Are you looking for a way to close ICICI Bank account online without visiting the branch? If yes, then you have come to the right place.

In this article, I will show you how to close ICICI Bank account online in 2023 in a few simple steps.

Reasons To Close ICICI Bank Account Online

ICICI Bank is one of the leading private sector banks in India, offering a range of banking products and services to its customers.

However, there may be various reasons why you may want to close your ICICI Bank account, such as

- Switching to another bank

- Dissatisfaction with the service

- Financial issues

- High fees and charges

- No need for multiple bank accounts

Whatever the reason, closing your ICICI Bank account online is possible and convenient.

How to Close ICICI Bank Account Online : Step by Step

To close ICICI Bank account online, you will need to follow these four steps:

- Transfer or withdraw the balance from your ICICI Bank account

- Download and fill out the ICICI Bank account closure form

- Send the form and the documents to the nearest ICICI Bank branch

- Confirm the closure of your ICICI Bank account

Let’s look at each step in detail.

Step 1: Transfer or withdraw the balance from your ICICI Bank account

Before you can close your ICICI Bank account online, you need to make sure that your account has zero balance.

This means that you need to transfer or withdraw all the money from your account. You can do this using any of the following methods:

- Online banking: You can use your internet banking login credentials to access your account and transfer the money to another bank account of your choice. You can also use IMPS, NEFT, or RTGS services for this purpose.

- ATM: You can use your debit card and PIN to withdraw the money from any ICICI Bank ATM or any other bank’s ATM that accepts your card. You can also use the cardless cash withdrawal feature if you have registered for it.

- Cheque: You can write a cheque in favour of yourself or any other person and encash it at any ICICI Bank branch or deposit it in another bank account.

- Cash: You can visit any ICICI Bank branch and withdraw the money in cash by filling out a withdrawal slip and presenting your passbook and identity proof.

Please note that some of these methods may incur some fees or charges depending on the amount and frequency of transactions.

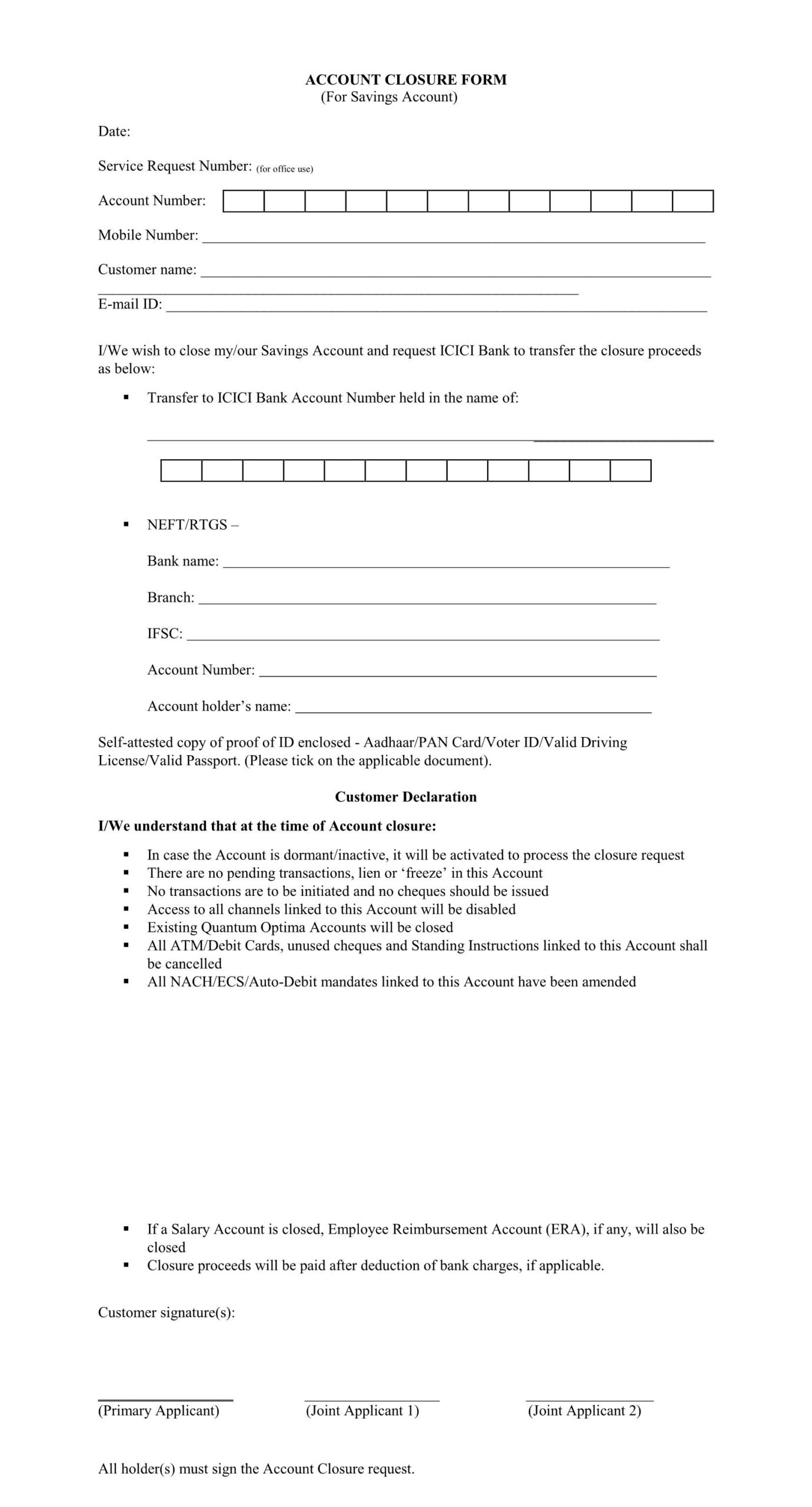

Step 2: Download and fill out the ICICI Bank account closure form

Once you have cleared the balance from your ICICI Bank account, you need to download and fill out the ICICI Bank account closure form.

You can download the form from Below Link. The form is a PDF file that you can print out.

The form requires you to provide some basic details about your account and yourself, such as:

- Account number

- Name

- Address

- Mobile number

- Email ID

- Reason for closure

- Mode of receiving balance (if any)

- Signature

You need to fill out these details carefully and accurately, as any mistake or discrepancy may cause delays or rejection of your request. You also need to attach a copy of your PAN card as a proof of identity along with the form.

Step 3: Send the form and the documents to the nearest ICICI Bank branch

After filling out and signing the form, you need to send it along with the copy of your PAN card to the nearest ICICI Bank branch where you opened your account.

You can find the address and contact details of your branch using this online locator.

You can send the form and the documents by courier or registered post to ensure that they reach safely and on time.

You may have to pay some postage or courier charges for this service depending on the distance and weight of the envelope.

Alternatively, you can also visit the branch personally and submit the form and the documents there. However, this may not be possible or convenient for everyone due to various reasons such as location, timing, or COVID-19 restrictions.

Documents To Send With ICICI Bank Account Closue Form :

You need to attach your KYC documents along with the account closure form follow while closing your ICICI Bank account online.

KYC stands for Know Your Customer, and it is a process that verifies your identity and address as a customer of the bank.

KYC documents are usually government-approved documents that have your photograph and address on them. You need to provide one document for identity proof and one document for address proof.

Attach Following Documents with ICICI Bank Account Closure Form :

- PAN Card

- Aadhaar Card

- Bank Passbook Copy

Step 4: Confirm the closure of your ICICI Bank account

The final step is to confirm that your ICICI Bank account has been closed successfully after sending the form and the documents. You can do this by checking the status of your request using any of these methods:

- Online banking: You can log in to your internet banking account and check if your account number is still visible or not. If not, then it means that your account has been closed.

- Mobile banking: You can use your iMobile app or SMS banking service to check if your account number is still active or not. If not, then it means that your account has been closed.

- Customer care: You can call the ICICI Bank customer care number 1860 120 7777 and speak to a representative to confirm the closure of your account. You may have to provide some details such as your account number, name, and date of birth for verification.

You should also receive a confirmation email or SMS from ICICI Bank once your account has been closed. You should keep a copy of this message for future reference.

Conclusion

Closing your ICICI Bank account online is a simple and hassle-free process that you can complete in four steps. All you need to do is:

- Transfer or withdraw the balance from your ICICI Bank account

- Download and fill out the ICICI Bank account closure form

- Send the form and the documents to the nearest ICICI Bank branch

- Confirm the closure of your ICICI Bank account

By following these steps, you can close ICICI Bank account online without visiting branch in 2023. This will save you time, money, and effort.

I hope you found this article helpful and informative. If you have any questions or feedback, please feel free to leave a comment below. Thank you for reading!

FAQs on Close ICICI Bank Account

What are the charges for closing an ICICI bank account?

There are no charges for closing an ICICI bank account if you have maintained it for more than one year. However, if you close your account within one year of opening it, you will have to pay a service charge of Rs. 500 plus GST.

Can I close my ICICI bank account from any branch?

No, you can only close your ICICI bank account from the branch where you opened it. You need to send the form and the documents to that branch only.

How long does it take to close an ICICI bank account?

It usually takes 7 to 10 working days to close an ICICI bank account after receiving the form and the documents. However, it may take longer depending on the verification process and the clearance of any pending dues.

How will I receive the balance amount in my ICICI bank account after closing it?

You can choose the mode of receiving the balance amount in your ICICI bank account closure form. You can opt for a cheque, a demand draft, or a fund transfer to another bank account.

What should I do with my debit card and cheque book after closing my ICICI bank account?

You should return your debit card and any unused cheque leaves to the bank after closing your ICICI bank account. You can either send them along with the form and the documents or destroy them securely.

Can I reopen my closed ICICI bank account?

No, you cannot reopen your closed ICICI bank account. Once your account is closed, it is permanently deactivated and cannot be reactivated.

What are the benefits of closing an unused ICICI bank account?

Closing an unused ICICI bank account can help you avoid paying unnecessary fees and charges, such as monthly maintenance fee, ATM withdrawal fee, cheque bounce fee, etc. It can also reduce the risk of fraud or identity theft.

Can I close a joint ICICI bank account online?

Yes, you can close a joint ICICI bank account online by following the same steps as mentioned above. However, you need to ensure that all the joint holders sign the form and provide their KYC documents.

What are the alternatives to closing an ICICI bank account online?

If you do not want to close your ICICI bank account online, you can also visit the branch personally and submit the form and the documents there. Alternatively, you can also call customer care and request for closure of your account. However, you will still need to send the form and the documents by post or courier later.