobile app and clicking on ‘Set UPI PIN’. You will need to enter your debit card details and an OTP to set your UPI PIN.

Once you have completed these steps, your ICICI Pay Later account will be activated and ready to use.

How to Use ICICI PayLater

You can use ICICI Pay Later account for making payments online and offline by following these steps:

- Select the ‘Pay Later’ option on the checkout page of any merchant website or app that accepts UPI payments. Alternatively, you can also scan the QR code of any merchant that accepts UPI payments using any UPI app.

- Enter your UPI ID that is linked to your ICICI Pay Later account and click on ‘Pay’ or ‘Proceed’.

- Enter your UPI PIN to authorize the payment and complete the transaction.

You can use ICICI Pay Later account for various types of payments, such as:

- Utility bills: You can pay your electricity, water, gas, DTH, broadband, etc. bills using ICICI Pay Later.

- Online shopping: You can shop online from various e-commerce platforms, such as Amazon, Flipkart, Myntra, etc. using ICICI Pay Later.

- Recharge: You can recharge your mobile, DTH, data card, etc. using ICICI Pay Later.

- Travel: You can book your flight, train, bus, hotel, etc. tickets using ICICI Pay Later.

- Food delivery: You can order food online from various platforms, such as Swiggy, Zomato, etc. using ICICI Pay Later.

You can find the list of merchants that accept ICICI Pay Later on the official website of ICICI Bank or on the iMobile app.

How to Repay ICICI PayLater

You need to repay your ICICI Pay Later dues before or on the due date to avoid any charges and penalties. You can repay your ICICI Pay Later dues by following these steps:

- Add funds to your linked Savings Account. You need to have sufficient balance in your linked Savings Account to repay your ICICI Pay Later dues.

- View your statement and due date. You can view your statement and due date on the ‘Pay Later’ section of your Internet Banking account or iMobile app. You can also receive monthly statements on your registered email ID.

- Make the payment. You can make the payment by clicking on ‘Pay Now’ or ‘Repay’ on the ‘Pay Later’ section of your Internet Banking account or iMobile app. Alternatively, you can also make the payment by using any UPI app and entering your UPI ID and UPI PIN.

You need to repay your ICICI Pay Later dues in one go before or on the due date. The due date is usually 15 days after the end of the billing cycle. For example, if your billing cycle is from 1st to 30th of a month, then your due date will be 15th of the next month.

If you fail to repay your ICICI PayLater dues on time, you will have to pay penal interest at the rate of 3% per month on the outstanding amount. You will also have to pay a late payment fee of Rs. 50 per month. Moreover, your credit score will be negatively affected and your account will be suspended until you clear your dues.

Also Read : 8 Best Buy Now Pay Later Apps in India

Charges and Fees for ICICI PayLater

ICICI Pay Later is a zero interest product that does not charge any interest for up to 45 days. However, there are some other charges and fees that you need to be aware of while using ICICI Pay Later. These are:

- GST: Goods and Services Tax (GST) is applicable on all transactions made using ICICI Pay Later at the rate of 18%.

- Penal interest: Penal interest is charged at the rate of 3% per month on the outstanding amount if you fail to repay your ICICI Pay Later dues on time.

- Late payment fee: Late payment fee is charged at Rs. 50 per month if you fail to repay your ICICI Pay Later dues on time.

- UPI charges: UPI charges are applicable on all transactions made using UPI apps at the rate of Rs. 2.5 per transaction for transactions up to Rs. 1000 and Rs. 5 per transaction for transactions above Rs. 1000.

You can find more details about the charges and fees for ICICI Pay Later on the official website of ICICI Bank or on the iMobile app.

Conclusion

ICICI PayLater is a digital credit product that offers you instant credit, zero interest, and hassle-free payments with ICICI Bank.

You can apply and activate ICICI Pay Later account online in a few simple steps and use it for various types of payments online and offline.

You need to repay your ICICI PayLater dues in one go before or on the due date to avoid any charges and penalties.

I hope this article has helped you understand how to apply and activate ICICI Pay Later account online. If you have any feedback or queries, please feel free to share them in the comments section below. Thank you for reading!

FAQs

What is ICICI Pay Later?

ICICI Pay Later is a digital credit product that offers you a pre-approved credit limit of up to Rs. 50000. You can use it to pay for your online and offline purchases without using your debit card or credit card. You can also enjoy zero interest for up to 45 days and pay back the amount in one go before the due date.

How can I apply and activate ICICI Pay Later?

You can apply and activate ICICI Pay Later online if you are an existing ICICI Bank customer with a Savings Account and meet the eligibility criteria. You will receive an invite pop-up on your Internet Banking or Mobile Banking app if you are eligible. You need to accept the invite, agree to the terms and conditions, and verify your OTP to apply for ICICI PayLater. Then, you need to create a UPI ID, link it to your Pay Later account, and set a UPI PIN to activate ICICI PayLater.

Where can I use ICICI Pay Later?

You can use ICICI Pay Later for various types of payments online and offline by selecting the Pay Later option on the checkout page of any merchant website or app that accepts UPI payments. Alternatively, you can also scan the QR code of any merchant that accepts UPI payments using any UPI app. You can use ICICI Pay Later for utility bills, online shopping, recharge, travel, food delivery, and more.

How can I repay ICICI Pay Later?

You need to repay your ICICI PayLater dues in one go before or on the due date to avoid any charges and penalties. You can repay your ICICI Pay Later dues by adding funds to your linked Savings Account, viewing your statement and due date on the app or website, and making the payment by clicking on ‘Pay Now’ or ‘Repay’ on the ‘Pay Later’ section of your Internet Banking account or iMobile app. Alternatively, you can also make the payment by using any UPI app and entering your UPI ID and UPI PIN.