Do you own a car? If yes, then you must be aware of the importance of having a comprehensive car insurance policy for your four-wheeler.

Car insurance not only protects you from the financial losses arising from accidents, theft, or natural disasters, but also covers your legal liabilities towards third parties in case of any damage or injury caused by your car.

But with so many car insurance companies and policies available in the market, how do you choose the best one for your car?

How do you ensure that you get the maximum coverage and benefits at the lowest premium?

And how do you access and manage your car insurance policy online without any hassle?

The answer to all these questions is Tata AIG car insurance. Tata AIG is one of the leading general insurance companies in India, offering a wide range of products and services for individuals and businesses.

Tata AIG car insurance is one of their most popular and trusted products, providing comprehensive protection for your car and yourself.

In this article, we will explore the benefits and features of Tata AIG car insurance policy, and show you several ways Tata AIG Car Insurance Policy Download PDF.

Tata AIG Car Insurance Policy Download PDF : Step by Step

Downloading Tata AIG car insurance policy PDF is also very simple and quick. You can do it anytime and anywhere from your laptop or smartphone. You just need to follow these steps:

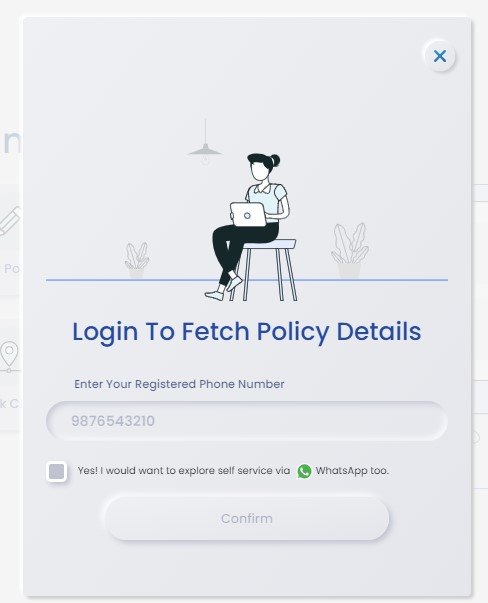

- Go to the Tata AIG website and click on the ‘Self Service’ tab.

- Register with your email and mobile number details, if you haven’t already done so.

- Log in to your account using the OTP sent to your mobile number or your policy number, whichever is applicable.

- Request for your policy document and wait for the confirmation.

- Check your email for the policy document and download it as a PDF file.

That’s all! You have successfully downloaded your Tata AIG car insurance policy PDF.

It is important to download and keep a copy of your car insurance policy PDF for future reference.

It serves as a proof of your coverage and helps in faster claim settlement.

How to Buy Tata AIG Car Insurance Online

To buy and renew Tata AIG car insurance online is very easy and convenient. You can do it from the comfort of your home or office, without visiting any branch or agent. All you need is an internet connection and a few minutes of your time. Here are the steps to follow:

- Visit the Tata AIG website and click on the “Buy/Renew Online” option under the “Motor Insurance” section.

- Enter your car details, such as make, model, variant, registration number, etc., and click on “Get Quote”.

- Choose the type of coverage you want for your car, either third-party liability only or comprehensive (including own damage).

- Select the add-on covers you want to enhance your protection, such as zero depreciation cover, roadside assistance, return to invoice, etc.

- Review your quote and premium details, and click on “Proceed to Buy”.

- Fill in your personal and contact details, such as name, email, phone number, address, etc., and click on “Continue”.

- Make the payment using your preferred mode of payment, such as credit card, debit card, net banking, UPI, etc.

- Once the payment is successful, you will receive a confirmation email with your policy details and number.

That’s it! You have successfully bought or renewed your Tata AIG car insurance policy online. You can also save up to 75% on your car insurance premium by buying your policy online, as compared to offline modes.

What are the Benefits and Features of Tata AIG Car Insurance Policy

Tata AIG car insurance policy offers many benefits and features that make it one of the best car insurance policies in India. Some of them are:

Coverage for third-party liabilities

Tata AIG car insurance policy covers your legal liabilities towards third parties in case of any damage or injury caused by your car.

The policy covers up to Rs. 7.5 lakhs for third-party property damage and unlimited amount for third-party bodily injury or death.

Coverage for own damage

Tata AIG car insurance policy also covers the damages to your own car due to accidents, theft, fire, natural disasters, or human causes.

The policy covers up to 100% of the insured declared value (IDV) of your car in case of total loss or theft, and up to the repair cost in case of partial loss.

Personal Accident Cover

Tata AIG car insurance policy also provides personal accident cover for yourself in case of accidental injuries or death while driving your car.

The policy covers up to Rs. 15 lakhs for accidental death and up to Rs. 7.5 lakhs for permanent total disability.

13 unique add-on covers

Tata AIG car insurance policy also offers 13 unique add-on covers that enhance your protection and convenience. These add-on covers are:

Zero Depreciation Cover

This cover ensures that you get the full claim amount without any deduction for depreciation of your car parts.

Roadside Assistance

This cover provides you with 24×7 emergency assistance in case of breakdown or flat tyre of your car.

Return to Invoice

This cover ensures that you get the original invoice value of your car in case of total loss or theft, instead of the depreciated value.

Engine Secure

This cover protects your engine and gearbox from damages due to water ingress, leakage of lubricants, or hydrostatic lock.

No Claim Bonus Protection

This cover protects your no claim bonus (NCB) even if you make a claim during the policy period, subject to certain conditions.

Consumable Expenses

This cover covers the cost of consumables, such as engine oil, coolant, brake fluid, etc., that are used during the repair of your car.

Key Replacement

This cover covers the cost of replacing your lost or stolen car keys, including the locksmith charges.

Tyre Secure

This cover covers the cost of repairing or replacing your damaged tyres due to punctures, cuts, or bursts.

Emergency Transport and Hotel Expenses

This cover covers the cost of emergency transport and hotel accommodation in case your car becomes immobile due to an accident or breakdown.

Loss of Personal Belongings

This cover covers the loss of your personal belongings, such as laptop, mobile phone, etc., that are stolen from your car.

Daily Allowance

This cover provides you with a daily allowance for hiring an alternative vehicle in case your car is under repair due to an accident or breakdown.

Depreciation Reimbursement

This cover reimburses you for the depreciation amount deducted from your claim settlement in case of partial loss of your car.

Courtesy/Hire Car

This cover provides you with a courtesy or hire car for a specified period in case your car is under repair due to an accident or breakdown.

Cashless repairs in more than 7500 network garages

Tata AIG car insurance policy also offers cashless repairs in more than 7500 network garages across the country.

You can get your car repaired without paying any money upfront and get it back in a good condition.

Claim assistance from 650 claim experts

Tata AIG car insurance policy also provides claim assistance from 650 claim experts who offer quick and easy claim settlement.

You can register your claim online or through a toll-free number and track its status online. You can also avail of free pick-up and drop service for your car in case of a claim.

Claim settlement ratio of 98% as of FY 2020-21

Tata AIG car insurance policy also boasts of a high claim settlement ratio of 98% as of FY 2020-21.

This means that out of every 100 claims made by Tata AIG customers, 98 were settled successfully.

Conclusion

Tata AIG car insurance policy is one of the best car insurance policies in India that offers comprehensive protection for your car and yourself.

It covers you for third-party liabilities, own damage, personal accident, and various add-on covers that enhance your protection and convenience. It also offers cashless repairs, claim assistance, and high claim settlement ratio.

If you are looking for a reliable and affordable car insurance policy for your four-wheeler, then Tata AIG car insurance policy is the perfect choice for you.

You can buy or renew it online in a few minutes and download it as a PDF document. You can also compare different plans and customize your coverage as per your needs and budget.

So what are you waiting for? Visit the [Tata AIG website] today and get your Tata AIG car insurance policy online. And don’t forget to download your policy PDF and keep it handy for future reference.

FAQs

What are the documents required to buy or renew Tata AIG car insurance online?

To buy or renew Tata AIG car insurance online, you will need the following documents:

A copy of your car’s registration certificate (RC)

A copy of your driving license

A copy of your previous car insurance policy (if any)

A copy of your Aadhaar card or PAN card (for KYC verification)

Your bank account details (for online payment)

How can I cancel my Tata AIG car insurance policy and get a refund?

You can cancel your Tata AIG car insurance policy and get a refund by following these steps:

1. Contact the Tata AIG customer care through their toll-free number 1800-266-7780 or email customersupport@tataaig.com and request for cancellation.

2. Provide your policy number and reason for cancellation.

3. Submit the required documents, such as a copy of your RC, a copy of your new car insurance policy (if you have switched to another insurer), and a cancellation request letter.

4. The company will verify your documents and process your cancellation request within 7 working days.

5. The refund amount will be calculated based on the pro-rata basis and transferred to your bank account.

How can I make a claim under my Tata AIG car insurance policy?

You can make a claim under your Tata AIG car insurance policy by following these steps:

1) Inform the Tata AIG customer care about the incident or accident within 24 hours through their toll-free number 1800-266-7780 or SMS ‘CLAIMS’ to 5616181.

2) Register your claim online or through the toll-free number and get a claim reference number.

3) Take your car to the nearest network garage or workshop for repair. You can also avail of free pick-up and drop service for your car in case of a claim.

4) Submit the required documents, such as a copy of your RC, a copy of your driving license, a copy of your FIR (if applicable), a copy of your policy document, and a duly filled and signed claim form.

5) The company will assess the damages and approve the claim amount. If you have opted for cashless repair, you don’t have to pay anything at the garage. If you have opted for reimbursement, you will have to pay at the garage and submit the bills to the company for reimbursement.

What are the exclusions under my Tata AIG car insurance policy?

Any damage or loss caused by normal wear and tear, depreciation, mechanical or electrical breakdown, or failure.

Any damage or loss caused by driving under the influence of alcohol or drugs, driving without a valid license, driving against the law, or driving for racing or competition purposes.

Any damage or loss caused by war, civil unrest, terrorism, nuclear risk, or any other malicious act.

Any damage or loss caused by intentional or deliberate act, fraud, or negligence by the insured or any other person.

Any damage or loss to accessories, tyres, tubes, batteries, etc., unless the vehicle is damaged at the same time.