Are you looking for a fast and secure way to transfer funds from your SBI account to another bank account? If yes, then you might want to use the SBI RTGS form, which is a convenient and easy method to transfer large amounts of money online.

But what is SBI RTGS form? How can you download it? How can you fill it? And how can you use it for online fund transfer?

In this article, we will answer all these questions and more. We will also provide you with some tips and tricks to make the process smoother and hassle-free.

So, let’s get started.

What is SBI RTGS Form?

RTGS stands for Real Time Gross Settlement, which is an electronic payment system that allows you to transfer funds from one bank account to another in real time. This means that the funds are settled as soon as they are transferred, without any delay or waiting period.

RTGS is ideal for transferring large amounts of money, as there is no limit on the transaction value. However, the minimum amount that can be transferred through RTGS is Rs. 2 lakh.

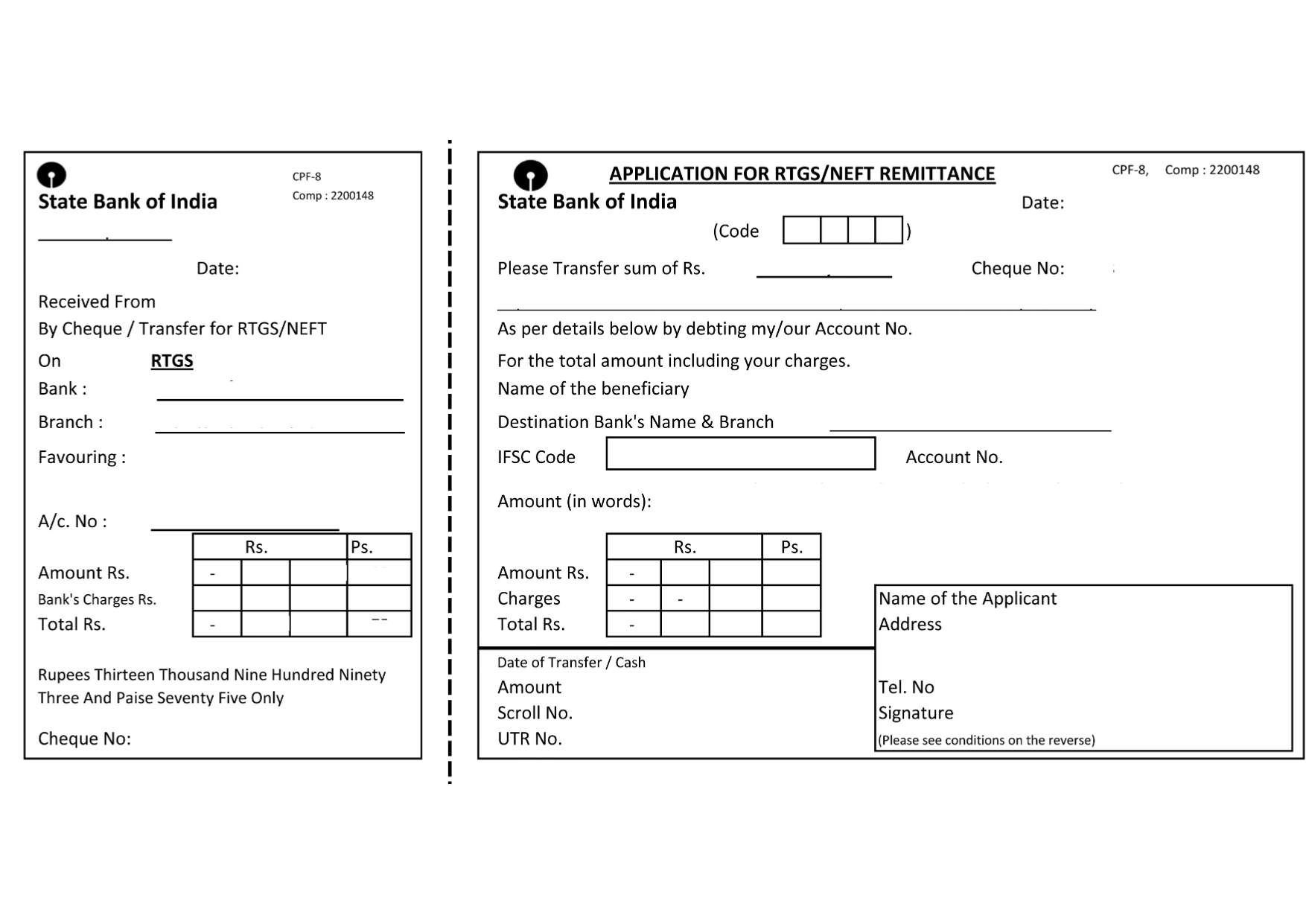

SBI RTGS form is an application form that you need to fill and submit to your SBI branch or online portal to initiate an RTGS transaction.

You can download the SBI RTGS form pdf from the official website of SBI or from the link given below.

The SBI RTGS form pdf is a single-page document that requires you to provide some basic details such as your name, account number, beneficiary name, account number, bank name, IFSC code, amount, and date.

How to Download SBI RTGS Form Pdf?

Downloading the SBI RTGS form pdf is very simple and easy. You can follow these steps to download the SBI RTGS form pdf online:

- Visit the official website of SBI at [sbi.co.in].

- Click on the “Personal Banking” tab on the homepage.

- Click on the “RTGS NEFT” option under the “Personal Banking” section.

- You will be redirected to a new page where you can find information about RTGS and NEFT services offered by SBI.

- Scroll down and click on the “Download Application Form” link under the “RTGS NEFT” section.

- A new tab will open where you can see the SBI RTGS form pdf.

- Click on the “Download” button or right-click and select “Save as” to save the SBI RTGS form pdf on your device.

Alternatively, you can also download the SBI RTGS form pdf from this direct link Below:

How to Fill SBI RTGS Form Pdf?

Filling the SBI RTGS form pdf is also very easy and straightforward. You just need to follow these steps to fill the SBI RTGS form pdf correctly:

- Take a printout of the downloaded SBI RTGS form pdf or open it in a PDF reader software on your device.

- Fill in your name, account number, mobile number, and email address in the “Remitter Details” section.

- Fill in the beneficiary name, account number, bank name, branch name, IFSC code, and amount in the “Beneficiary Details” section.

- Fill in the date and time of remittance in the “Remittance Details” section.

- Fill in any additional information or remarks in the “Sender to Receiver Information” section if required.

- Sign and date the form at the bottom.

- Attach a copy of your PAN card or Aadhaar card as an identity proof along with the form.

Here is an example of how a filled SBI RTGS form pdf looks like:

How to Use SBI RTGS Form Pdf for Online Fund Transfer?

Using the SBI RTGS form pdf for online fund transfer is also very simple and quick. You can follow these steps to use the SBI RTGS form pdf for online fund transfer:

- Visit your nearest SBI branch or login to your online banking account at [sbi.co.in].

- Submit the filled and signed SBI RTGS form along with the identity proof to the branch officer or upload it on the online portal.

- The branch officer or the online portal will verify your details and process your request.

- You will receive a confirmation message on your registered mobile number or email address once your transaction is completed.

- You can also check the status of your transaction by using the reference number or UTR number provided by the bank.

What Data Do You Need for Online Fund Transfer with SBI RTGS Form?

To use the SBI RTGS form for online fund transfer, you need to have some essential data ready with you. These are:

- Your own name, account number, mobile number, and email address

- The beneficiary’s name, account number, bank name, branch name, and IFSC code

- The amount that you want to transfer

- The date and time of remittance

- Any additional information or remarks that you want to convey to the beneficiary

You can find most of this data on your bank statement, cheque book, passbook, or online banking portal. You can also ask the beneficiary to provide you with their details if you don’t have them.

What are the Timings and Charges for Online Fund Transfer with SBI RTGS Form?

The timings and charges for online fund transfer with SBI RTGS form vary depending on the channel and the amount of the transaction. Here are the details:

- The RTGS service is available 24×7, except between 11:50 PM and 00:30 AM on all days.

- The NEFT service is also available 24×7 on all days.

- If you use the online channel for RTGS transfers, there are zero SBI RTGS charges applicable. Also, there are no processing charges for RTGS transactions, as per the RBI guidelines.

- If you use the branch channel for RTGS transfers, SBI charges a fee of Rs. 20 plus GST for transactions between Rs. 2 lakh and Rs. 5 lakh, and Rs. 40 plus GST for transactions above Rs. 5 lakh .

- If you use the online channel for NEFT transfers, there are zero SBI NEFT charges applicable.

What are the risks of using SBI RTGS form pdf for online fund transfer?

Some of the risks or challenges of using SBI RTGS form pdf for online fund transfer are:

- It is irreversible and non-refundable, so you cannot cancel or modify your transaction once it is processed.

- It requires accurate and complete details, such as IFSC code, beneficiary name, account number, etc., as any mistake or discrepancy can lead to rejection or delay of your transaction.

- It depends on the availability of the bank’s servers and systems, as RTGS transactions are processed and settled on a real time basis.

Tips and Tricks for Using SBI RTGS Form Pdf

Here are some tips and tricks that can help you use the SBI RTGS form pdf more effectively and efficiently:

- Make sure that you fill in all the details correctly and legibly on the SBI RTGS form pdf. Any mistake or discrepancy can lead to rejection or delay of your transaction.

- Make sure that you have sufficient balance in your account before initiating an RTGS transaction. RTGS transactions are irreversible and non-refundable, so you cannot cancel or modify them once they are processed.

- Make sure that you provide the correct IFSC code of the beneficiary bank and branch. IFSC code is a unique identifier that helps in routing the funds to the correct destination. You can find the IFSC code of any bank branch on the bank’s website or on the cheque book.

- Make sure that you use the SBI RTGS form pdf only for transferring funds above Rs. 2 lakh. For transferring funds below Rs. 2 lakh, you can use the SBI NEFT form pdf, which is another online payment system that works on a deferred net settlement basis.

- Make sure that you use the SBI RTGS form pdf only during the working hours of the bank. RTGS transactions are processed and settled on a real time basis, so they are dependent on the availability of the bank’s servers and systems.

Conclusion

We hope that this article has helped you understand what is SBI RTGS form pdf, how to download it, how to fill it, how to use it for online fund transfer, what data do you need, what are the timings and charges, and what are some tips and tricks for using it.

SBI RTGS form pdf is a convenient and easy way to transfer large amounts of money online in a fast and secure manner.

If you have any queries or feedback, please feel free to comment below.

Thank you for reading!

FAQs

What is the difference between RTGS and NEFT?

RTGS and NEFT are both online payment systems that allow you to transfer funds from one bank account to another. The main difference between them is the speed and the amount of the transaction. RTGS transfers funds in real time, while NEFT transfers funds in batches at fixed intervals. RTGS is suitable for transferring large amounts of money, while NEFT is suitable for transferring small amounts of money.

How can I check the status of my SBI RTGS form transaction?

You can check the status of your RTGS transaction by using the reference number or UTR number provided by the bank. You can either visit the bank branch, call the customer care, or login to your online banking account to check the status of your transaction.

How can I get the SBI RTGS form pdf in Hindi or other languages?

The SBI RTGS form pdf is available only in English on the official website of SBI. However, you can use an online translator tool to convert the form into Hindi or other languages. You can also visit your nearest SBI branch and ask for a printed copy of the form in your preferred language.

How can I contact the SBI customer care for any queries or complaints regarding SBI RTGS Form transactions?

You can contact the SBI customer care for any queries or complaints regarding RTGS transactions by using any of the following methods:

Call the toll-free number 1800 11 2211 or 1800 425 3800 from your registered mobile number.

Send an email to [customercare@sbi.co.in] with your transaction details and reference number.