Do you have an HDFC bank account that you no longer use or need? Maybe you want to switch to another bank, or you have too many accounts to manage. Whatever your reason, you might be wondering how to close your HDFC bank account properly.

Closing a bank account is not as simple as just withdrawing all your money and cutting up your debit card.

There are some considerations, procedures, and timing involved in the account closure process. If you don’t follow them correctly, you might face some hassles, delays, or even penalties.

In this article, I will show you how to close HDFC bank account in a hassle-free manner.

How to Close HDFC Bank Account : Step-by-Step Guide

Once you have decided to close your HDFC account, you need to follow these steps:

1. Transfer Out Any Positive Balance

The first step is to clear any remaining funds from your account. You can do this by transferring them to another account or withdrawing them in cash.

You should also check if there are any interest or dividends credited to your account after the last statement date. If yes, you should transfer or withdraw them as well.

2. Download HDFC Account Closure Form

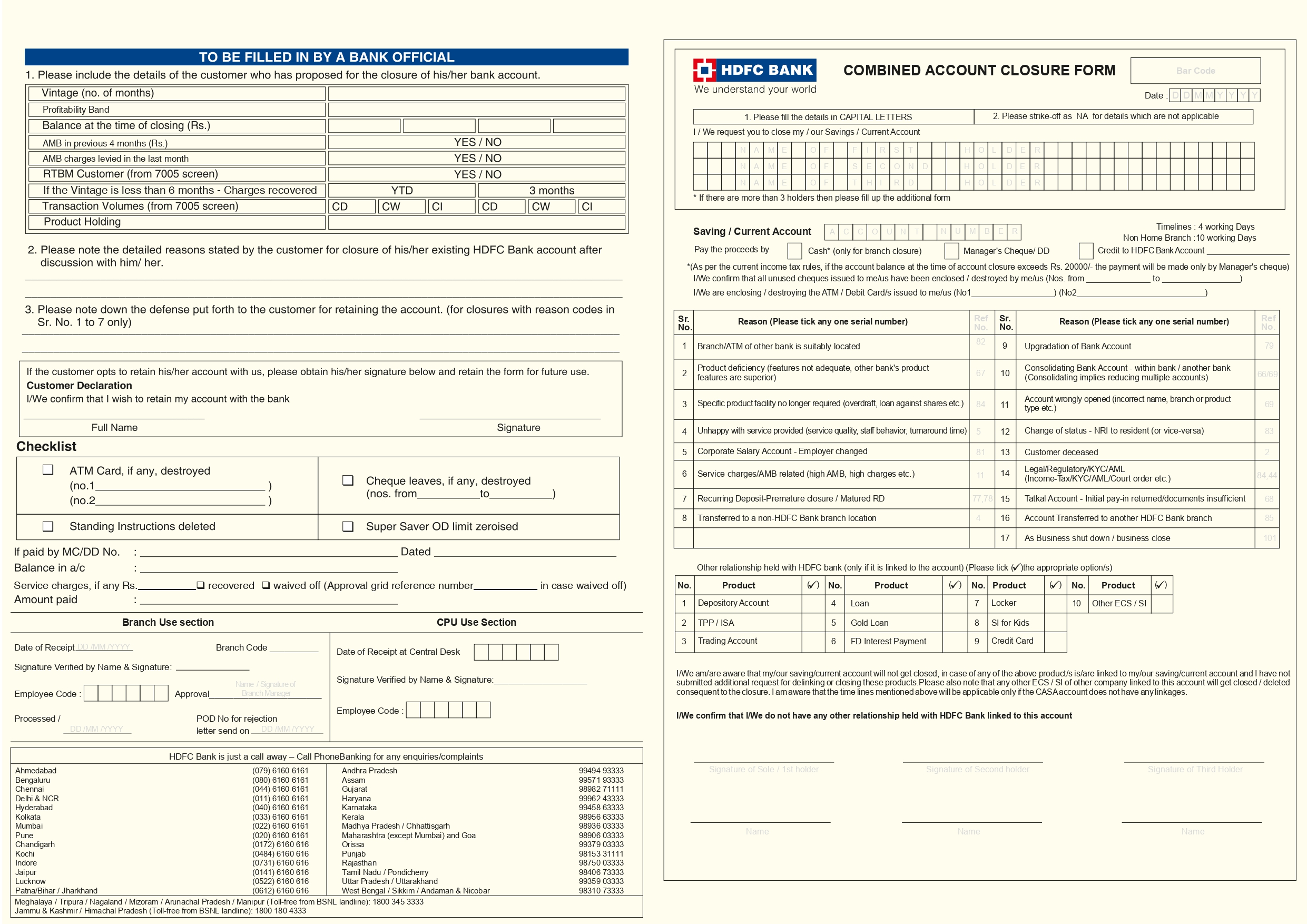

The next step is to download the account closure form from the HDFC website. You can find it under the “Forms Center” section.

Alternatively, you can also get the form from any HDFC branch.

3. Duly Fill All Details in Closure Form

The third step is to fill out the account closure form with all the required details. You need to provide:

- Your name and customer ID

- Your account number and type

- Your reason for closing the account

- Your signature and date

You also need to choose how you want to receive the balance amount (if any) from your account. You can opt for:

- Cash

- Cheque

- Transfer to another HDFC account

- Transfer to another bank account

If you choose the last two options, you need to provide the beneficiary account details as well.

It is important that you fill out the form accurately and completely. Any incorrect or incomplete information might cause delays or rejection of your request.

4. Submit Documents at HDFC Branch

The fourth step is to visit the nearest HDFC branch and submit your documents for closing your account. You need to bring:

- The completed and signed account closure form

- Your original and photocopy of ID proof (such as Aadhaar card, PAN card, passport, etc.)

- Your original and photocopy of address proof (such as utility bill, bank statement, rent agreement, etc.)

- Your cheque book, debit card, and passbook (if applicable)

You need to hand over these items to the bank officer and request for closing your account. The officer will verify your details and process your request.

5. Handover Cheque Book, Debit Card, and Passbook

The fifth step is to surrender your cheque book, debit card, and passbook (if applicable) to the bank officer. Although this is not necessary step.

6. Get Acknowledgment Receipt

The sixth and final step is to get an acknowledgment receipt from the bank officer. This receipt will confirm that you have submitted your documents and request for closing your account. You should keep this receipt safely until your account is closed.

7. Wait for the Account to Close in 10 Days

After you have completed the above steps, you need to wait for the account closure process to be completed. This usually takes about 10 working days from the date of submission of your request.

You can check the status of your request online or by calling the HDFC customer care.

Once your account is closed, you will receive a confirmation message from the bank. You will also receive the balance amount (if any) from your account as per your chosen mode of payment.

How to Close HDFC Bank Account Online

You might be wondering how to close hdfc bank account without visiting branch.

Unfortunately, the answer is no. HDFC does not offer an online option for account closure. You need to submit your documents in person at the branch.

However, there is a way to save some time and effort by downloading and filling the account closure form online. Here is how you can do it:

Download and Fill the Account Closure Form

The first step is to download the account closure form from the HDFC website. You can find it under the “Forms Center” section. Alternatively, you can also get the form from any HDFC branch.

The second step is to fill out the form with all the required details. You need to provide:

- Your name and customer ID

- Your account number and type

- Your reason for closing the account

- Your signature and date

- Your mode of payment for receiving the balance amount (if any)

- Your beneficiary account details (if applicable)

You should fill out the form accurately and completely. Any incorrect or incomplete information might cause delays or rejection of your request.

Send Form and Documents via Speed Post

The third step is to send the completed form and relevant documents to your home branch via speed post. You need to attach:

- Your original and photocopy of ID proof (such as Aadhaar card, PAN card, passport, etc.)

- Your original and photocopy of address proof (such as utility bill, bank statement, rent agreement, etc.)

- Your cheque book, debit card, and passbook (if applicable)

You should write your name, customer ID, and account number on the envelope. You should also mention “Account Closure Request” on the envelope.

You should send the envelope to the address of your home branch. You can find it on the HDFC website or on your bank statement.

You should also keep the speed post receipt and tracking number for future reference.

How Much Does It Cost to Close HDFC Bank Account

The charges for closing an HDFC bank account depend on how long you have maintained the account. Here are the different scenarios:

- If you close your account within 14 days of opening it, there are no charges.

- If you close your account between 15 days and 12 months of opening it, there is a closure fee of Rs 500 (Rs 300 for senior citizens).

- If you close your account after 12 months of opening it, there are no charges.

Therefore, it is advisable to close your account either within two weeks or after one year of opening it to avoid paying any fees.

What Documents Are Required to Close HDFC Bank Account

To close your HDFC bank account, you need to submit the following documents along with the closure form:

- Photocopies of your KYC documents, such as Aadhaar card, PAN card, and voter ID card.

- Your original debit card, cheque book, and passbook.

You may also need to provide other documents depending on your type of account. For example, if you have a joint account or a minor account, you may need additional signatures or consents from other holders or guardians.

Points to Note Before Closing HDFC Account

Before you close your HDFC account, you should keep in mind these important points:

- You should maintain the minimum balance requirement in your account until it is closed. Otherwise, you might be charged a penalty fee.

- You should cancel any standing instructions or ECS mandates on your account before closing it. Otherwise, you might face dishonor charges or legal issues.

- You should update your KYC details and mobile number in your account before closing it. Otherwise, you might face difficulties in verifying your identity or receiving OTPs.

- You should close any linked accounts or products (such as fixed deposits, Credit cards, mutual funds, insurance, etc.) before closing your main account. Otherwise, you might lose access to them or face complications in redeeming them.

Conclusion

Closing your HDFC bank account is not a complicated process if you follow the steps outlined in this article. You just need to clear your balance, download and fill the form, submit your documents, hand over your items, get a receipt, and wait for confirmation.

By doing so, you can close your HDFC account without any trouble and switch to another bank or simplify your finances.

If you have any queries or doubts about closing your HDFC account, you can contact the HDFC customer care or visit their website for more information.

I hope this article was helpful and informative for you. If you liked it, please share it with your friends and family who might benefit from it. Thank you for reading!

FAQs

How long does it take to close an HDFC bank account?

It usually takes about 10 working days from the date of submission of your request to close your HDFC bank account. You can check the status of your request online or by calling the HDFC customer care.

What happens to my linked accounts or products after I close HDFC bank account?

You should close any linked accounts or products (such as fixed deposits, mutual funds, insurance, etc.) before closing your main account. Otherwise, you might lose access to them or face complications in redeeming them.

Can I reopen my HDFC bank account after closing it?

No, you cannot reopen your HDFC bank account after closing it. You will have to apply for a new account if you want to bank with HDFC again.

Can I close my HDFC bank account online without visiting the branch?

No, you cannot close your HDFC bank account online without visiting the branch. You need to submit your documents in person at the branch. However, you can download the account closure form online and fill it in advance and send it to home brach via speed post.

What if I have a joint HDFC bank account? Can I close it by myself?

No, you cannot close a joint HDFC bank account by yourself. You need to get the consent and signature of all the joint holders on the account closure form. You also need to submit their ID and address proofs along with yours.

What if I have a negative balance in my HDFC bank account? Can I still close it?

No, you cannot close your HDFC bank account if you have a negative balance in it. You need to clear your balance and any overdraft charges before closing your account. Otherwise, your request will be rejected.

What if I have any queries or doubts about closing my HDFC bank account? Whom should I contact?

If you have any queries or doubts about closing your HDFC bank account, you can contact the HDFC customer care on 1800 202 6161 or Chat with them on their portal.