As we all know, online shopping has taken the world by storm, and it’s only natural that we need a credit card tailored to our online shopping needs.

Now, some of you might be thinking, “Why do I need another credit card? I already have a bunch of them lying around.” Well, my friend, let me tell you – this is not just another credit card.

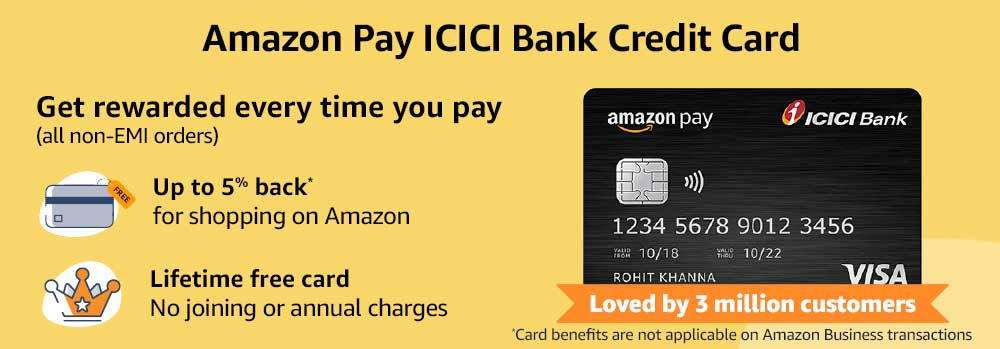

The Amazon Pay ICICI Credit Card is designed specifically for those of us who love to shop online and, more importantly, love to shop on Amazon.

In this article, rapidloans.in will explain the various features and benefits of the Amazon Pay ICICI Credit Card, as well as its fees, eligibility criteria, and application process.

Amazon Pay ICICI Credit Card Benefits

Welcome Benefits

- Rs. 1,500 as Amazon Pay balance on joining the card membership

- The welcome benefit amount keeps changing

Dining Benefits

- Minimum of 15% off on bill payments at all the member restaurants as a part of ICICI bank’s Culinary Treats program

- Limited period offer of complimentary 3-month Eazydiner Prime membership on spending a minimum of Rs. 25,000 with the ICICI Amazon Credit Card

Fuel Surcharge Waiver and Cashback

- 1% fuel surcharge waiver at all fuel stations across India (provided that the transaction size does not exceed Rs. 4,000)

- 5% cashback on the first fuel transaction of the month

- A minimum purchase of Rs. 2,000 is required to avail of the offer

- The maximum cashback is capped at Rs. 150 in a month.

Amazon Pay ICICI Credit Card Rewards and Cashback

- 5% cashback on all purchases made on Amazon India (amazon.in) for Prime members

- 3% cashback on Amazon for non-Prime users

- 1% cashback on purchases made from any other Amazon country-specific domain (including amazon.com)

- 2% cashback on payments made for books, bill payments, mobile/DTH recharges, air ticket bookings, movie or bus tickets, and loading balance to Amazon Pay Wallet

- 2% cashback on purchases made from over 100 partner merchants with log in with the Amazon payment option

- 1% cashback on all other transactions made with the card- both online and offline, except payments made at fuel stations.

The Amazon Pay ICICI Credit Card comes with a host of benefits and features that make it an attractive choice for online shoppers.

Let’s break it down for you. First up, you get a welcome benefit of up to Rs. 1,500 as Amazon Pay balance when you join the card membership, so you can shop till you drop without worrying about spending too much.

Plus, you also get dining benefits, with a minimum of 15% off at all member restaurants. And that’s not all- you also get a fuel surcharge waiver and cashback, as well as rewards and cashback on all Amazon purchases.

With so many benefits, it’s no wonder that the Amazon Pay ICICI Credit Card is the go-to choice for all you savvy shoppers out there.

Amazon Pay ICICI Credit Card: Fees & Charges

Here’s what you need to know about the fees and charges associated with the Amazon Pay ICICI Credit Card:

- Joining Fee: Rs. 500 (waived on spending Rs. 500 or more on Amazon.in within 45 days of card issuance)

- Annual Fee: Rs. 500 (waived on spending Rs. 1,00,000 or more in the previous year)

- Interest Rate: 40.8% per annum

- Late Payment Charges: Rs. 100-750 (depending on the outstanding balance)

- Over-limit Charges: 2.5% of the over-limit amount (subject to a minimum of Rs. 500)

- Cash Withdrawal Fee: 2.5% of the cash withdrawal amount (subject to a minimum of Rs. 300)

- Foreign Currency Transaction Fee: 3.5% of the transaction amount

Now, before you start panicking, let’s put things into perspective. Compared to other credit cards in the market, the fees and charges of the Amazon Pay ICICI Credit Card are pretty reasonable.

In fact, the annual fee is waived if you spend a certain amount, and the joining fee is waived if you make a purchase on Amazon.in within a certain timeframe. So, if you’re an avid Amazon shopper, this could be a great way to save some money on fees.

Eligibility and Application Process

Applying for the Amazon Pay ICICI Credit Card is almost as easy as ordering a pizza online. Here’s what you need to know:

Eligibility Criteria:

Before you get too excited, it’s important to make sure you’re eligible for the card. Here are the eligibility criteria:

- You must be an Indian citizen or a Non-Resident Indian (NRI) with a valid Indian address.

- You must be between the ages of 23 and 60 years old.

- You should have a good credit score and a stable source of income.

Documents Required:

Now, you’ll need to gather a few documents to complete your application. Here’s what you’ll need:

- Aadhaar Card or PAN Card

- Proof of Income

- Passport-size photograph

Application Process:

If you meet the eligibility criteria and have the necessary documents, you can apply for the Amazon Pay ICICI Credit Card. Here’s how:

- Visit the ICICI Bank website and navigate to the Amazon Pay ICICI Credit Card section.

- Fill out the application form and submit your documents.

- Once your application is approved, your card will be delivered to your doorstep in no time.

- You can also apply though Amazon app, Open the app and search for “Amazon Pay ICICI Credit Card” and follow the instruction.

So,

So, what are my final thoughts on Amazon Pay ICICI Credit Card

Well, as a credit card expert and online shopping addict, I must say that the Amazon Pay ICICI Credit Card is a pretty solid choice for anyone who loves to shop online.

It offers great rewards and benefits, while also being quite affordable in terms of fees and charges. Plus, the application process is a breeze. So, what are you waiting for? Go ahead and give it a try!

What is the Amazon Pay ICICI Credit Card?

The Amazon Pay ICICI Credit Card is a co-branded credit card offered by Amazon Pay and ICICI Bank. It is designed for online shoppers who frequently use Amazon and want to earn cashback and rewards on their purchases.

Can I use the Amazon Pay ICICI Credit Card outside of Amazon?

Yes, you can use the card for all your online and offline purchases. However, the cashback rewards are higher for Amazon purchases.

What are the welcome benefits of the Amazon Pay ICICI Credit Card?

You get a welcome benefit of Rs. 1,500 as Amazon Pay balance on joining the card membership. The welcome benefit may vary from time to time.

Does the Amazon Pay ICICI Credit Card have an annual fee?

No, the card does not have an annual fee. However, there are some other fees and charges associated with the card, which are mentioned in the terms and conditions.

What is the rewards/cashback of the Amazon Pay ICICI Credit Card?

The card offers cashback on various transactions such as Amazon purchases, bill payments, mobile/DTH recharges, and more. Amazon Prime members can earn 5% cashback on Amazon purchases, while non-Prime members can earn 3% cashback.

Can I get a fuel surcharge waiver with the Amazon Pay ICICI Credit Card?

Yes, you can get a 1% fuel surcharge waiver on all fuel purchases across India. Additionally, you can earn 5% cashback on your first fuel transaction of the month.

What are the dining benefits of the Amazon Pay ICICI Credit Card?

The card offers a minimum of 15% discount on dining bills at partner restaurants under the ICICI Bank’s Culinary Treats program.

What are the eligibility criteria for the Amazon Pay ICICI Credit Card?

The eligibility criteria include a minimum age of 23 years, a regular source of income, and a good credit score. The specific criteria may vary based on the bank’s policies.

What documents do I need to apply for the Amazon Pay ICICI Credit Card?

You will need to provide your PAN card, Aadhaar card, income proof, and address proof to apply for the card.

How can I apply for the Amazon Pay ICICI Credit Card?

You can apply for the card online through the Amazon Pay website or mobile app. You will need to fill in the application form, upload the required documents, and complete the verification process.

Does the Amazon Pay ICICI Credit Card offer airport lounge access?

No, the Amazon Pay ICICI Credit Card does not offer airport lounge access as one of its benefits.