You’re out with friends, enjoying a great meal, and the bill arrives. But wait, you’ve forgotten your wallet at home!

Sounds familiar? We’ve all been there.

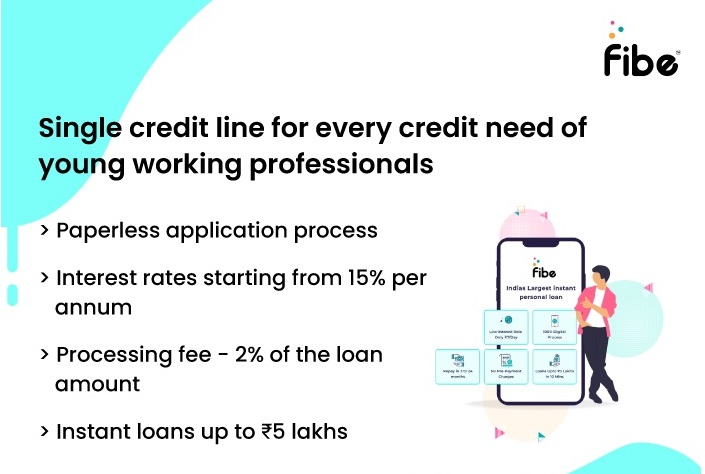

That’s where Fibe comes in – a mobile app that offers instant loans to help you tackle such sticky situations.

But how reliable is the Fibe app? Is it worth it?

In this article, we’ll explore everything you need to know about Fibe (previously EarlySalary) instant loan app – from its eligibility criteria to its interest rates, and everything in between.

What is Fibe (Previously EarlySalary) Instant Loan?

Fibe is an instant loan app that was previously known as EarlySalary. It offers personal loans to individuals who are in need of quick and hassle-free financing.

With Fibe, you can apply for a loan and get approval within minutes, without having to go through the lengthy and complicated process of traditional loans.

Eligibility Criteria for Fibe (Previously EarlySalary) Instant Loan

When it comes to availing an instant personal loan from Fibe (previously EarlySalary), there are certain eligibility criteria that must be met. Here are the key requirements:

- Age limit and citizenship: you should be an Indian Citizen and between the ages of 21 and 60 years old.

- Income requirement: The minimum monthly income required to be eligible for a loan from Fibe is Rs. 18,000.

- Employment status: Salaried Individuals with minimum 3 months of work experience in current company.

- Credit score requirement: While a credit score is not mandatory to avail of a loan from Fibe, having a credit score of 575 or above can increase the chances of loan approval.

- Other requirements, if any: Fibe may require additional documentation or information based on the loan amount and other factors. The app provides a list of required documents during the application process.

EarlySalary Instant Loan Application Process

To apply for an instant personal loan with Fibe (previously EarlySalary), follow these steps:

- Click on the download button below to download the Fibe app from Playstore.

- Open the application, accept the terms and conditions by ticking the checkbox, click ‘I Agree’, and give all required permissions to the app.

- Enter your mobile number and click on ‘Get OTP’. Enter the OTP sent to the mobile number and click on ‘Login’.

- Next, click on ‘Sign in with Google’ and choose the email address.

- From the homepage, choose ‘Instant Cash’ option.

- Enter your personal details such as name, date of birth, gender, etc., and click on ‘Proceed’.

- Next, enter your professional details such as company name, office address, etc., and click on ‘Proceed’.

- Upload your bank statement via Net-Banking or manually.

- Enter your current residential address details and proceed.

- You can see the eligible loan amount on the home screen.

- Complete the KYC either online or manually.

- Enter your salary bank account details and confirm.

- After completing the KYC, set up smart repay either online or manually to enable auto-debit.

The Fibe team will take some time to check the information and documents provided by you. You may also receive a call from them. You may also receive a call from them. it will take4-5 hours to approve your loan.

Documents Required for Fibe (Previously EarlySalary Instant Loan)

To apply for a loan through Fibe (previously EarlySalary) instant loan app, you need to provide certain documents. Here is a list of the documents required for loan application:

- Identity proof – Aadhaar Card, PAN Card, Voter ID, Passport, or Driving License

- Address proof – Aadhaar Card, Passport, Voter ID, or Utility Bills

- Income proof – Bank Statement or Salary Slip

- Employment proof – Offer Letter or Appointment Letter

- Photograph – Passport size photograph

Make sure you keep these documents ready before applying for a loan through the Fibe app.

Features of EarlySalary Instant Loan

When it comes to loan features, Fibe Instant Loan App offers a range of options to its customers. Let’s take a closer look:

A. Loan amounts and tenure

- Fibe offers instant personal loans starting from ₹ 5,000 and going up to ₹ 5,00,000.

- The loan tenure can range from 62 days to 24 months, depending on the borrower’s needs and eligibility.

B. Interest rates and other charges

- The interest rates on Fibe’s personal loans can vary from 18% to 36% per annum, depending on the borrower’s creditworthiness and other factors.

- In addition to interest charges, Fibe also charges a processing fee of up to 2% of the loan amount.

C. Repayment options

- Fibe allows borrowers to repay their loans in equal monthly installments (EMIs) via auto-debit from their bank accounts.

- The EMI amount is calculated based on the loan amount, interest rate, and tenure.

D. Part-payment and foreclosure options

- Fibe offers borrowers the option to make part-payments towards their loan, which can help reduce the total interest cost.

- You can also choose to foreclose their loan.

E. Other loan features

- Fibe’s personal loans come with a range of additional features, such as instant approval, quick disbursal, and no prepayment charges after a certain period.

- Borrowers can also use the Fibe app to track their loan status, view their repayment schedule, and more.

Pros and Cons of Fibe Instant Loan App

Here are some advantages and disadvantages of using Fibe (previously EarlySalary) Instant Loan App:

User Reviews and Ratings

When it comes to Fibe (previously EarlySalary) Instant Loan App, user reviews and ratings can give you a good idea of the app’s performance.

A. Overall rating and user reviews

The Fibe app has a 4.2-star rating on Google Play Store based on 2 lakh user reviews. On Apple App Store, it has a rating of 4.6 stars based on 29,000 ratings.

B. Positive and negative feedback

Users appreciate the easy and quick loan approval process, hassle-free documentation, and transparent interest rates. Some users also found the app’s credit score tracking feature useful.

However, some users faced issues with the loan disbursement process, delayed approval, and incorrect credit score reporting.

C. Common complaints, if any

Some users have reported facing difficulties in the customer support and grievance redressal process.

Verdict

Fibe Instant Loan App (previously EarlySalary) is a useful tool for those who need quick and hassle-free personal loans. Its easy application process, flexible repayment options, and transparent interest rates make it a popular choice among users.

Based on our research and user reviews, we recommend Fibe Instant Loan App to those who need short-term loans quickly.

Download the Fibe instant loan app and Apply for a loan today

FAQS

How do I apply for a loan through Fibe?

To apply for a loan through Fibe, you need to download the app from the Google Play Store or the Apple App Store, register using your mobile number, and submit your KYC and income documents. Once your documents are verified, you can apply for a loan through the app.

What is the eligibility criteria for getting a loan through Fibe?

To be eligible for a loan through Fibe, you must be an Indian citizen aged between 18 and 60 years, with a monthly income of at least ₹ 18,000. You should also have a stable employment history and a good credit score.

How long does it take to get approved for a loan through Fibe?

Fibe claims to offer loan approvals within 10 minutes of receiving the loan application, provided all the required documents are submitted and verified.

What are the interest rates for Fibe loans?

The interest rates for Fibe loans range from 2.5% to 3.5% per month, depending on the loan amount and repayment period.

What is the repayment period for Fibe loans?

The repayment period for Fibe loans ranges from 3 months to 24 months, depending on the loan amount and the borrower’s preference.

What happens if I miss an EMI payment?

If you miss an EMI payment, Fibe will charge a late payment fee, which varies depending on the loan amount and the duration of the delay. Failing to pay the EMI for an extended period can also negatively impact your credit score.