Are you ready to hit the road in your very own set of wheels? Are you looking for a new car to make your daily commute more comfortable & to take on your weekend adventures, one of the first things you’ll need to think about is financing.

And let’s be real, finance can be a daunting topic, but it doesn’t have to be. HDFC car loan is one of the most popular options for car buyers in India, and with a 7% interest rate, it’s one of the most affordable options too.

In this blog post, we’re going to break down the process of applying for an HDFC car loan so you can hit the dealership with confidence.

We’ll cover everything from the eligibility criteria to maximizing your savings, so you can drive away in your dream car without breaking the bank. So, buckle up and let’s get started on the journey towards car ownership.

Highlights of HDFC Car Loan

- HDFC Car Loan offers an attractive interest rate of 7.35% per annum

- Minimum loan amount available is ₹ 100,000

- You can borrow up to 90% of the on-road price or 100% of the ex-showroom price as the maximum loan amount

- The loan tenure can range from 1 year to 7 years

- The lowest EMI per lac is ₹ 1,512

- To be eligible for the loan, you should have a minimum net monthly income of ₹ 20,000

- Minimum ITR required for self-employed individuals is ₹ 2,00,000

- Age criteria for salaried individuals is between 21 years to 60 years and for self-employed individuals is between 21 years to 65 years

- The loan can be availed for all new passenger cars, MUVs and SUVs

- The loan processing fee is 0.5% of the principal amount

- Foreclosure charges would be 6% if done between 7-12 months

- Basic documentation required include Address Proof, Bank Statement, Car Quotation and ID Proof.

Advantages of HDFC Bank Car Loan:

- High loan amount: HDFC Bank offers loan disbursal up to 100% of the on-road price, including ex-showroom and additional charges for registration, road tax, insurance, and accessories.

- Faster loan disbursal: The processing and disbursal of HDFC Bank car loans can be completed within 2-3 working days, making the process hassle-free for borrowers.

- Fixed interest rates: HDFC Bank offers fixed car loan interest rates, meaning the rate of interest will remain constant throughout the loan tenure. This allows borrowers to plan their budget easily with fixed EMIs.

- Longer loan tenure: HDFC Bank offers loan tenure of up to 7 years for new cars and 5 years for older models, providing borrowers with more time to pay off the loan.

- Loan approval in 30 minutes: HDFC Bank offers fast loan approval, with decisions made in as little as 30 minutes.

- Lowest rate of interest: HDFC Bank offers some of the lowest car loan interest rates in the market.

- Minimum documentation: HDFC Bank requires minimal documentation for car loan applications.

- Paperless process: The car loan process is fully digital, eliminating the need for paper documents.

- Flexible repayment: HDFC Bank offers flexible repayment options for car loans.

- Zero or Minimum foreclosure charges: HDFC Bank does not charge any foreclosure charges on car loans or can charge a minimal charge depending on your credit profile.

- No hidden charges: HDFC Bank does not have any hidden charges associated with their car loans.

Eligibility Criteria of HDFC Car Loan

| Criteria | Salaried | Self-Employed |

|---|---|---|

| Age | 21-60 years | 21-65 years |

| Net Monthly Income | Minimum ₹20,000 | Minimum ₹3,00,000 per annum |

| Employment Duration | 1 year minimum | 3 year minimum |

| Income Eligibility | Based on Form 16 and salary slip | Depends on latest Income Tax Returns |

| Minimum ITR | – | Rs. 2 lakh |

| Presentation of IT returns & audited financials | – | 2 years with Calculated Income |

| Income | A minimum annual income of₹ 2,50,000 is required | A minimum annual income of₹ 3,00,000 is required |

| Job/Business Stability | Must have a work experience of 2 years, with atleast 1 year with the existing employer | Should have been in the business for a minimum period of 2 years |

| Maximum Loan Amount | up to 100% of the on-road price | up to 100% of the on-road price |

Documents Required for HDFC Car Loan

| Type of Applicant | Identity & Address Proof | Income Proof | Bank Statement |

|---|---|---|---|

| Salaried Individuals | Valid Passport, Permanent Driving license, Voters ID Card, Job card issued by NREGA, Letter issued by the National Population Register, Aadhar Card (with consent letter) | Latest salary slip and Form 16 | Bank statement of the previous 6 months |

| Self-Employed Individuals (Sole Proprietorship) | Telephone Bill, Electricity Bill, Shop & Establishment Act Certificate, SSI Registered Certificate, Sales Tax Certificate | Latest Income Tax Returns (ITR) | Bank statement of the previous 6 months |

| Self-Employed Individuals (Partnership Firms) | Telephone Bill, Electricity Bill, Shop & Establishment Act Certificate, SSI Registered Certificate, Sales Tax Certificate | Audited Balance Sheet, Profit & Loss Account of the previous 2 years, Company ITR for the previous 2 years | Bank statement of the previous 6 months |

| Self-Employed Individuals (Private Limited Companies) | The latest copy of MOA and AOA Copy of Incorporation Telephone Bill, Electricity Bill, Shop & Establishment Act Certificate, SSI Registered Certificate, Sales Tax Certificate | Audited Balance Sheet, Profit & Loss Account of the previous 2 years, Company ITR for the previous 2 years | Bank statement of the previous 6 months |

| Self-Employed Individuals (Public Limited Companies) | The latest copy of MOA and AOA Copy of Incorporation Telephone Bill, Electricity Bill, Shop & Establishment Act Certificate, SSI Registered Certificate, Sales Tax Certificate | Audited Balance Sheet, Profit & Loss Account of the previous 2 years, Company ITR for the previous 2 years | Bank statement of the previous 6 months |

HDFC Car Loan Interest Rate, Fees, and Charges

- Interest Rate:

- New Car Loan: 7.35% p.a.

- Used Car Loan: 11.80% p.a. to 13.80% p.a.

- HDFC Car Loan Processing Fee: A minuscule 0.40% for both new and used car loans

- Repayment Schedule Charges:

- New Car Loan: A nominal fee of around Rs. 500 for a duplicate schedule

- Used Car Loan: Same as above

- Foreclosure Charges: A fixed rate of 6% for both types of car loans

- Penal Interest: A steep 2% per month for late payments on both new and used car loans

- Part Payment Charges: 6% of the outstanding amount, applicable to both new and used car loans

- Cheque/Instrument Swap Charge: A small fee of around Rs. 500 for both new and used car loans

- Documentation Charge: A nominal fee of around Rs. 500 for both types of car loans

- Duplicate No Dues Certificate Charges: A small fee of around Rs. 500 for both new and used car loans

- Registration Certification Collection Charge: A minimal fee of around Rs. 200 for both new and used car loans

- Cheque Bounce/Instrument Return Charges: A small fee of around Rs. 500 for both new and used car loans

- Duplicate Statement Charges: A small fee of around Rs. 500 for both new and used car loans

- Loan Cancellation/Re-booking Charges: A moderate fee of around Rs. 1000 for both new and used car loans

- Issuance of Credit Report: A nominal fee of around Rs. 50 for both types of car loans

How to apply for HDFC car loan in 2023 ?

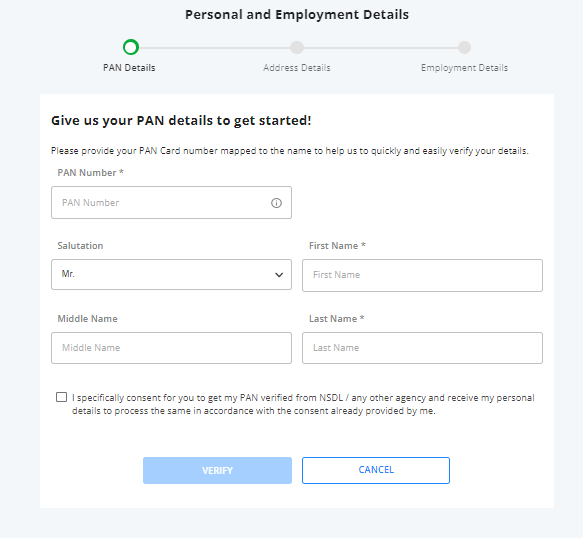

To apply for an HDFC car loan in 2023, you can follow these steps:

- Check your eligibility: Before applying for an HDFC car loan, check if you meet the eligibility criteria such as age, income, credit score, etc.

- Gather required documents: Keep all the necessary documents like ID proof, address proof, income proof, and other relevant documents ready for the loan application process.

- Choose a car: Choose the car you wish to purchase and its model.

- Visit the HDFC website: Go to the HDFC website and look for the car loan section.

You can also apply with rapidloans.in for a seamless loan application process and expert advice. - Fill in the application form: Fill in the application form with the required details and upload the necessary documents.

- Submit the application: Submit the application form and wait for the bank to process it.

- Get the loan approved: Once the loan is approved, you will receive a sanction letter with the loan details.

- Sign the loan agreement: Sign the loan agreement and submit it to the bank.

- Disbursement of loan: The loan amount will be disbursed to the car dealer after you submit the required documents.

Note: The process may vary slightly depending on your location and the specific HDFC branch you are applying to. It is recommended to check the HDFC website for more information or contact the bank directly for more details about the process.

HDFC Bank Car Loan Customer Care – Toll-Free Number

To reach HDFC Bank customer care for general enquiries, you can call their 24*7 toll-free number. The number to dial varies depending on your location. For Ahmedabad, Bangalore, Chennai, Delhi & NCR, Hyderabad, Kolkata, Mumbai, and Pune, dial 61606161. For Chandigarh, Cochin, Indore, Jaipur, and Lucknow, dial 61606161.

FAQS (Frequently Asked Questions)

-

What is the interest rate for HDFC Car Loan?

The interest rate for HDFC Car Loan is currently 7%.

-

Who is eligible for HDFC Car Loan?

Eligibility criteria for HDFC Car Loan may vary, but generally, salaried individuals, self-employed individuals, and non-individuals such as partnership firms or private limited companies can apply for the loan.

-

What documents are required to apply for HDFC Car Loan?

Documents required for HDFC Car Loan may include proof of identity, address, income, and employment continuity, as well as bank statements and other financial documents

-

Can I check my HDFC Car Loan application status online?

Yes, you can check the status of your HDFC Car Loan application online by logging into your account using your login ID and password.

-

Can I pre-close my HDFC Car Loan?

Yes, you can pre-close your HDFC Car Loan by paying the pre-closure charges as per the bank’s policy

-

How do I apply for HDFC Car Loan?

You can apply for HDFC Car Loan online or by visiting a HDFC Bank branch. You may need to fill out an application form and provide the necessary documents.

-

How can I reach customer care for any assistance ?

The customer care for HDFC Car Loan is available 24*7. You can reach customer care by dialing the toll-free number 61606161 for Ahmedabad / Bangalore / Chennai / Delhi & NCR / Hyderabad / Kolkata / Mumbai / Pune . For Chandigarh / Cochin / Indore / Jaipur / Lucknow dial 61606161.

-

Can I make a part payment on my HDFC Car Loan?

Yes, you can make a part payment on your HDFC Car Loan as per the bank’s policy

-

Is there any processing fee for HDFC Car Loan?

Yes, there may be a processing fee for HDFC Car Loan as per the bank’s policy

-

What is the maximum loan amount that can be availed for HDFC Car Loan?

The maximum loan amount for HDFC Car Loan may vary depending on the bank’s policy and your income and creditworthiness.

-

How long does it take to get HDFC Car Loan disbursed?

The disbursal of HDFC Car Loan may vary depending on the bank’s policy and the completeness of your application and documents.

1 thought on “HDFC Car Loan at 7% Interest Rate : Checkout Eligibility Criteria and How to Apply”