Owning a home is more than just a financial investment – it’s a place to create lasting memories with your loved ones. Imagine coming home to a space that’s truly your own, where you can relax and unwind after a long day.

This dream can become a reality with the help of ICICI Bank Home Loan, now available at a low-interest rate of 8.75%. With a simple and straightforward application process, ICICI Bank makes it easy for you to turn your dream into a reality and get the home you’ve always wanted.

In this blog post, we’ll explore the benefits of applying for an ICICI Bank Home Loan @ 8.75% and what makes it the best option for your home buying journey.

ICICI Bank Home Loan Types

- The Regular Home Loan: A classic home loan solution perfect for buying or building your dream home. You can repay it over a span of up to 20 years.

- The Instant Home Loan (Pre-approved): Want a home loan that’s quick, simple and tailored to your salary account with ICICI Bank? This one’s for you. Get loan amounts up to Rs 3 crore, with repayments spread out over a maximum of 30 years.

- The Express Home Loan: A fast track solution to home ownership, this loan allows you to apply, get approved and start building in no time. The provisional sanction letter remains valid for 6 months, and you can get loan amounts of up to Rs 5 crore, with repayments over a maximum of 30 years.

- The Extra Home Loan: This home loan gives you the flexibility to increase your repayment period till 67 years of age to enhance your loan amount by 20%. And it’s all backed by Mortgage Guarantee. Get loan amounts of up to Rs 2 crore, with repayments till 67 years of age.

- The Balance Transfer and Top-up: If you have an existing home loan with another bank, ICICI Bank Home Loan offers the option to transfer it over at lower interest rates. And to meet your personal or professional requirements, you can even get an additional top-up loan. Repayments are spread over a maximum of 20 years.

- The Pratham Home Loan: A home loan solution for affordable housing, perfect for salaried applicants with a minimum salary of Rs 10,000 per month, and self-employed applicants with a business vintage of at least 5 years. Get loan amounts between Rs 5 lakh and Rs 50 lakh, with repayments over a maximum of 20 years.

- The Land Loan: You’ve found the perfect plot, but need help purchasing it? ICICI Plot Loans are here for you. Get loan amounts of up to Rs 3 crore, with repayments spread over a maximum of 20 years.

- The NRI Home Loan: For NRIs looking to purchase or construct a house in India, ICICI NRI Home Loans provide the financial support you need. Repayments are spread over a maximum of 30 years.

- The Insta Home Loan Overdraft (Pre-Approved): Get a pre-approved digital home loan overdraft with instant access to funds. Perfect for covering personal expenses such as education, home renovation, debt consolidation, and emergencies. Get loan amounts of up to Rs 25 lakh.

- The Insta Top-up Loan (Pre-Approved): Need instant funds for personal or business needs? Get a pre-approved top-up loan in just 3 clicks. Get loan amounts of up to Rs 1 crore, with repayments spread over a maximum of 10 years.

- The Pradhan Mantri Awas Yojna (PMAY): Get an interest subsidy of up to Rs 2.67 lakh for the purchase of a new or old residential house, home construction, land purchase, construction of a dwelling unit, or extension of an existing residential property. Repayments are spread over a maximum of 20 years.

ICICI Bank Home Loan : Documents Required

| Document Type | Required Documents |

|---|---|

| Proof of Identity | PAN Card, Passport, Aadhaar Card, Voter’s ID Card, Driving License (any one) |

| Proof of Age | Aadhaar Card, PAN Card, Passport, Birth Certificate, 10th Class Marksheet, Bank Passbook, Driving License (any one) |

| Proof of Residence | Bank Passbook, Voter’s ID, Ration Card, Passport, Utility bills (Telephone Bill, Electricity Bill, Water Bill, Gas Bill), LIC Policy Receipt, Letter from a recognized public authority verifying the customer’s address (any one) |

| Proof of Income for Salaried | Form 16, Certified letter from Employer, Payslip of last 3 months, Increment or Promotion letter, IT returns of past 3 years |

| Proof of Income for Self Employed | Income Tax Returns (ITR) of last 3 years, Balance Sheet and Profit & Loss Account Statement of the Company/Firm (duly attested by a C.A.), Business License Details (or any other equivalent document), The license of Professional Practice (For Doctors, Consultants, etc.), Registration Certificate of Establishment (For Shops, Factories & Other Establishments), Proof of Business Address |

| Property documents | Receipts of payments made to the developer (in case of a new house), Allotment Letter / Buyer Agreement, Title Deeds including the chain of previous property documents (in case of house resale), A copy of the sale agreement (if already executed), Receipt of initial payment made to the house seller, Title Deeds of the plot (in case of house construction), A detailed estimate of house construction by an Architect / Civil Engineer, A copy of the plans, approved by the Local Authorities, Proof of no encumbrances on the property |

| Other Documents | Passport size photographs of all the applicants/co-applicants (to be affixed on the application form and signed across), Proof of own contribution, Last 6 months’ bank statements showing the repayment of ongoing loans (if any), The details of ongoing loans (such as the outstanding amount, monthly instalments, purpose, remaining loan tenure, etc.) in the name of an individual or business entity (if any), A cheque for processing fee favoring the home loan provider |

ICICI Bank Home Loan Fees & Charges

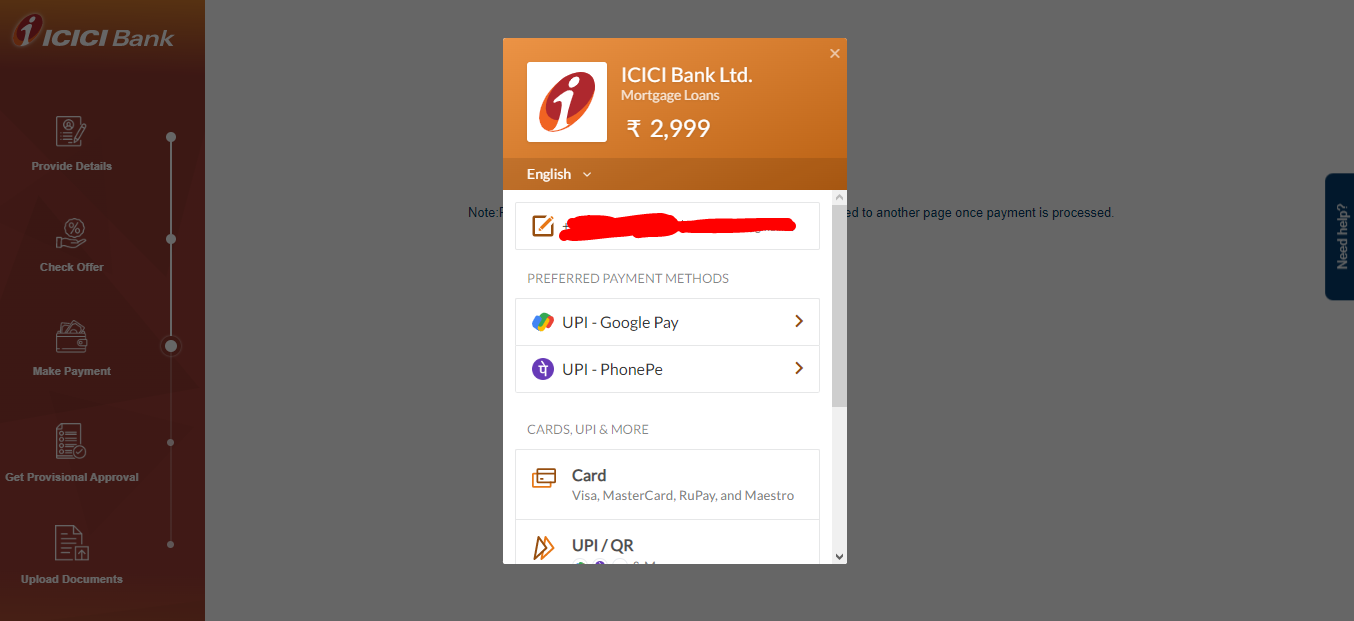

- Loan Processing/Renewal Charges: Rs 2,999 (Special processing fee as a part of Festive Offer, available for applicants with Bureau Score ≥ 750 & Loan amount ≥ 50 Lakhs & includes all taxes, CIBIL & CERSAI charges if applicable)

- Prepayment Charges:

- NIL for floating rate ICICI Bank Home Loan and Home Improvement Loans

- 2% of outstanding principal on full repayment for fixed rate ICICI Home Loans

- 2% of outstanding principal on full repayment for Non-Individual Top Up Loan

- 4% of outstanding amount for Non-Individual or fixed rate Individual loans

- Late Payment Charges:

- Home Loans: 2% per month

- Home OD: 1.5% of outstanding amount (minimum of Rs. 500 and maximum of Rs. 5000)

- Conversion Charges for ICICI Bank Home Loans:

- Floating to Floating: 0.5% of principal outstanding

- Dual fixed rate to Floating: 0.5% of principal outstanding

- Floating to Dual fixed rate: 0.5% of principal outstanding

- Lifetime fixed to Floating: 1.75% of principal outstanding

- Repayment Mode Swap Charge: Rs 500

- Document Retrieval Charge: Rs 500

- Cheque Bounce Charge: Rs 500

- Duplicate No Objection Certificate/No Due Certificate: Rs 100

- Revalidation of No Objection Certificate: Rs 100

- Administrative Charge: Rs 5000

- CIBIL Report Charge: Rs 50

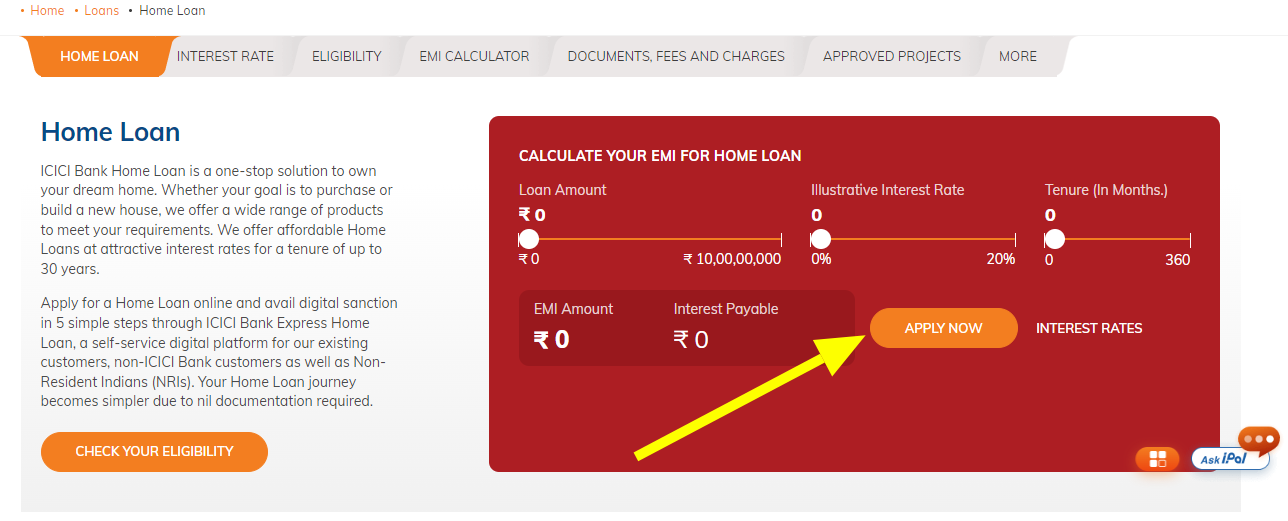

ICICI Bank Home Loan EMI Calculator

Loan Calculator

Loan EMI

Total Interest Payable

Total Amount

Benefits of ICICI Bank Home loan

Do you want to own a home but worried about the high costs? ICICI Bank offers you a stress-free solution with its home loans! With flexible repayment options and attractive interest rates, you can choose the right scheme based on your needs.

And the best part? There are no prepayment or foreclosure charges for floating-rate loans!

Keep an eye on your loan application status with the handy Trackmyloan feature on the ICICI Bank website.

The process is quick, transparent, and with special benefits for premium customers, it just gets better!

Want to transfer your existing home loan to ICICI Bank? You can do that too, and enjoy reduced EMIs. So, why wait? Start your journey to your dream home today!

How To Apply for ICICI Bank Home Loan

Steps to Avail ICICI Bank Home Loan: Your Guide to Owning Your Dream Home

Applying for a Home Loan can be a daunting task, but not with ICICI Bank. The bank has made the process seamless and convenient, so you can easily own your dream home. Here’s a step-by-step guide on how to avail ICICI Bank Home Loan and make your homeownership journey a smooth one.

- Start your Application Online

The first step is to visit ICICI Bank’s website and start your Home Loan application. Choose the right option – whether you’re applying for a new Home Loan or a Home Loan balance transfer.

Fill out the online form with personal details and employment information. Cross-check your entries before submitting the form. You will receive an OTP to verify your application.

- Know Your Loan Offer

Based on the information you’ve provided, ICICI Bank’s online platform will determine your Home Loan eligibility and present you with a custom offer.

You’ll see the maximum loan amount you can avail and a detailed breakdown of the monthly EMIs, based on the loan amount, tenure, and interest rate. If you want to increase your eligibility, you can add a co-applicant by filling out a separate form.

- Pay Processing Fee and Receive Provisional Approval

To get a provisional approval for your Home Loan, you need to pay the login fee online. Once you’ve paid the fee, you’ll receive a provisional approval via email.

- Submit Your Documents

The next step is to upload the required Home Loan documents, such as identity proof, residence proof, income documents, bank statements, signature proof, etc.

ICICI Bank Home Loan also offers doorstep document pickup services if you prefer to submit physical copies.

Once you’ve finalized the property, you’ll also need to upload property-related documents.

- Get Your Sanction Letter

Once ICICI Bank has received all the necessary documents, the loan approval process will begin.

If everything is in order, your loan will be approved, and you’ll receive the Home Loan Sanction Letter.

The letter will contain important information such as the loan amount, interest rate, tenure, EMI details, terms and conditions, and charges.

- Sign on the Loan Agreement

If you’re satisfied with the terms and conditions, sign the document and send it back to ICICI Bank.

The bank will then verify and ensure that all the crucial property-related documents are in order.

- Disbursal of Loan Amount

Finally, ICICI Bank will disburse the loan amount.

The disbursal may be made in parts or as a lump-sum amount, as per the mutually agreed terms.

Apply ICICI Bank Home Loan with Rapidloans.in

Apply for your home loan through Rapidloans.in today and enjoy a seamless and hassle-free process. Our dedicated team will be with you every step of the way, ensuring that you get the best deal possible. Take the first step towards making your home ownership dream a reality and apply for an ICICI Bank Home Loan through Rapidloans.in today!

3 thoughts on “Apply for ICICI Bank Home Loan @ 8.75%: Get the Home of Your Dreams”