With every passing day, it is becoming increasingly difficult to keep a good credit score. It is important that you are well aware of the 10 tricks to maintain a good credit score and how to check your credit score for free in India.

What is Credit Score?

Credit score is a numerical expression based on a statistical analysis of a person’s credit files, to represent the creditworthiness of that person. A credit score is primarily based on credit report information typically sourced from credit bureaus.

Lenders use credit scores to evaluate the probability that an individual will repay a loan. A high credit score indicates low default risk, while a low score indicates high default risk.

These scores are usually ranges between 300 and 850, with 300 being the lowest (riskiest) and 850 being the highest (safest).

Why Is Credit Important?

Credit is important because it is one of the main factors that lenders look at when considering a loan. A high credit score means you’re a low-risk borrower, which could lead to a lower interest rate on your loan. A low credit score could lead to a higher interest rate and could mean you won’t qualify for a loan at all.

Checking Your Credit Score

If you’re looking to maintain a good credit score, one of the first things you need to do is check your credit score. Luckily, there are a few ways you can check your credit score for free.

One way to check your credit score for free is through AnnualCreditReport.com. This website allows you to request your credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) once every 12 months.

You can also check your credit score for free on some financial websites, like Paisabazaar.com or wishfin.com . These websites will show you your credit score from one or more of the major credit bureaus, as well as give you an idea of where your score falls within the “good,” “fair,” or “poor” range.

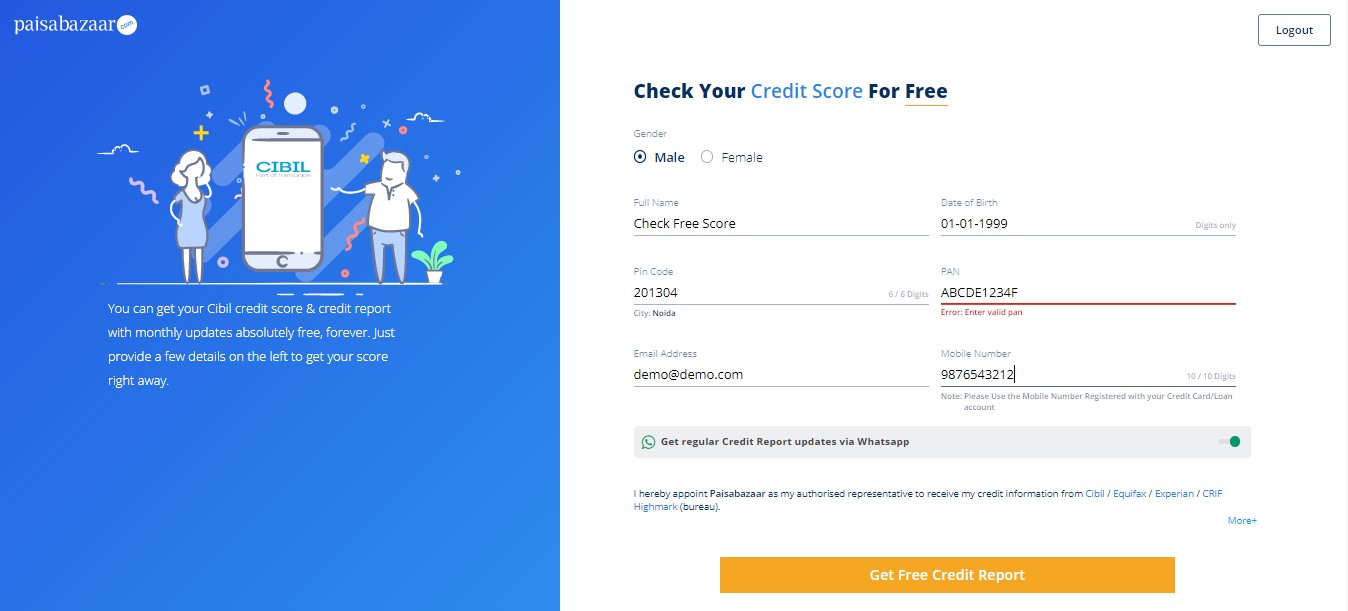

Steps to check credit score for free on Paisabazaar.com

There are many ways to check your credit score for free. The most popular way is through a credit score website like Paisabazaar.

- The first step is to visit the website of Paisabazaar.com and check their credit score for free.

- Enter your basic details like name, mobile number, email id, etc. in the respective fields.

- After that, you will be required to answer some questions related to your financial history and current status.

- Once you have answered all the questions, click on the ‘Get my Free Credit Score’ button.

- Your credit score will be displayed on the screen along with an analysis of your report.

10 Tricks To Maintaining A Good Credit Score

It’s no secret that your credit score is important. A good credit score can help you get the best interest rates on loans and credit cards, and can even help you get a job. A bad credit score can make life much more difficult, and can even prevent you from getting approved for a loan or credit card.

But what exactly is a good credit score? And how do you maintain a good credit score? Here are some tips:

- Check your credit report regularly. You are entitled to one free credit report per year from each of the three major credit reporting agencies (Equifax, Experian and TransUnion). You can request your report online at AnnualCreditReport.com or by calling 1-877-322-8228.

- dispute any errors on your credit report. If you find any inaccuracies on your report, contact the relevant creditor or lender to dispute the error.

- Pay your bills on time, every time. Payment history is the most important factor in determining your credit score, so it’s important to make all of your payments on time, every time. Set up automatic payments if necessary to make sure you never miss a payment.

- Keep your balances low. Your credit utilization ratio (the amount of debt you’re carrying compared to your total available credit) is also a key factor in determining your score. To keep your ratios low, try to pay off your balances in full each month or keep your balances well below your credit limits.

- Use a mix of different types of credit. Lenders like to see that you can manage different types of credit responsibly, so it’s helpful to have a mix of installment loans (like auto loans or mortgages) and revolving credit (like credit cards) on your credit report.

- Don’t close unused credit cards. It may seem counterintuitive, but closing unused credit cards can actually hurt your score by reducing your available credit and increasing your credit utilization ratio. If you’re concerned about the temptation to use a card you don’t need, just cut it up and throw it away.

- Don’t open too many new accounts at once. Opening several new lines of credit in a short period of time can be a red flag for lenders and can ding your score. If you do need to open a new account, space out your applications so they’re not all bunched together.

- Use your credit regularly. If you have a lot of inactive accounts, it can make lenders nervous that you’re not using your credit wisely. To avoid this, use each of your active accounts at least once every few months, even if you just make a small purchase and pay it off right away.

- Keep old accounts open. In addition to showing lenders that you have a long credit history, keeping old accounts open also increases your available credit, which can help keep your credit utilization ratio low.

- Monitor your score. In addition to checking your credit report regularly, you should also monitor your credit score to see how your behavior is impacting your score. You can get your score for free from a number of sources, including Credit Karma and Credit Sesame.

Conclusion

It’s important to stay on top of your credit score so that you can get the best interest rates and terms possible when taking out loans. By following the tips in this article, you can easily check your credit score for free and keep tabs on any changes. Additionally, make sure to keep updated on any new credit scoring methods so that you can be sure you’re getting the most accurate representation of your financial health.

What is a good credit score?

A good credit score is a score that indicates you’re a low-risk borrower. Lenders usually see a good credit score as 650 or higher.

How do I check my credit score for free?

You can easily check you credit score for free by visiting several credit card or lending websites, e.g, Paisabazaar.com

How do I improve my credit score?

You can improve your credit score by paying your bills on time, maintaining a good credit history, and using a credit monitoring service.