Are you looking for a personal loan to meet your urgent financial needs? Do you want to get the best deal on your loan without wasting time and money? If yes, then you should check out Paisabazaar.

Paisabazaar is India’s leading online marketplace for loans and credit cards. It helps you find and compare the best personal loan offers from various lenders in minutes. You can also apply for a personal loan online through Paisabazaar and get instant approval and disbursal.

But before you apply for a personal loan from Paisabazaar, you need to know Paisabazaar Personal Loan Eligibility.

In this article, we will tell you everything you need to know about eligibility of paisabazaar personal loan . We will also show you how to use the Paisabazaar Personal Loan Eligibility Calculator, what documents you need to submit, and how to apply for a personal loan online or offline.

So, let’s get started!

Paisabazaar Personal Loan Eligibility Criteria

The eligibility criteria for applying for a personal loan from Paisabazaar are:

- You must be an Indian citizen or a resident of India.

- You must be at least 21 years old and not more than 60 years old at the time of loan maturity.

- You must have a regular source of income, either from a salaried or a self-employed profession.

- You must have a minimum monthly income of Rs. 15,000 if you live in a metro city, or Rs. 12,000 if you live in a non-metro city.

- You must have a good credit score of at least 650 or above.

These are the basic eligibility criteria that apply to most lenders. However, different lenders may have different requirements based on their own policies and risk assessment. For example, some lenders may ask for a higher income or a lower age limit.

Paisabazaar Personal Loan Eligibility Calculator

How do you know if you meet the eligibility criteria for applying for a personal loan from Paisabazaar? How do you know which lender will offer you the best interest rate, tenure, and EMI? How do you compare different loan offers from different lenders in one place?

The answer is simple: use the Paisabazaar Personal Loan Eligibility Calculator.

The Paisabazaar Personal Loan Eligibility Calculator is a free online tool that helps you check your eligibility and compare loan offers from different lenders in minutes.

All you need to do is enter some basic details like your name, age, income, city, loan amount, tenure, and credit score. The calculator will then show you a list of lenders that match your profile and their respective interest rates, tenures, EMIs, processing fees, and other charges.

You can also filter the results by selecting your preferred lender type (bank or NBFC), interest rate type (fixed or floating), repayment mode (EMI or bullet), and prepayment option (yes or no). You can also sort the results by interest rate (low to high or high to low), EMI (low to high or high to low), or processing fee (low to high or high to low).

Here is how to use the Paisabazaar Personal Loan Eligibility Calculator step by step:

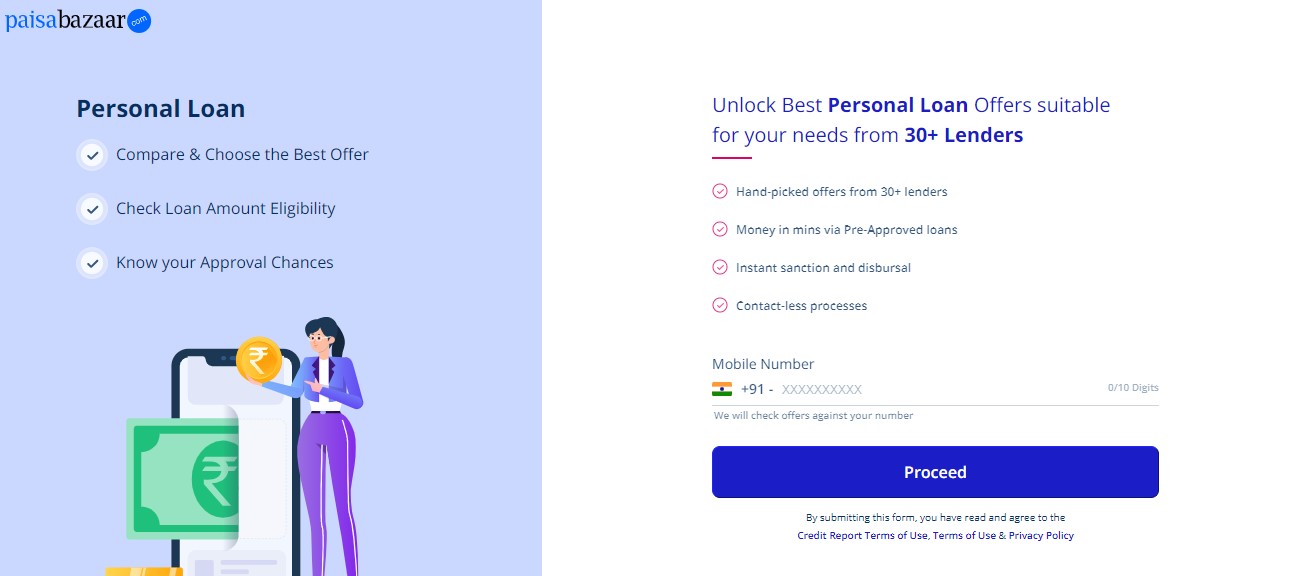

- Visit Paisabazaar.com Eligibility Calculator page and enter your name, mobile number, email address, and date of birth. Click on “Check Your Eligibility”.

- On the next page, enter your income details, such as your monthly income, existing EMI (if any), employer name, employer type (government or private), and profession type (salaried or self-employed). Click on “Continue”.

- On the next page, enter your loan details, such as your desired loan amount, tenure, credit score (if known), and city of residence. Click on “View Best Offers”.

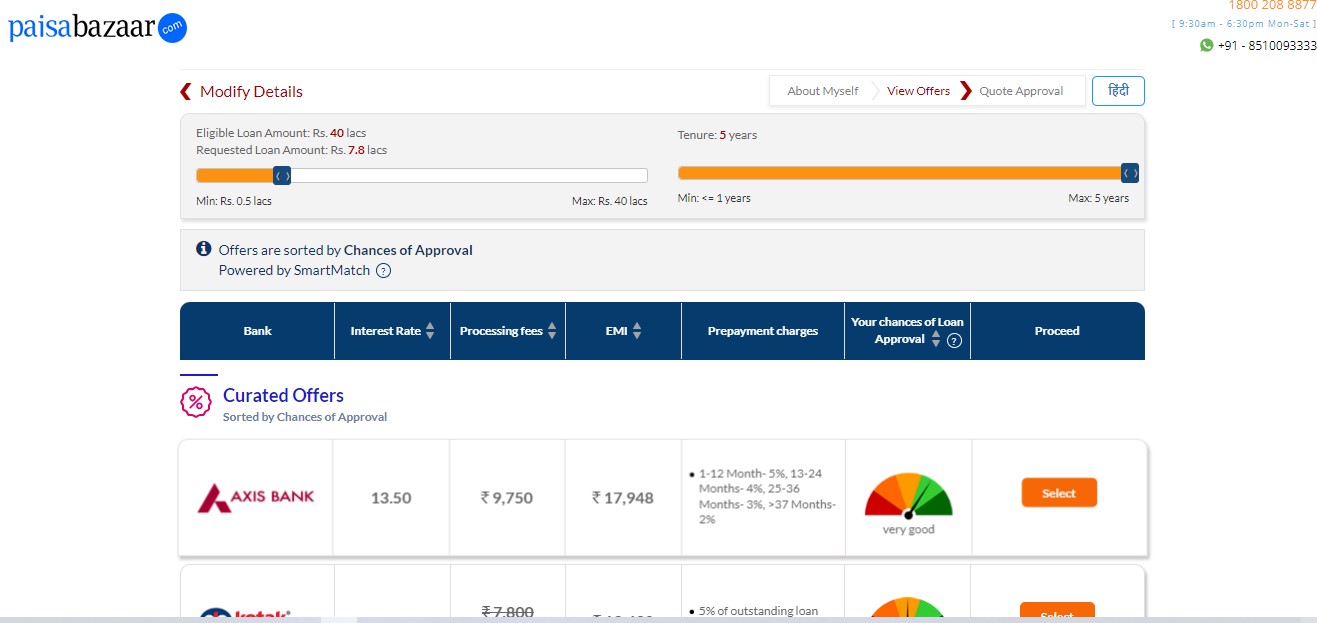

- On the next page, you will see a list of lenders that match your profile and their respective loan offers. You can compare them by interest rate, EMI, tenure, processing fee, etc. You can also filter and sort them as per your preference.

- Once you find the best offer for you, click on “Apply Now” to proceed with the online application process.

Here is an example of how the Paisabazaar Personal Loan Eligibility Calculator works:

Paisabazaar Personal Loan Documents Required

The documents required for applying for a personal loan from Paisabazaar are: Open in browser

| Document Type | Document Name |

|---|---|

| Identity Proof | Aadhaar Card, PAN Card, Passport, Voter ID Card, Driving License, etc. |

| Address Proof | Aadhaar Card, Passport, Voter ID Card, Driving License, Utility Bill, Bank Statement, Rent Agreement, etc. |

| Income Proof | For Salaried: Salary Slip, Form 16, Bank Statement, etc. For Self-Employed: Income Tax Return, Profit and Loss Statement, Balance Sheet, Bank Statement, etc. |

| Bank Statement | Bank Statement of the last 6 months showing salary or business income credit and existing EMI debit (if any) |

These are the common documents required by most lenders. However, different lenders may ask for additional documents based on their own policies and risk assessment. For example, some lenders may ask for a guarantor or a collateral.

The documents are important because they help the lenders verify your identity, address, income, and creditworthiness. They also help the lenders determine your loan eligibility and amount.

You can submit the documents online, you need to upload scanned copies or images of the documents on the Paisabazaar website or app.

How to Apply for Paisabazaar Personal Loan

How to apply for a personal loan from Paisabazaar online ? It’s simple and easy. Just follow these steps:

Online Application Process

- Visit Paisabazaar and enter your name, mobile number, email address, and date of birth. Click on “Check Your Eligibility”.

- Follow the steps mentioned in the previous section to use the Paisabazaar Personal Loan Eligibility Calculator and compare loan offers from different lenders.

- Once you find the best offer for you, click on “Apply Now” to proceed with the online application process.

- Fill in the online application form with your personal, professional, and financial details. Review and submit the form.

- Upload the required documents online as per the lender’s instructions.

- Verify your details through an OTP sent to your mobile number or email address.

- Choose the lender of your choice from the list of options provided by Paisabazaar.

- Sign the loan agreement online using a digital signature or an e-signature.

- Wait for the final approval from the lender after they verify your details and documents.

- Receive the loan amount in your bank account within 24 hours.

Apply Now

Get the Best Personal Loan Offer from Paisabazaar.com

Conclusion

We hope this article has helped you understand everything you need to know about Paisabazaar Personal Loan Eligibility. We have covered the eligibility criteria, eligibility calculator, documents required, and application process for applying for a personal loan from Paisabazaar.

Now that you know how easy and convenient it is to get a personal loan from Paisabazaar, why wait? Check your eligibility and apply for a personal loan from Paisabazaar today and get instant approval and disbursal.

Thank you for reading this article till the end. If you have any questions or feedback, please feel free to leave a

FAQs

What is the minimum and maximum personal loan amount that I can get from Paisabazaar?

The minimum personal loan amount that you can get from Paisabazaar is Rs. 30,000 and the maximum personal loan amount that you can get from Paisabazaar is Rs. 40 lakh. However, some lenders may offer higher or lower loan amounts depending on your profile and eligibility.

What is the interest rate for a personal loan from Paisabazaar?

The interest rate for a personal loan from Paisabazaar varies from lender to lender and from borrower to borrower. The interest rate is determined by the lender based on your creditworthiness, repayment capacity, loan amount, tenure, etc. The interest rate for a personal loan from Paisabazaar usually starts from 10.49% p.a. onwards. However, some public sector banks may charge lower interest rates.

How long does it take to get a personal loan from Paisabazaar?

It takes very little time to get a personal loan from Paisabazaar. If you apply online through Paisabazaar and submit all the required documents online, you can get instant approval and disbursal within 24 hours.