Aditya Birla Capital is a leading financial services company in India offering a range of products and services, including personal loans.

Aditya Birla Capital personal loan is a flexible and convenient solution for your financial needs.

In this blog article, we will tell you everything you need to know about Aditya Birla Capital personal loan, such as its Rate Of Interest, Eligibility & Features.

Read on to find out more.

How To Apply For Aditya Birla Capital Personal Loan

Applying for Aditya Birla Capital personal loan is easy and convenient. You can apply for the loan online or offline, depending on your preference.

Here are the steps to apply for Aditya Birla Capital personal loan online:

- Visit the Aditya Birla Capital Personal Loan website by Clicking Here or Below Button.

- Enter your mobile number, personal email address and verify. Accept the terms and conditions and click on “Proceed”.

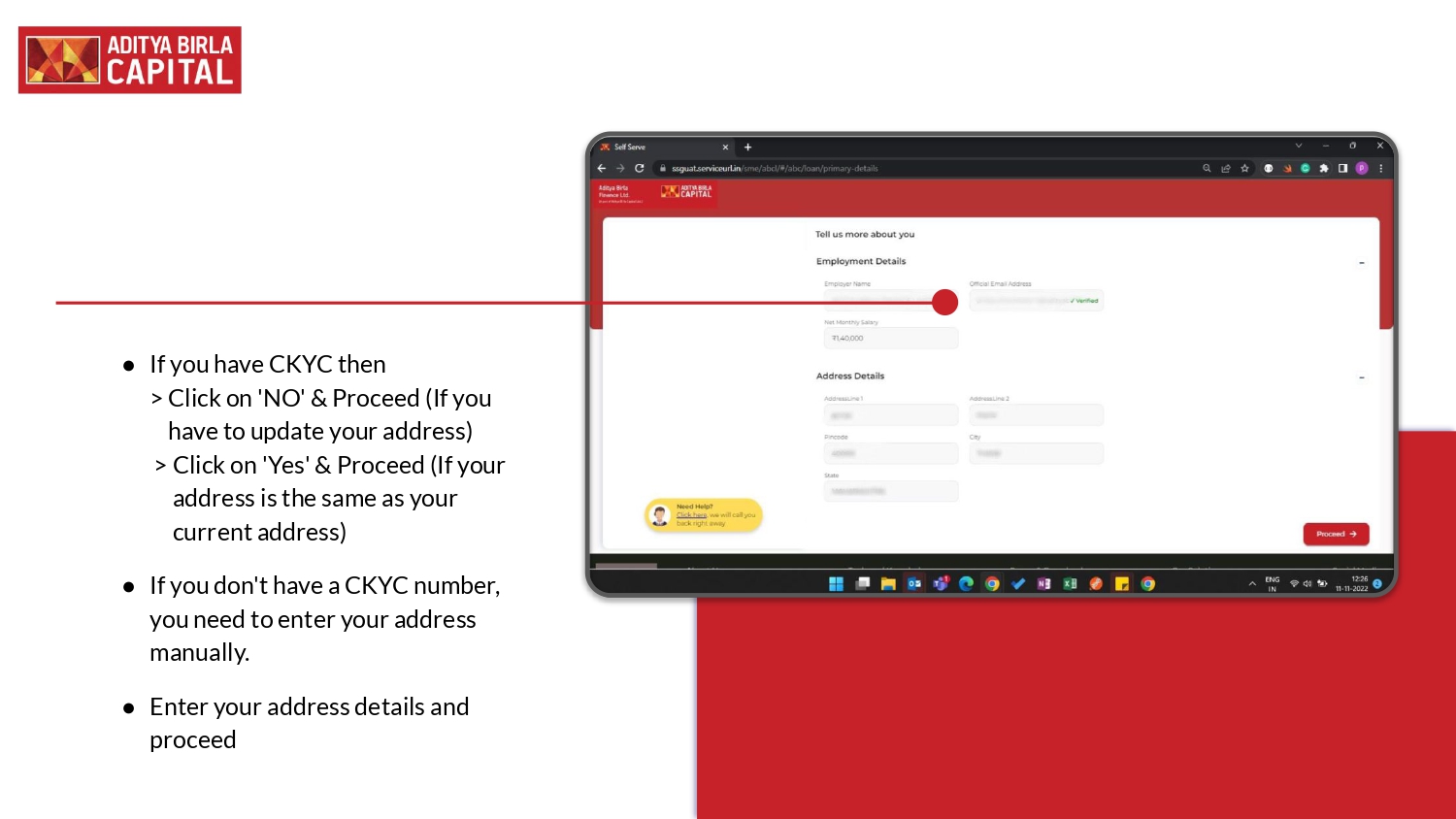

- Select your employment type, enter your personal details, employment details and proceed. Note: If you have CKYC number in your PAN card, the system will display a popup window screen in the address section. If your current address is same as your Aadhaar card address then system will check liveliness otherwise system will go for video KYC.

- If you have CKYC then click on “No” & Proceed (If you have to update your address) or click on “Yes” & Proceed (If your address is the same as your current address). If you don’t have a CKYC number, you need to enter your address manually.

- Enter your address details and proceed.

- Choose your preferred loan amount from the maximum loan offer, select loan period and proceed.

- Your current address details will be auto-populated, select your “Residence type”. Note: If you select the residential type as “Rented”, you need to enter the “Permanent Address”.

- Enter your office address details, other details and proceed.

- Now you can see the summary screen where you can review all the information you have filled. Click on “Banking Details” and proceed.

- Enter your bank account details such as bank name, IFSC code, account number, etc., and proceed.

- Upload all the required documents.

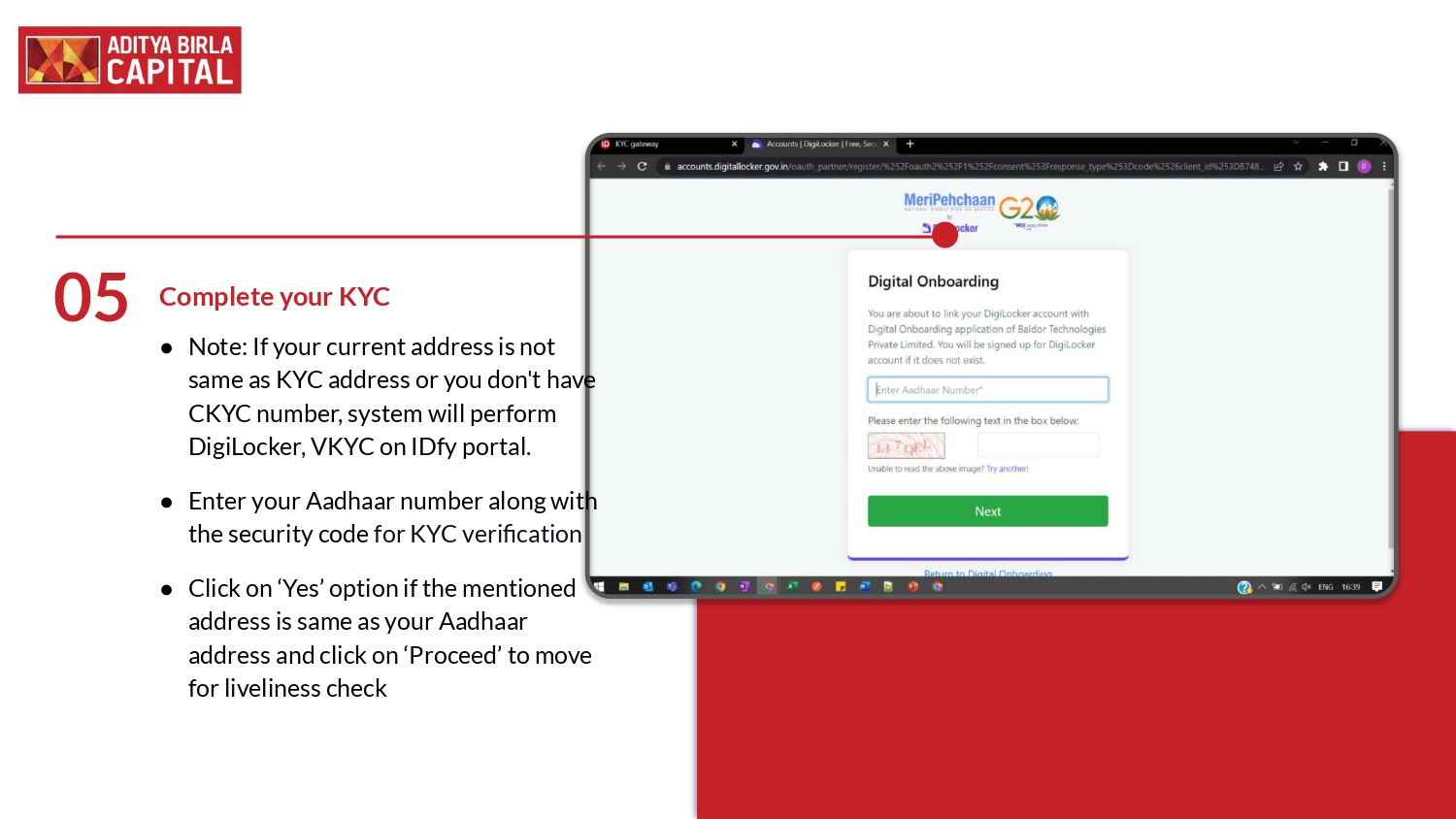

- Enter your Aadhaar number along with the security code for KYC verification. Click on “Yes” option if the mentioned address is same as your Aadhaar address and click on “Proceed” to move for liveliness check.

- Upload a selfie to verify your identity. If the mentioned address is not same as your Aadhaar address click on “No” option and then click on “Proceed”. You need to tick the checkboxes and then click on “I’m ready” button to complete your KYC.

- Click on “Schedule a Call” if the representative is not currently available. Once the appointment is booked click on “Close” and the system will show the scheduled date and time.

- Once the video call is completed, a thank you message will appear on the screen.

You will get confirmation of your loan application on your email.

GET INSTANT PERSONAL LOAN

Don’t wait any longer. Apply for Aditya Birla Capital personal loan today and fulfill your dreams.

Aditya Birla Capital Personal Loan Rate of Interest

One of the most important factors that you need to consider when applying for a personal loan is the interest rate.

The interest rate for Aditya Birla Capital personal loan is determined based on various factors, such as your credit score, loan amount, tenure, income, etc. The higher your credit score, the lower your interest rate.

The current range of interest rates offered by Aditya Birla Capital for different loan amounts and tenures is as follows:

| Loan Amount | Tenure | Interest Rate |

|---|---|---|

| Rs. 25,000 – Rs. 50 lakh | 12 – 60 months | 14% – 26% p.a. |

As you can see, Aditya Birla Capital offers competitive interest rates that are comparable or lower than other leading personal loan providers in India.

For example, HDFC Bank charges 11% – 21.5% p.a., ICICI Bank charges 11% – 22% p.a., and Bajaj Finserv charges 16% – 26% p.a. for similar loan amounts and tenures.

Therefore, by choosing Aditya Birla Capital personal loan, you can save money on your interest payments and repay your loan faster.

GET INSTANT PERSONAL LOAN

Don’t wait any longer. Apply for Aditya Birla Capital personal loan today and fulfill your dreams.

Fees and Charges of Aditya Birla Capital Personal Loan

Apart from the interest rate, you also need to be aware of the fees and charges that Aditya Birla Capital may levy on your personal loan.

These fees and charges may vary depending on the loan amount, tenure, and other factors.

Here is a table that summarizes the fees and charges for Aditya Birla Capital personal loan:

| Fee/Charge | Amount |

|---|---|

| Processing fee | Up to 2% of the loan amount |

| Penalty on late payment of EMI | 3% of pending amount per month |

| Penalty on prepayment or foreclosure | 4% of principal outstanding |

| Fee for duplicate statement | Rs. 200 per instance |

| CIBIL report retrieval fee | Rs. 100 + GST per instance |

| Loan re-schedule charge | Rs. 5,000 + GST per instance |

| Stamp duty | As per actuals if applicable |

| Insurance premium | As per actuals if applicable |

| Pre-closure quote | Rs. 1,000 + GST per instance |

You can find more details about these fees and charges on the website of Aditya Birla Capital or in the loan agreement document.

You can also contact the customer care team of Aditya Birla Capital for any queries or clarifications.

Aditya Birla Capital Personal Loan Eligibility

Another factor that you need to consider when applying for a personal loan is the eligibility criteria.

The eligibility criteria for applying for Aditya Birla Capital personal loan are as follows:

- You must be an Indian citizen and resident.

- You must be between 23 and 60 years of age.

- You must have a minimum monthly income of Rs. 25,000.

- You must have a minimum credit score of 700.

- You must have a stable source of income and employment history.

The minimum and maximum loan amount and tenure that you can avail from Aditya Birla Capital are as follows:

- The minimum loan amount is Rs. 25,000 and the maximum loan amount is Rs. 50 lakh.

- The minimum loan tenure is 12 months and the maximum loan tenure is 60 months.

The Documents Required For Aditya Birla Capital Personal Loan

- Identity proof: PAN card, Aadhaar card, passport, voter ID card, etc.

- Address proof: Aadhaar card, passport, utility bill, rent agreement, etc.

- Income proof: 3 Month’s salary slip, bank statement, income tax return, etc.

You can apply for Aditya Birla Capital personal loan online or offline by visiting the nearest branch or calling the customer care number.

GET INSTANT PERSONAL LOAN

Don’t wait any longer. Apply for Aditya Birla Capital personal loan today and fulfill your dreams.

Aditya Birla Capital Personal Loan Details

Now that you know the interest rate and eligibility criteria for Aditya Birla Capital personal loan, let’s look at some of the features and benefits of this loan.

- No collateral or security required: As mentioned earlier, Aditya Birla Capital personal loan is an unsecured loan, which means you do not have to pledge any asset or property as collateral or security. This makes the loan process easier and faster, as you do not have to worry about the valuation or verification of your asset or property.

- No prepayment or foreclosure charges*: Aditya Birla Capital personal loan allows you to prepay or foreclose your loan without any extra charges for selected customers. This means you can repay your loan before the end of the tenure and save on interest. You can prepay or foreclose your loan anytime after paying 6 EMIs.

- Flexible repayment options: Aditya Birla Capital personal loan offers flexible repayment options that suit your convenience and budget. You can choose the loan tenure from 12 to 60 months, depending on your loan amount and income.

- Online application and tracking: Aditya Birla Capital personal loan allows you to apply for the loan online through its website or mobile app. You can fill the loan application form, upload the required documents, and get instant approval within minutes. You can also track the status of your loan application and disbursement online through the website or mobile app.

- Special offers and schemes: Aditya Birla Capital personal loan provides special offers and schemes for its customers, such as discounts, rewards, cashback, etc. For example, you can get a 0.25% discount on the interest rate if you are an existing customer of Aditya Birla Capital or if you have a good credit score. You can also get a cashback of up to Rs. 10,000 if you refer a friend or family member to apply for Aditya Birla Capital personal loan.

Aditya Birla Capital personal loan has received positive feedback and satisfaction from its customers.

Aditya Birla Capital Personal Loan Customer Care Number

If you have any queries or complaints regarding Aditya Birla Capital personal loan, you can contact the customer care team of Aditya Birla Capital. The customer care team is available 24/7 to assist you with your loan-related issues.

The contact details of Aditya Birla Capital customer care team are as follows:

- Toll-free number: 1800-270-7000

- Email address: care.finance@adityabirlacapital.com

- Website link: [https://www.adityabirlacapital.com/personal-loan]

Here are some tips or suggestions on how to get the best service from Aditya Birla Capital customer care team:

- Mention your loan reference number when you call or email the customer care team. This will help them identify your loan account and provide you with relevant information.

- Be polite and patient when you communicate with the customer care team. They are there to help you and resolve your issues as soon as possible.

- Provide feedback or suggestions on how to improve the service or product of Aditya Birla Capital. This will help them serve you better in the future.

Aditya Birla Capital Personal Loan Calculator

One of the tools that can help you plan your personal loan repayment schedule and budget is the personal loan calculator. A personal loan calculator is an online tool that can help you calculate your

monthly EMI, total interest payable, and total amount payable for your desired loan amount and tenure. By using the personal loan calculator, you can compare different loan scenarios and choose the best one for your needs.

Loan Calculator

Loan EMI

Total Interest Payable

Total Amount

Aditya Birla Capital provides an online personal loan calculator tool that you can access through its website or mobile app. You can use this tool to calculate your EMI, interest, and amount for Aditya Birla Capital personal loan. All you need to do is enter the following details:

- Loan amount: The amount of money that you want to borrow from Aditya Birla Capital.

- Loan tenure: The duration of time that you want to repay the loan to Aditya Birla Capital.

- Interest rate: The rate of interest that Aditya Birla Capital charges for the loan.

Once you enter these details, the personal loan calculator will show you the following results:

- EMI: The equated monthly installment that you have to pay every month to Aditya Birla Capital until the end of the loan tenure.

- Interest: The total amount of interest that you have to pay to Aditya Birla Capital over the loan tenure.

- Amount: The total amount of money that you have to pay to Aditya Birla Capital, including the principal and interest.

You can also change the loan amount, tenure, or interest rate and see how it affects your EMI, interest, and amount. You can also download or print the results for your reference.

Here are some examples or scenarios of using the personal loan calculator tool and the results in a table format:

| Scenario | Loan Amount | Tenure | Interest Rate | EMI | Interest | Amount |

|---|---|---|---|---|---|---|

| 1 | Rs. 1 lakh | 12 months | 14% p.a. | Rs. 8,960 | Rs. 7,520 | Rs. 1,07,520 |

| 2 | Rs. 5 lakh | 36 months | 16% p.a. | Rs. 17,624 | Rs. 1,34,464 | Rs. 6,34,464 |

| 3 | Rs. 10 lakh | 60 months | 18% p.a. | Rs. 25,393 | Rs. 5,23,580 | Rs. 15,23,580 |

As you can see, by using the personal loan calculator tool, you can easily plan your personal loan repayment schedule and budget according to your needs and preferences.

Conclusion

Aditya Birla Capital personal loan is a flexible and convenient solution for your financial needs. It offers competitive interest rates, flexible repayment options, quick approval, and online application and tracking. It also provides special offers and schemes for its customers and has a dedicated customer care team to assist you with your queries or complaints.

If you are interested in applying for Aditya Birla Capital personal loan, you can visit its website or mobile app and fill the online application form. You can also use the online personal loan calculator tool to calculate your EMI, interest, and amount for your desired loan amount and tenure.

Alternatively, you can visit the nearest branch of Aditya Birla Capital or call its toll-free number to apply for the loan offline or get more information.

We hope this blog article has helped you understand everything about Aditya Birla Capital personal loan. If you have any feedback or comments on this blog article, please feel free to share them with us. We would love to hear from you. 😊

FAQs

What is the interest rate on a personal loan from Aditya Birla Finance?

The interest rate on a personal loan from Aditya Birla Finance depends on your credit score, the amount of loan you are applying for, and the tenure of the loan. The current interest rate range is between 13% and 28% p.a.

What is the maximum tenure of a personal loan from Aditya Birla Finance?

The maximum tenure of a personal loan from Aditya Birla Finance is 5 years.

How long does it take to get a personal loan from Aditya Birla Finance?

The processing time for a personal loan from Aditya Birla Finance depends on the documentation you submit and the credit score you have. The average processing time is 7-10 working days.

How can I track my personal loan application status?

You can track your personal loan application status online or by calling the customer care number. The customer care number is 1800 270 7000.

How do I repay my personal loan?

You can repay your personal loan through ECS/NACH. You can also make manual payments at any Aditya Birla Finance branch.