Finding the best credit card for students can feel like navigating a maze. But trust me, it’s worth the effort. With the right credit card, students can build credit, manage expenses, and even snag some perks along the way.

When choosing the best credit card, look for:

- Low or no annual fees: You don’t want a card that eats into your limited student budget.

- Rewards and perks: Who doesn’t love cash back or points for spending?

- Ease of eligibility: Some cards are more student-friendly than others.

In this guide, we’ll dive into top picks , exploring their features, eligibility criteria, and what makes each one unique. By the end, you’ll have a clear picture of the best options to kickstart your financial journey in style.

Ready? Let’s get started.

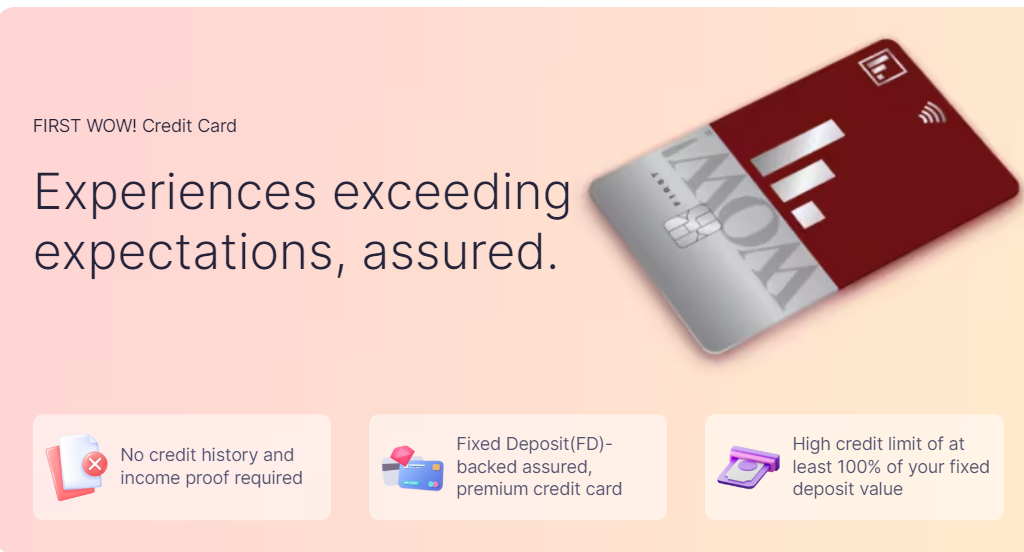

IDFC FIRST WOW Credit Card

Finding the best credit card for students isn’t always straightforward, but the IDFC FIRST WOW Credit Card is top student credit cards. Why? Because it packs a punch with features that are super friendly for students.

- Features: Imagine a card that gives you cashback on every purchase. The IDFC FIRST WOW does just that, plus zero annual fees and a generous credit limit. Sounds good, right?

- Eligibility: This card is designed with students in mind, making the eligibility criteria accessible. No need to jump through hoops to get approved.

- Interest Rates: Keeping costs low is crucial for students. The IDFC FIRST WOW Credit Card offers competitive interest rates, helping you manage your budget effectively.

- Credit Limit: You won’t find yourself struggling for credit with this card. The limit is 100 % of the FD Amount.

| Feature | Details |

| Annual Fee | Zero |

| Interest Rate | Competitive |

| Credit Limit | Generous |

| Eligibility | Easy student access |

In essence, if you’re hunting for the best credit card for students, the IDFC FIRST WOW Credit Card is a stellar choice. It combines affordability, accessibility, and perks designed to suit student life perfectly. Ready to explore more options? Let’s move on to the next card.

SBI Student Plus Advantage Credit Card

Looking for a student friendly credit card with solid benefits? The SBI Student Plus Advantage Credit Card is a stellar pick.

- Features: This card offers reward points on every spend, which can be redeemed for a plethora of options like travel, shopping, and more. Plus, enjoy fuel surcharge waiver and railway ticket booking through IRCTC.

- Eligibility: As the name suggests, it’s made for students. Easy eligibility makes it a go-to choice for many.

- Interest Rates: The interest rates are competitive, keeping your costs down while you build your credit score.

- Credit limit: With a decent credit limit upto 110 % of the FD amount, this card provides enough flexibility for students managing various expenses.

| Feature | Details |

| Annual Fee | INR 500 |

| Interest Rate | 2.5% per month |

| Credit Limit | Based on Fixed Deposit |

| Eligibility | Students with FD in SBI |

The SBI Student Plus Advantage Credit Card is a strong contender for the best credit card for students. It offers a mix of rewards, practical benefits, and is designed to be accessible to students without previous credit history. Ready to explore more options? Let’s check out the next card.

Kotak 811 #DreamDifferent Credit Card

Ready for another great option? The Kotak 811 #DreamDifferent Credit Card stands out with its student-centric features.

- Features: Enjoy benefits like cashback on every purchase, zero annual fees, and special offers on dining and travel. It also provides easy-to-track spending reports to help manage your budget effectively.

- Eligibility: This card is crafted for students, ensuring the application process is straightforward and hassle-free.

- Interest Rates: The interest rates are designed to be student-friendly, helping you manage your finances without breaking the bank.

- Credit Limit: With a flexible credit limit, this card is perfect for covering both daily expenses and unexpected costs.

| Feature | Details |

| Annual Fee | Zero |

| Interest Rate | 3.5% per month |

| Credit Limit | Customizable |

| Eligibility | Students in India |

The Kotak 811 #DreamDifferent Credit Card is another contender for the best credit card for students. It combines affordability, accessibility, and perks specifically tailored for student needs. Intrigued by more options? Let’s move on to the next card.

ICICI Coral Contactless Credit Card

Next up is the ICICI Coral Contactless Credit Card—a great option for students who are always on the go.

- Features: This card offers contactless payments for added convenience, plus rewards on every purchase. Enjoy benefits like complimentary movie tickets and discounts on dining.

- Eligibility: It’s designed to be accessible, making it a student-friendly choice with straightforward eligibility criteria.

- Interest Rates: With competitive interest rates, managing your expenses while building your credit score becomes hassle-free.

- Credit Limit: The credit limit is flexible, allowing students to handle both regular and unexpected expenses with ease.

| Feature | Details |

| Annual Fee | INR 500 (waived on spending) |

| Interest Rate | 3.4% per month |

| Credit Limit | Based on student profile |

| Eligibility | Students with valid ID |

The ICICI Coral Contactless Credit Card is a practical choice for the best credit card for students. It combines convenience with a range of perks, making it perfect for students who want to enjoy a little extra while managing their finances wisely. Want to see more options? Let’s explore the next card.

ICICI Bank Student Forex Prepaid Card

Let’s dive into the ICICI Bank Student Forex Prepaid Card. A great companion for students studying abroad or planning to travel. This is one of the best credit cards for college students

- Features: This card offers multi-currency support, making it incredibly convenient for international travel. It also provides complimentary insurance coverage, rewards on spends, and emergency assistance services.

- Eligibility: The application process is smooth and designed with students in mind.

- Interest Rates: As it’s a prepaid card, there’s no interest to worry about, making it a worry-free option for students.

- Credit Limit: While it doesn’t offer a loan amount per se, it allows you to load money as per your requirement, ensuring you have funds when you need them.

| Feature | Details |

| Annual Fee | INR 499 |

| Interest Rate | N/A |

| Credit Limit | Based on loaded amount |

| Eligibility | Students with valid ID |

The ICICI Bank Student Forex Prepaid Card stands out for its practicality, especially for students traveling abroad. It offers peace of mind with its prepaid structure and convenient features, making it a top choice for the best credit card for students. Let’s keep the momentum going and check out the next card.

Uni Credit Card for Students

Last but not least, the Uni Credit Card. This card is best credit cards for students with good credit.

- Features: This card provides the unique benefit of splitting your purchases into three parts, with zero interest, making it easier to manage your expenses. It also offers cashback on every spend, rewards for timely repayments, and no annual fees.

- Eligibility: The Uni Credit Card is designed with students in mind, ensuring a hassle-free application process.

- Interest Rates: With a zero-interest split payment option, this card helps students avoid high interest rates, offering a more manageable way to handle expenses.

- Credit Limit: The credit limit is flexible, adapting to student needs and ensuring enough funds are available when necessary.

| Feature | Details |

| Annual Fee | Zero |

| Interest Rate | Zero interest on split payments |

| Credit Limit | Flexible |

| Eligibility | Students with valid ID |

The Uni Credit Card stands out for its innovative features and student-friendly policies, making it a strong candidate for the best credit card for students. With its unique split payment option and zero annual fees, it’s perfect for managing your expenses efficiently. Let’s wrap things up in the conclusion.

Conclusion

So, there you have it—some of the best credit cards for students available in India. Each card offers unique benefits tailored to suit student needs, from cashback and rewards to low fees and easy eligibility.

Whether you’re managing everyday expenses, planning for future purchases, or even traveling abroad, these credit cards can be your financial allies, helping you build credit and develop good financial habits. Remember, it’s essential to compare and choose a card that aligns best with your lifestyle and financial goals.

In conclusion, having the right credit card can make a significant difference in managing your finances as a student. Do your research, consider your options, and you’ll find the perfect card to help you on your journey.

FAQs

What are the benefits of having a student credit card?

Student credit cards help build credit history, manage expenses, and offer rewards and perks tailored for students.

How do I choose the best credit card for students?

Look for cards with low or no annual fees, rewards programs, and easy eligibility criteria. Compare features to find the best fit for your needs.

Can students with no credit history get a credit card?

Yes, many student credit cards are designed for those with no credit history. Some require a fixed deposit or parental co-signer.

What is the eligibility criteria for student credit cards?

Typically, you need to be enrolled in a college or university, be at least 18 years old, and provide proof of enrollment and identity.

Are there any fees associated with student credit cards?

Some cards have no annual fees, while others might have low fees. Always check the terms and conditions before applying.

How can I maintain a good credit score with a student credit card?

Pay your bills on time, keep your credit utilization low, and monitor your credit report regularly

What should I do if I encounter issues with my student credit card?

Contact your card issuer’s customer service for assistance. They can help resolve issues like billing errors or unauthorized transactions.