Did you know that only 10% of Indian households have access to formal Credit/Loan? (source: Reserve Bank of India)

In a country where access to credit is limited, Navi Personal Loan is offering a solution to those in need of quick and easy loans.

In this article, we’ll discuss the features and benefits of Navi Personal Loan, as well as the eligibility criteria, application process & Navi Personal Loan Interest Rate, so you can make an informed decision about whether it’s the right option for you.

If you’re in need of quick cash, Navi Personal Loan offers a range of features and benefits that make it a great option for Indian customers. Here are some of the top features and benefits:

A. Instant Disbursal

Navi Personal Loan offers instant disbursal of funds to your bank account, saving you the hassle of waiting for 3-4 days.

With just a few clicks on the app, eligible customers can receive the money they need within minutes. It’s fast and simple, making it a great option for emergencies.

B. 100% Paperless Process

Navi’s app-based process eliminates the need for physical documentation, allowing customers to apply for a loan from anywhere, anytime.

The entire process, from application to disbursal, is completed digitally, making it a convenient and hassle-free experience.

C. Flexible EMI Options

Navi understands that every customer has unique financial circumstances. That’s why they offer flexible repayment tenures of up to 6 years or 72 months.

You can choose the repayment tenure that suits your budget and pay off your loan stress-free.

D. Minimal Documentation

Getting a loan has never been easier with Navi’s minimal documentation requirements. All you need is your PAN card as the primary document.

Say goodbye to heavy paperwork and enjoy instant personal loans of your choice with attractive interest rates.

E. No Collateral Required

With Navi’s unsecured personal loans, you don’t have to worry about pledging collateral or finding a guarantor.

The loan amount and interest rate are determined based on your eligibility, making it an accessible option for many Indian customers.

F. Get Loan Amount of Your Choice

Navi Personal Loan offers loans for every need, whether it’s for medical bills or a much-needed staycation.

Customers can apply for instant loans of up to ₹20 lakh, providing them with the funds they need to achieve their goals.

| Loan Details | Amount |

|---|---|

| Interest Rate | 9.90% p.a. onwards |

| Processing Fee** | Up to ₹7,500** |

| Loan Amount | Up to ₹20 lakh |

| Loan Prepayment Fee | Nil |

| Loan Tenure | From 3 to 72 months |

Navi Personal Loan offers attractive interest rates starting at 9.9% p.a., which is one of the lowest rates in the market.

Customers can avail loans of up to ₹20 Lakh with flexible repayment tenures of up to 72 months.

This makes it easy for customers to choose a repayment tenure that suits their needs and financial situation.

Apart from the interest rate, Navi’s charges and fees are transparent and easy to understand.

There are no hidden charges, and customers are aware of the fees they need to pay upfront.

This means that customers can plan their finances better and avoid any surprises or unexpected expenses later on.

Overall, Navi Personal Loan offers competitive interest rates and transparent charges, making it a popular choice among customers looking for affordable and hassle-free personal loans.

Eligibility Criteria and Documents Required

When it comes to personal loans, eligibility criteria and documentation are critical factors. Navi Personal Loan offers easy eligibility and a hassle-free application process. Here are the details:

A. Eligibility Criteria for Navi Personal Loan

To be eligible for Navi Personal Loan, you must:

- Be a citizen of India

- Be aged between 21 and 60 years

- Have a minimum income of ₹20,000 per month

- Have a good CIBIL score (a score of 650 and above is preferred)

B. Documents Required for Navi Personal Loan

The following documents are required to apply for a Navi Personal Loan:

- Aadhaar card

- PAN card

- Income Proof

Having these documents readily available can make the loan application process smoother and faster.

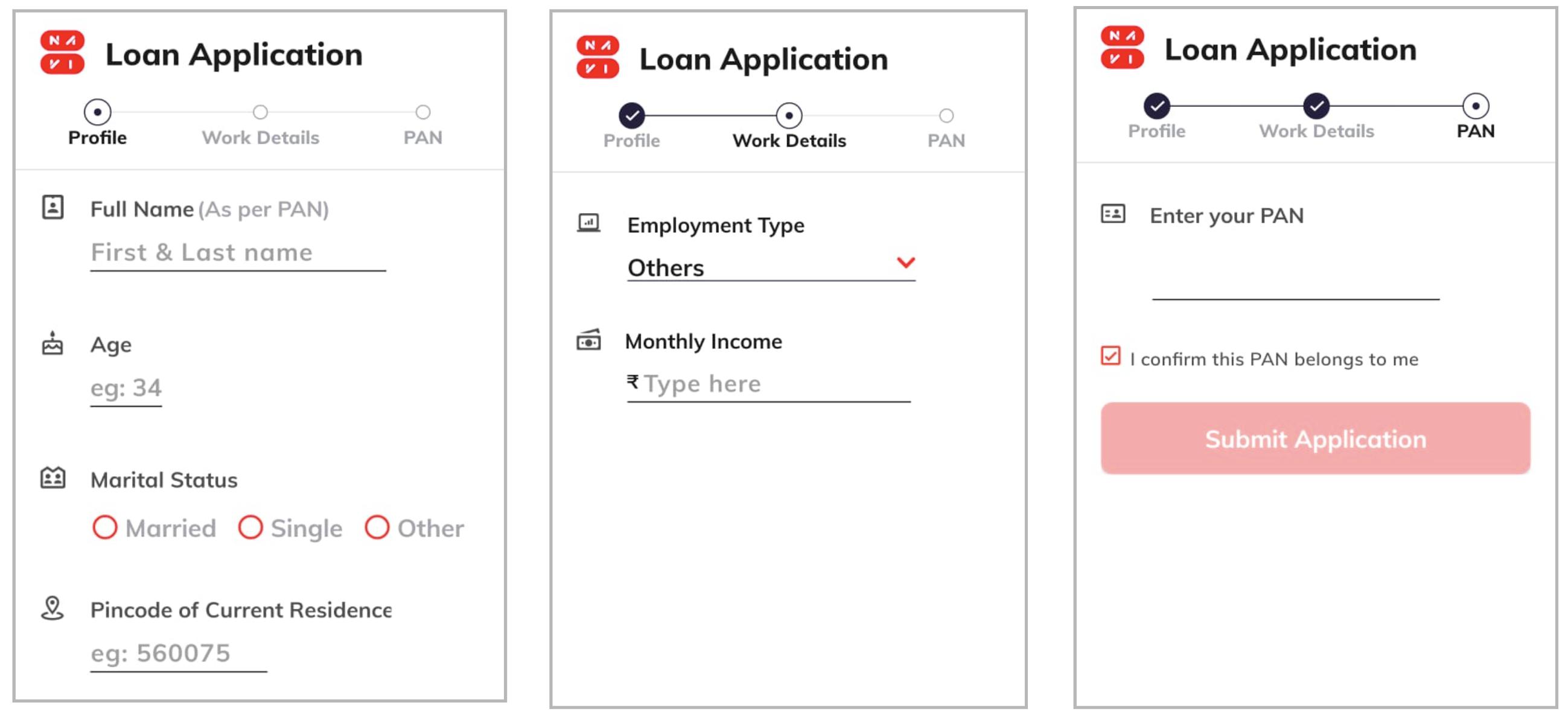

Are you interested in applying for a Navi Personal Loan? Here’s a step-by-step guide to help you through the process:

- Click Here to visit your personalized page and fill in your basic details.

- Next, you will be redirected to the Play Store, where you can download the Navi App.

- Enter and verify your mobile number using OTP.

- Enter your personal details, including your name, date of birth, and work details such as PAN, employment type, and monthly income.

- The eligible loan amount will be displayed, and you can select the required loan amount.

- Fill in your bank account details, including bank name, account number, and IFSC code.

- To complete the KYC process, click a selfie and upload your Aadhaar, and proceed for video KYC.

- Finally, check all relevant details such as EMI, tenure, interest rate, and more. If everything looks good, click on “Get Loan” to transfer the loan amount to your bank account.

Final Words

In conclusion, Navi Personal Loan is a great option for anyone in need of quick loan. With its instant disbursal, app-based process, flexible EMI options, minimal documentation, and no collateral required, it’s a loan that can help you meet your financial needs without any stress or hassle.

Navi offers attractive interest rates starting at 9.9% p.a. and loans up to ₹20 lakh with a repayment tenure of up to 72 months.

Moreover, Navi’s charges and fees are transparent and easy to understand, giving you complete clarity on the costs involved.

So don’t wait, apply for a Navi Personal Loan today and take control of your finances.

Lastly, if you found this article helpful, please share it with your friends and family who may benefit from Navi Personal Loan.

FAQS

What is Navi Personal Loan?

Navi Personal Loan is an unsecured loan that can be availed online, with no collateral required. It is designed to provide quick and easy access to cash for individuals who need it.

What is the eligibility criteria to apply for Navi Personal Loan?

To be eligible for Navi Personal Loan, you must be an Indian citizen between the ages of 21 to 58 years old, have a minimum income of Rs. 20,000 per month, and have a good credit score.

How much loan amount can I avail through Navi Personal Loan?

You can avail a loan amount up to Rs. 20 lakhs through Navi Personal Loan, depending on your eligibility and creditworthiness.

What is the minimum and maximum loan tenure for Navi Personal Loan?

The minimum loan tenure is 6 months and the maximum loan tenure is 72 months for Navi Personal Loan.

What is the interest rate for Navi Personal Loans?

The interest rate for Navi Personal Loan starts from 9.9% per annum and can go up to 45% per annum, depending on various factors such as credit score, loan amount, and repayment tenure.

Can I prepay or foreclose my Navi Personal Loans?

Yes, you can prepay or foreclose your Navi Personal Loan at any time without any penalty charges.

How do I repay my Navi instant Personal Loan?

You can repay your Navi Personal Loan through EMIs (Equated Monthly Installments) using automatic debit from your bank account or by manually transferring the amount through NEFT/RTGS.

How long does it take for the loan amount to be disbursed?

Once your loan application is approved and all required documents are submitted, the loan amount will be disbursed to your bank account within 24 hours.

Is there a prepayment charge for Navi Instant Personal Loan?

No, there are no prepayment charges for Navi Personal Loan. You can prepay your loan at any time without incurring any extra charges.

What documents do I need to submit to apply for Navi Instant Personal Loan?

You will need to submit your PAN card, Aadhaar card, bank statements, and salary slips to apply for Navi Instant Personal Loan. Additionally, you may be required to submit other documents depending on your specific loan application.