Do you need a personal loan for your urgent expenses, but don’t want to deal with the hassle of banks and NBFCs? Do you want to get a loan that is fast, easy, and affordable? If yes, then you should consider Prefr Loan.

Prefr Loan is a new and innovative way to get personal loans online. It is a digital lending platform that offers instant loans upto 3 lakh with low interest rates and flexible repayment options.

You can apply for Prefr Loan using your smartphone, either through the Prefr app or the Google Pay app. You don’t need any physical documents, collateral, or guarantor.

In this article, we will show you how to apply for Prefr Loan online and get money in your bank account within minutes.

We will also explain the eligibility criteria, features and benefits, and fees and charges of Prefr Loan.

By the end of this article, you will have all the information you need to make an informed decision about Prefr Loan .

How to Apply for Prefr Loan Online

Applying for Prefr Loan online is very simple and convenient. You can do it in just five easy steps:

- Visit the Prefr website by clicking on the link and start the application journey. Let’s start!

- Mobile number authentication: Click on ‘Apply Now’, enter your mobile number and click on ‘Send OTP’. Enter the OTP sent to your mobile number and proceed.

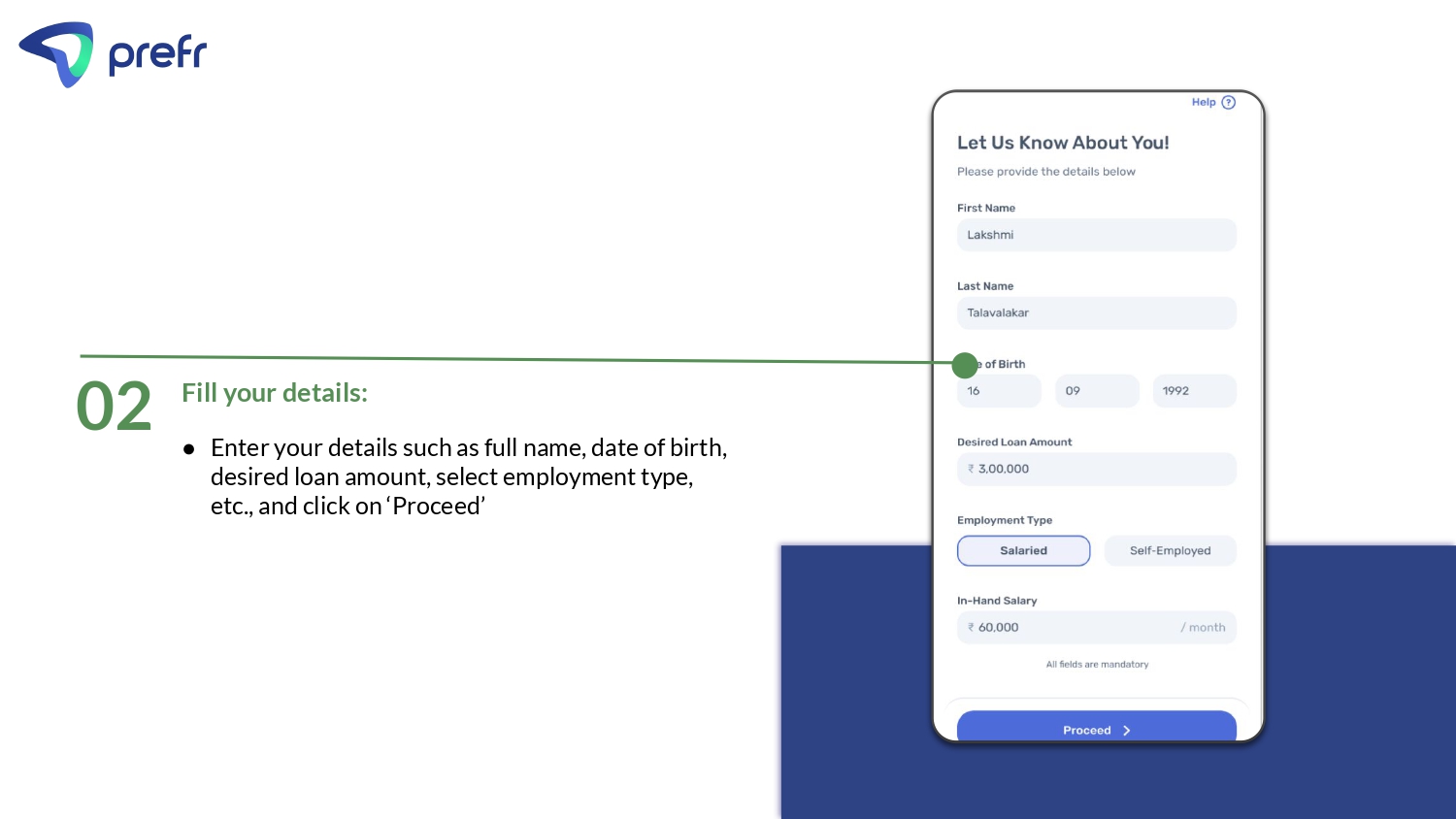

- Fill your details: Enter your details such as full name, date of birth, desired loan amount, select employment type, etc., and click on ‘Proceed’. Enter your personal details such as gender, PAN number, Pincode, personal email ID and click on ‘Get Offer’.

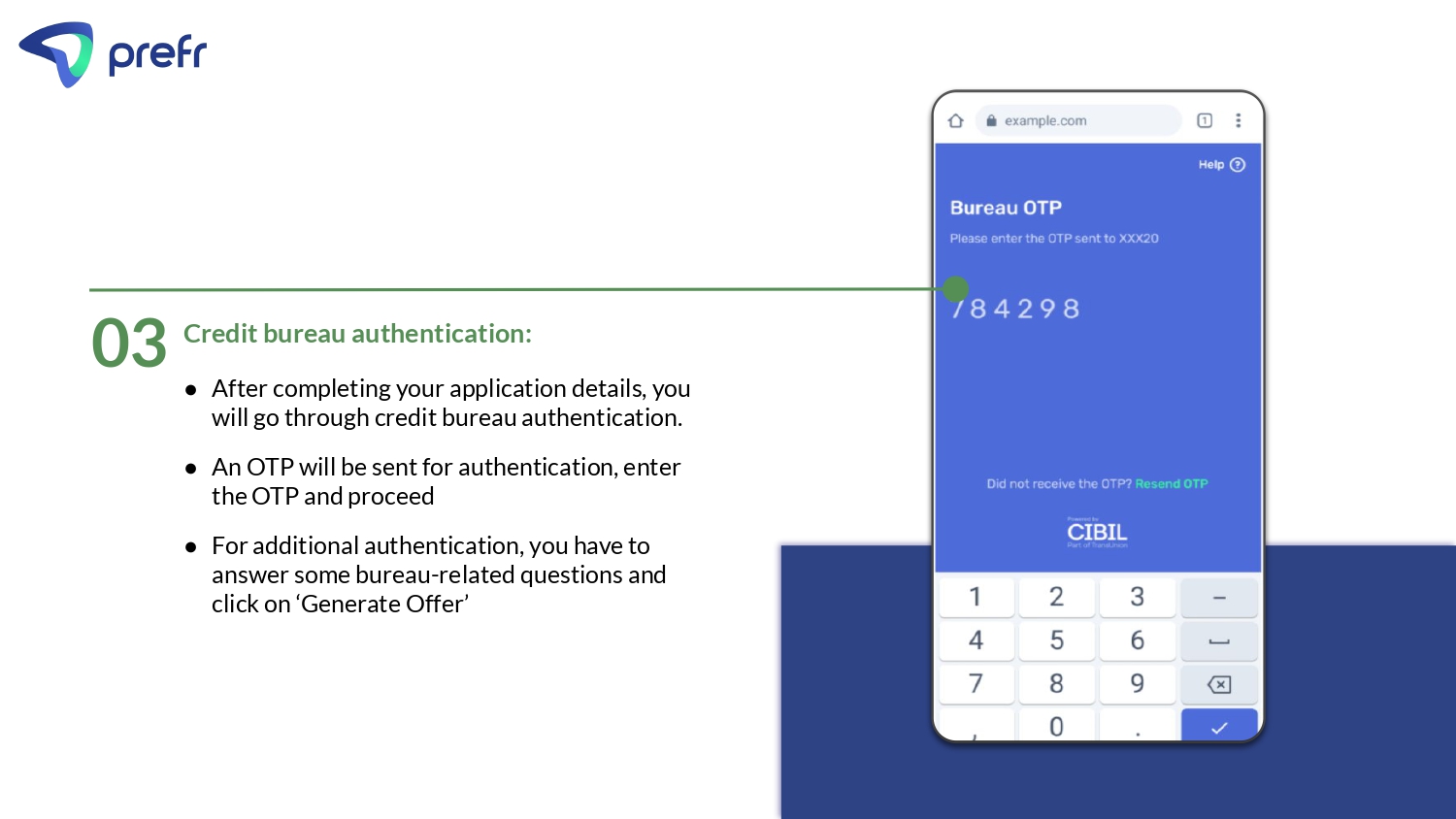

- Credit bureau authentication: After completing your application details, you will go through credit bureau authentication. An OTP will be sent for authentication, enter the OTP and proceed. For additional authentication, you have to answer some bureau-related questions and click on ‘Generate Offer’.

- Choose your loan offer: Provide your work details based on the type of employment. If you are salaried, enter your company details such as company name, company email ID and office address. If you are self-employed, enter your business details such as business name, business type, business place ownership and business address. Click on ‘Proceed To KYC’.

- The final step is to complete your KYC: Upload the required documents and complete KYC. Add your bank account details such as bank name, account number, IFSC code, etc., and verify. Set up auto EMI repayment.

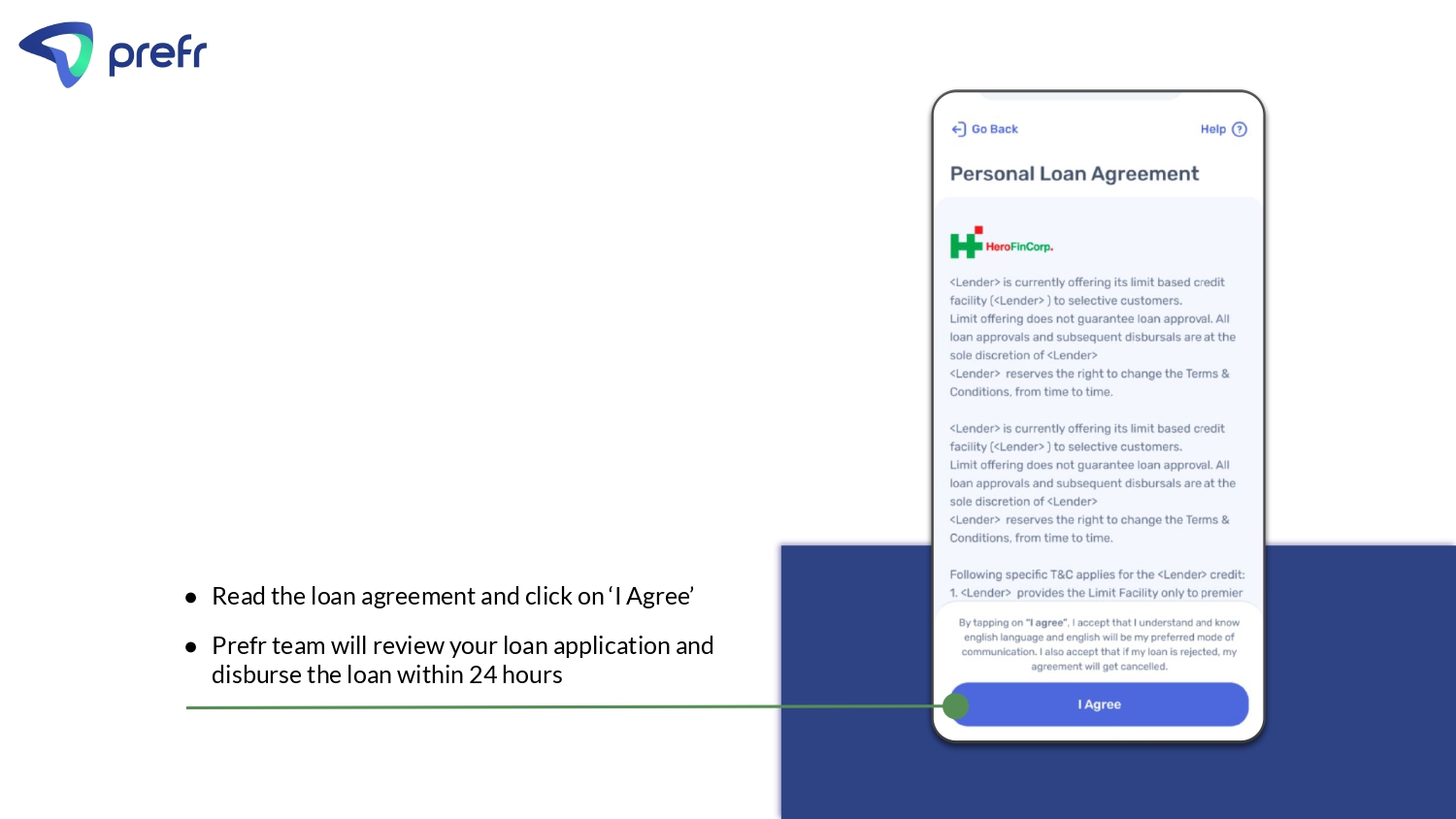

- Read the loan agreement and click on ‘I Agree’. Prefr team will review your loan application and disburse the loan within 24 hours.

That’s it! You will get an instant approval decision and the loan amount will be credited to your bank account within minutes.

Eligibility Criteria for Prefr Loan

To be eligible for Prefr instant Loan, you need to meet the following criteria:

| Criteria | Requirement |

|---|---|

| Age | 22 years or above |

| Income | Minimum ₹18,000 per month |

| Credit Score | Minimum 650 |

| Bank Account | Active account with UPI enabled |

| Aadhaar Card | Linked with mobile number |

| PAN Card | Valid and active |

Prefr Loan is RBI approved and follows all the regulations and guidelines of the Reserve Bank of India. You can trust Prefr Loan for your personal loan needs.

Fees and Charges for Prefr Loan

Prefr Loan charges a nominal processing fee of 2% of the loan amount, which is deducted from the disbursed amount. There are no hidden charges or extra costs involved.

The interest rate of Prefr Loan ranges from 12% to 24% per annum, depending on your credit profile and loan tenure. The interest rate is fixed and does not change during the loan period.

If you miss a payment or delay it beyond the due date, you will have to pay a late payment fee of 2% per month on the overdue amount.

If you want to prepay or close your loan before the end of the tenure, you can do so without any prepayment fee or penalty.

| Fee/Charge | Amount |

|---|---|

| Processing Fee | 2% of loan amount |

| Interest Rate | 12% to 24% per annum |

| Late Payment Fee | 2% per month on overdue amount |

| Prepayment Fee | Nil |

Features and Benefits of Prefr Loan

Prefr Loan offers many features and benefits that make it an attractive option for personal loans. Some of them are:

- Low Interest Rate: Prefr Loan offers competitive interest rates that are lower than most banks and NBFCs. You can save money on interest payments and repay your loan faster.

- Flexible Repayment: Prefr Loan allows you to choose the loan tenure that suits your budget and cash flow. You can repay your loan in monthly EMIs ranging from 3 months to 36 months. You can also change your EMI amount or date anytime through the app.

- Instant Approval: Prefr Loan gives you an instant approval decision within seconds of submitting your application. You don’t have to wait for days or weeks to get a loan approval.

- Quick Disbursal: Prefr Loan disburses the loan amount to your bank account within minutes of approval. You don’t have to visit any branch or submit any physical documents.

- No Collateral or Guarantor: Prefr Loan does not require any collateral or guarantor to secure your loan. Your Aadhaar and PAN card are enough to verify your identity and creditworthiness.

- Paperless and Contactless: Prefr Loan is a completely paperless and contactless process. You can apply for Prefr Loan from anywhere and anytime using your smartphone. You don’t have to touch any paper or meet any person.

Conclusion

Prefr Loan is a smart and convenient way to get personal loans online. It offers instant loans upto 3 lakh with low interest rates and flexible repayment options.

You can apply for Prefr Loan using the Prefr app or the Google Pay app. You just need to meet some basic eligibility criteria and provide your Aadhaar and PAN details.

If you are looking for a personal loan that is fast, easy, and affordable, then you should apply for Prefr Loan today. Visit the website https://prefr.com/ or download the app to get started.

Thank you for reading this article. We hope you found it useful and informative. If you have any feedback or questions, please leave them in the comments section below. We would love to hear from you.😊

Apply Now

Don’t miss this opportunity to get a personal loan that is fast, easy, and affordable. Apply now and get money in your bank account within minutes.

FAQs

How much loan amount can I get from Prefr?

You can get a loan amount from ₹10,000 to ₹3,00,000 from Prefr, depending on your eligibility and credit profile.

What documents are required to get a personal loan from Prefr?

To get a personal loan from Prefr, you need to provide the following documents:

PAN Card

Aadhaar Card

3 months bank statement in PDF format

Business proof (if self-employed)

I don’t have a credit(CIBIL) score. Will I get a loan?

Yes, Prefr will use your banking data to generate an offer for you. You don’t need to have a credit score to get a loan from Prefr.

How long will it take to get Prefr Personal Loan?

Prefr loan will be disbursed in your bank account within 24 hours of approval. You don’t have to wait for days or weeks to get your loan.

How can I contact prefr loan customer care?

You can contact prefr loan customer care through any of the following ways:

Prefr loan customer care number: 040-48521334

Email: wecare@prefr.com

Website: https://prefr.com/