In this era of technology driven advancements, in banking services have evolved beyond brick and mortar branches. In this landscape of services provided by IndusInd Bank enables customers to effortlessly open a zero balance account online without any hassle or inconvenience.

Imagine the convenience of initiating an account without the obligation to uphold a minimum balance requirement – an freeing aspect that truly resonates with individuals.

Why should you think about opting for indusind bank zero balance account opening online ? Well for one thing it takes away the hassle of keeping an amount in your account so you can concentrate on your money aspirations instead.

This particular account is particularly advantageous, for students and young professionals seeking flexibility and ease, in their banking interactions.

Advantages of having a IndusInd Bank zero balance account .

Starting a Zero Balance Account, with IndusInd Bank online feels like a change in the realm of banking, for several reasons;

- You are not required to have a balance : No need to stress about keeping everything in check! This option works great for students and young professionals who value having some freedom with their finances.

- Convenient Online Account Registration : Avoid waiting in line. Easily set up your IndusInd Bank Zero Balance Account from your home with a few clicks!

- Ease of access and convenience : Taking care of your finances has become so convenient now! Thanks, to services, like banking and a mobile app that allow you to access your account wherever and whenever you need it.

- Enticing Rates of Interest : Even if your account has no money left in it all… You can still earn some interest, on it! It’s, like getting the best of both worlds. Having your cake and eating it too!

Step-by-Step Guide to Indusind Bank Zero Balance Account Opening Online

Opening an IndusInd Bank zero balance account online is straightforward. Just follow these steps:

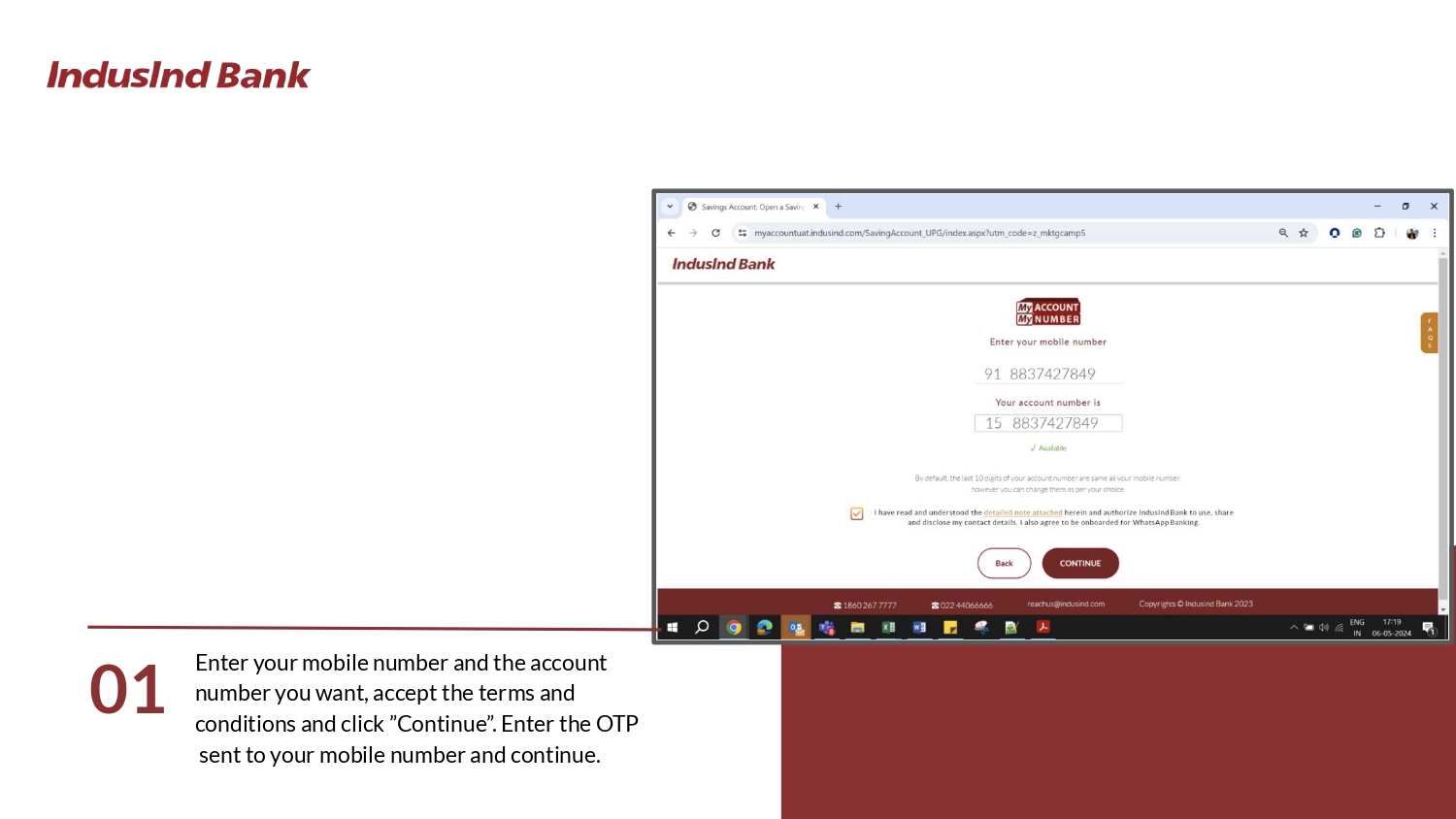

Step 1 : Enter Your Mobile Number

- Input your mobile number and the desired account number.

- Accept the terms and conditions, then click “Continue”.

- Enter the OTP sent to your mobile number to proceed.

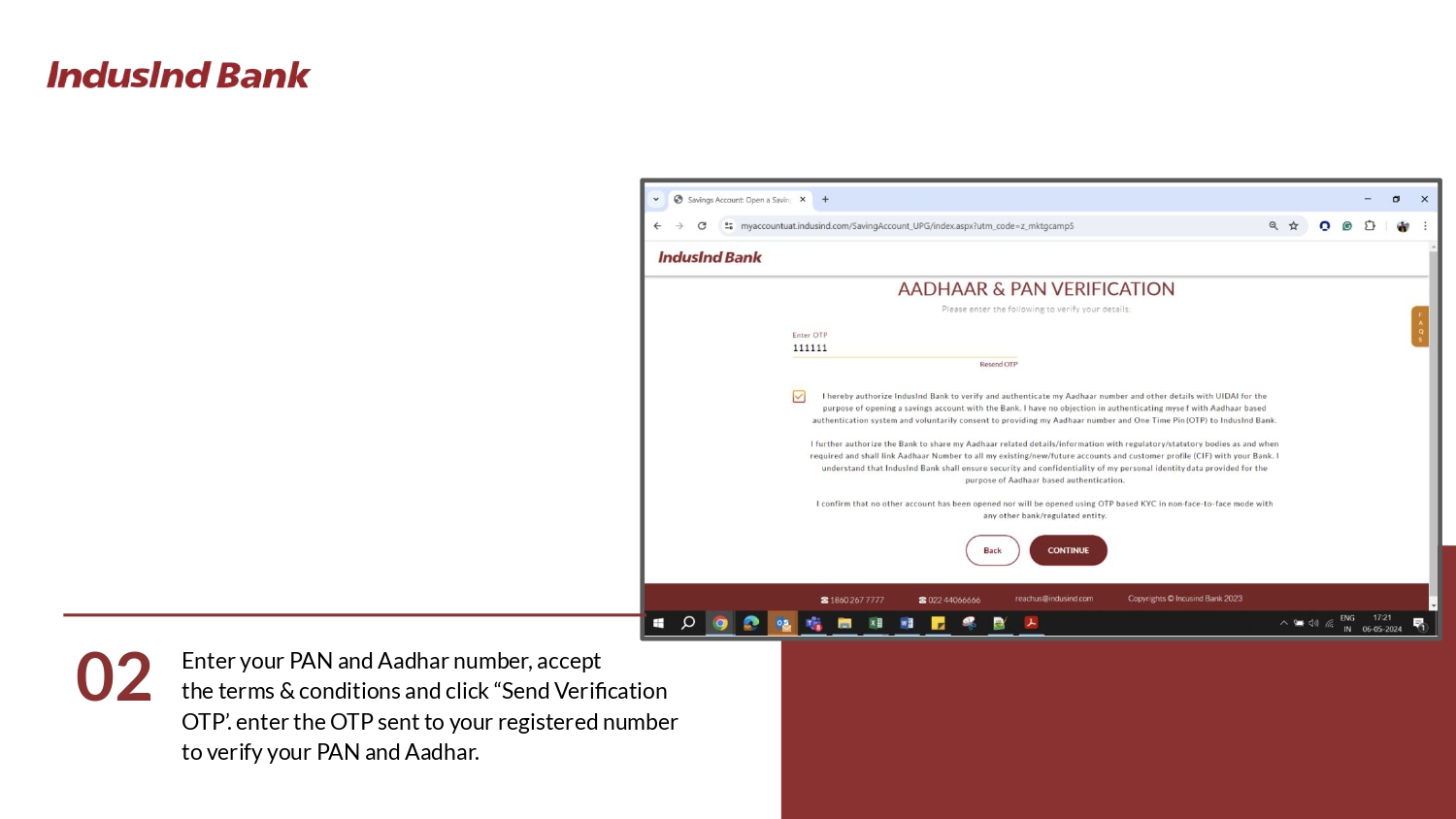

Step 2 : PAN and Aadhaar Verification

- Enter your PAN and Aadhaar numbers.

- Accept the terms and conditions, then click “Send Verification OTP”.

- Enter the OTP sent to your registered number to verify your PAN and Aadhaar.

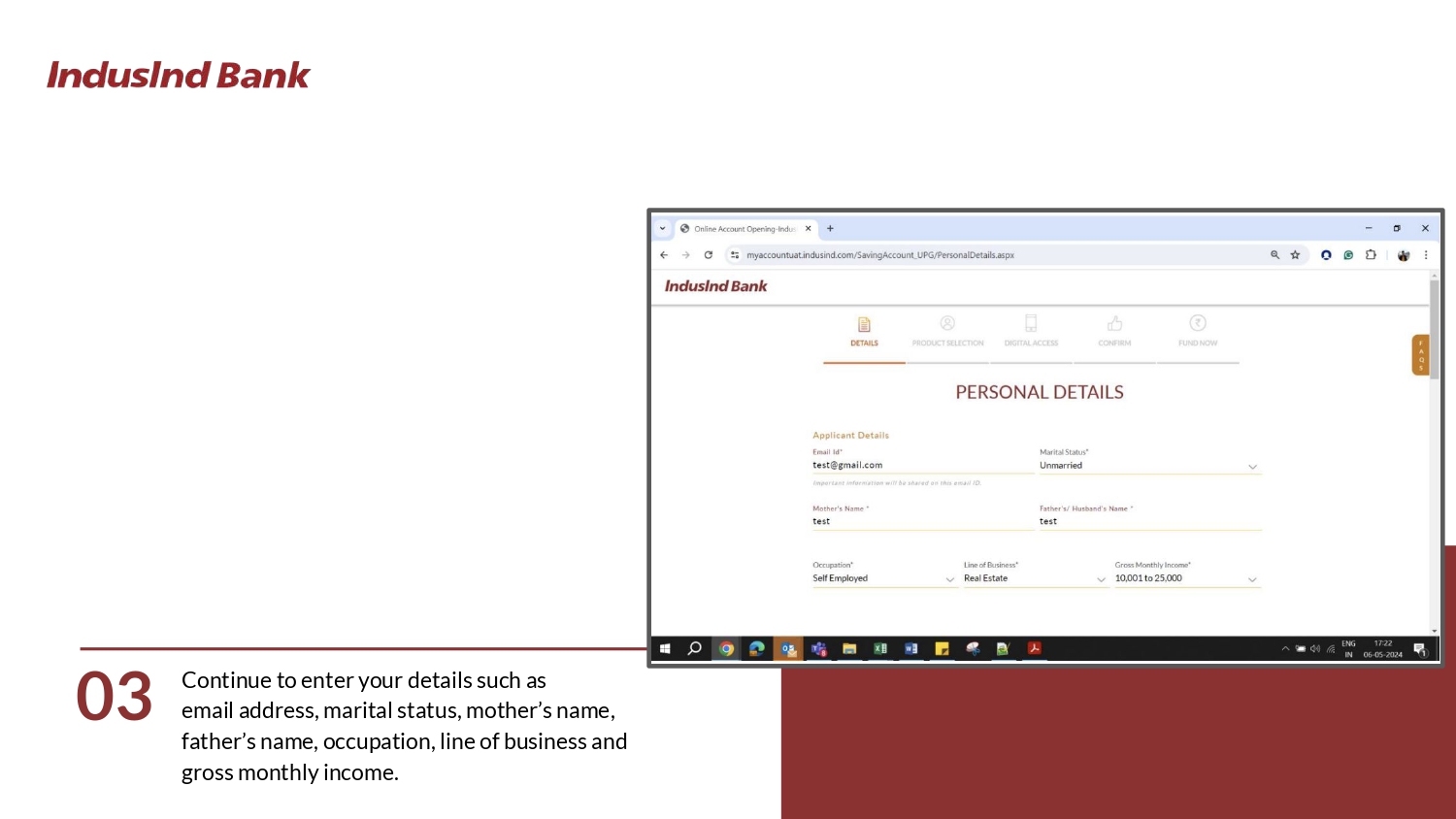

Step 3 : Provide Personal Details

Continue by entering your details such as:

- Email address

- Marital status

- Mother’s name

- Father’s name

- Occupation

- Line of business

- Gross monthly income

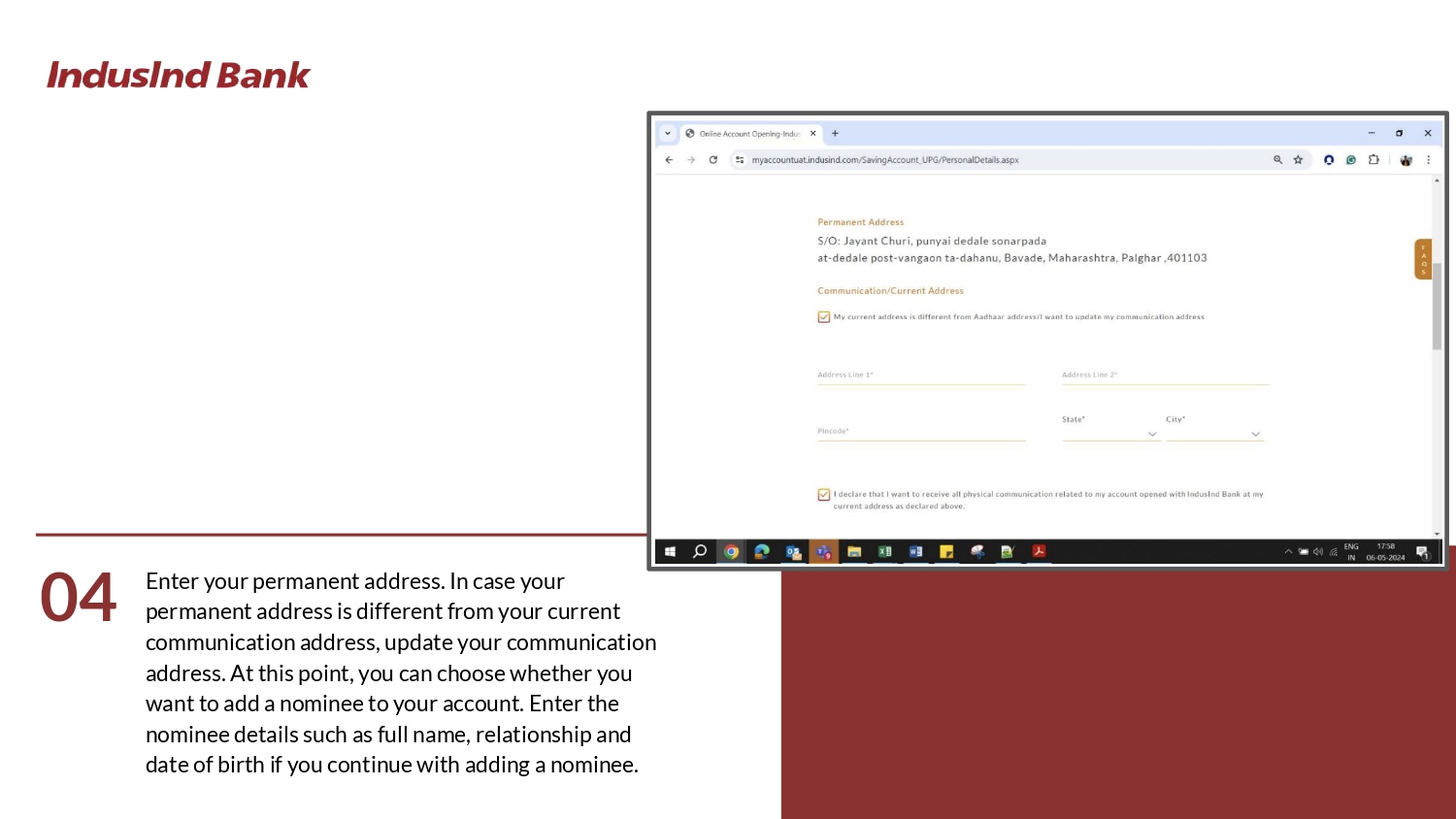

Step 4 : Enter Address Details

- Input your permanent address. If it differs from your current communication address, update accordingly.

- Choose if you want to add a nominee and enter their details (full name, relationship, date of birth).

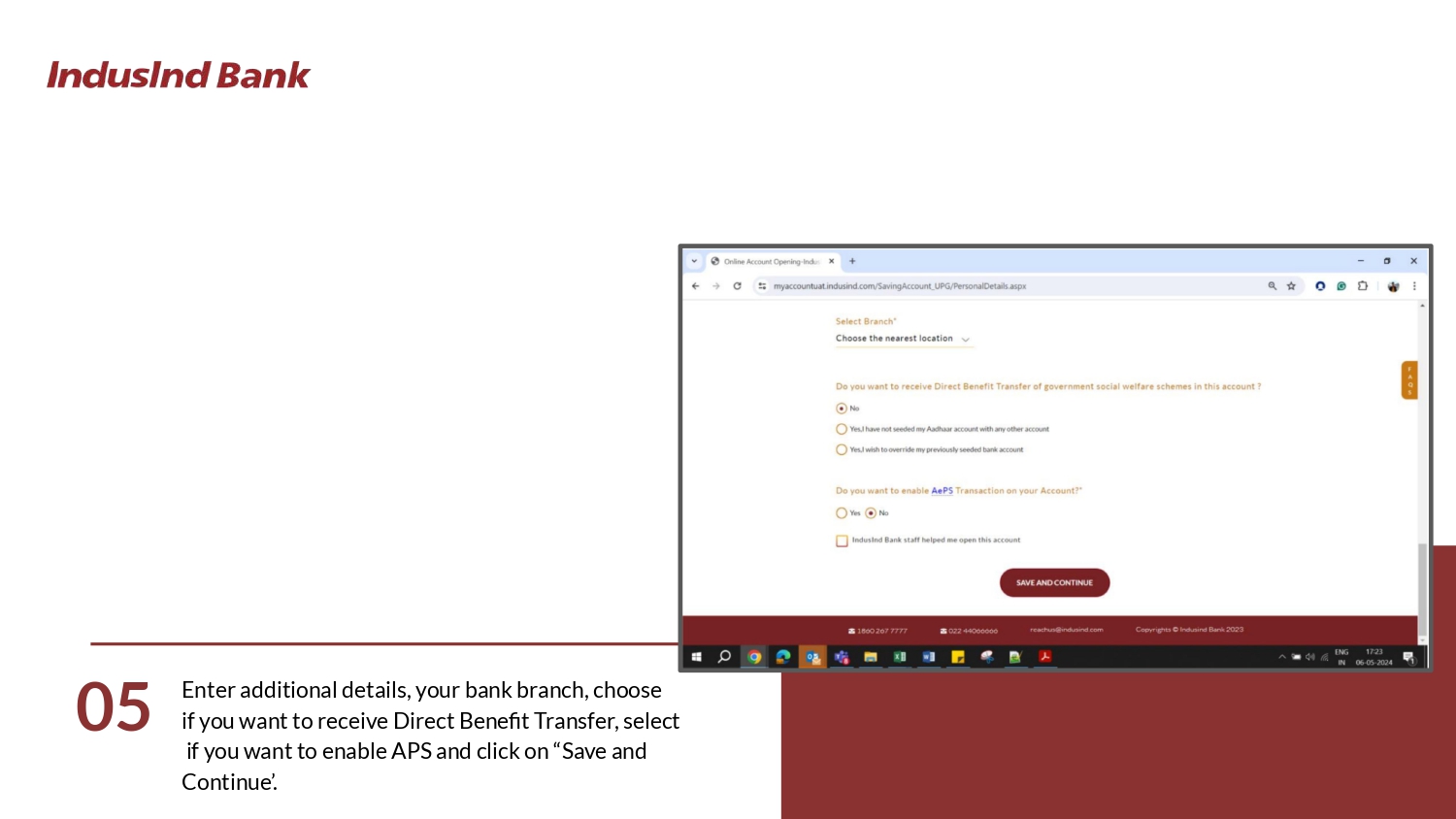

Step 5 : Additional Details

- Enter your bank branch and choose if you want to receive Direct Benefit Transfer.

- Select if you want to enable APS and click on “Save and Continue”.

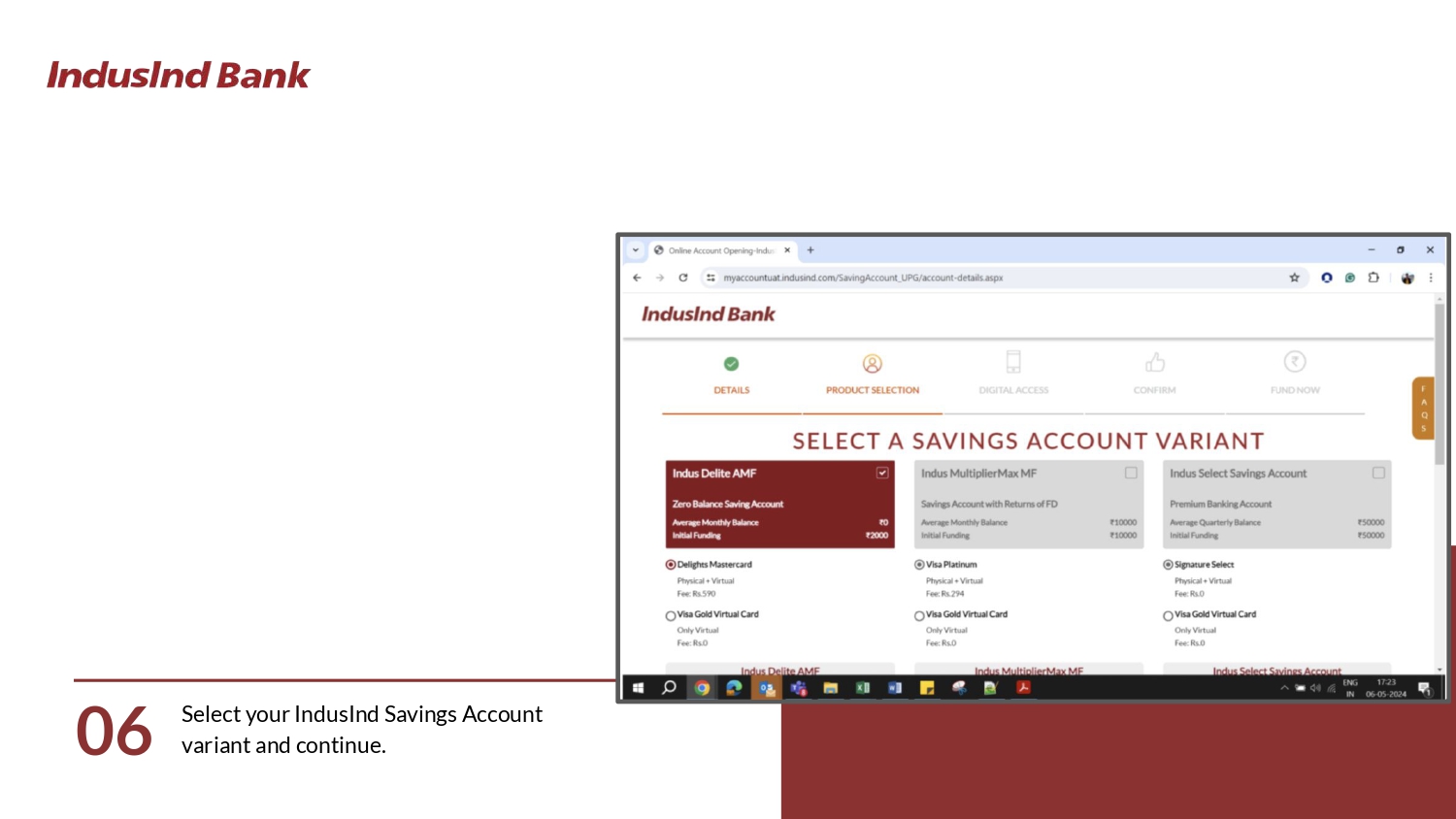

Step 6 : Select Account Variant

- Choose your IndusInd Savings Account variant and continue.

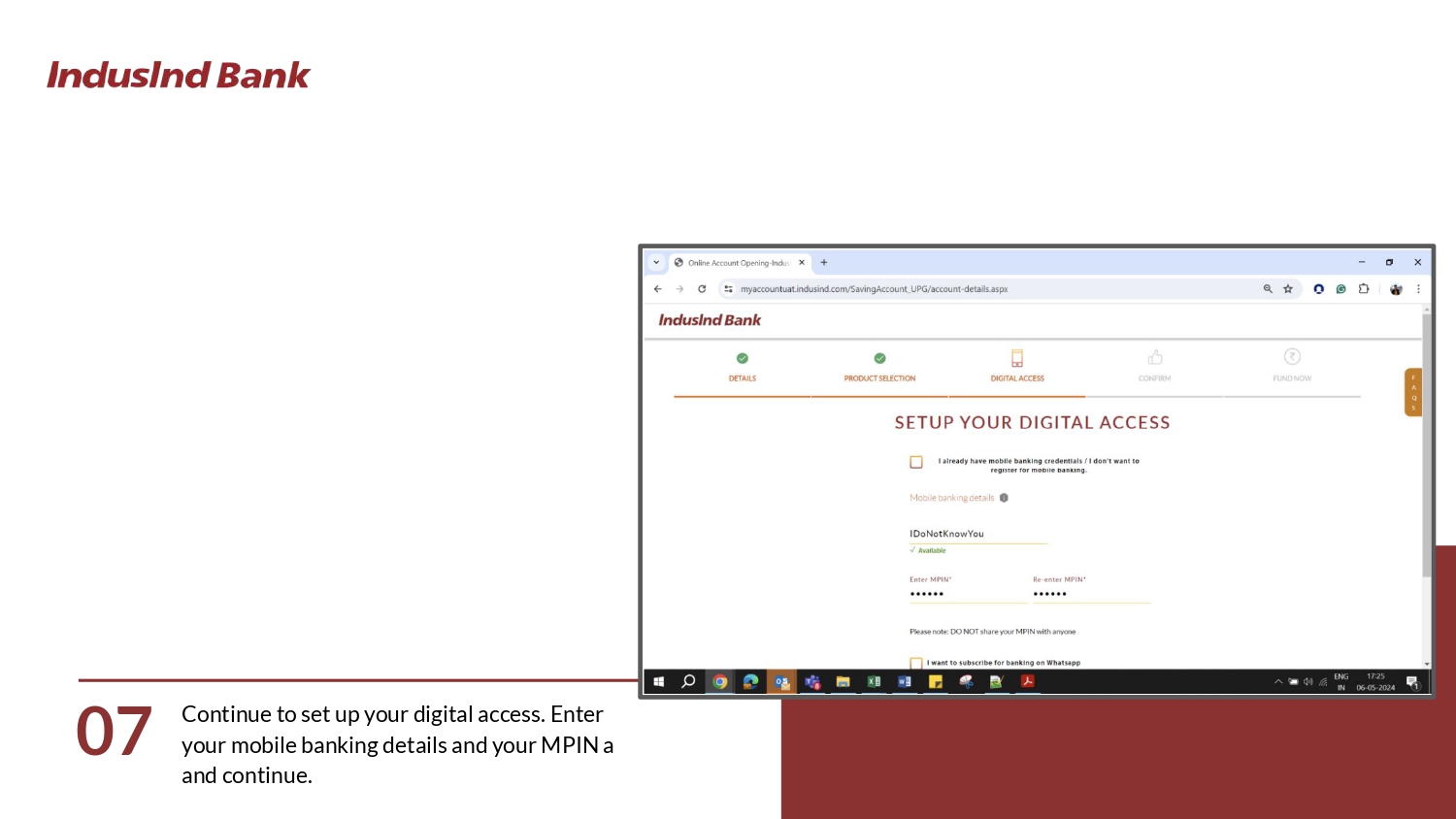

Step 7 : Setup Digital Access

- Enter your mobile banking details and set up your MPIN.

- Continue to the next step.

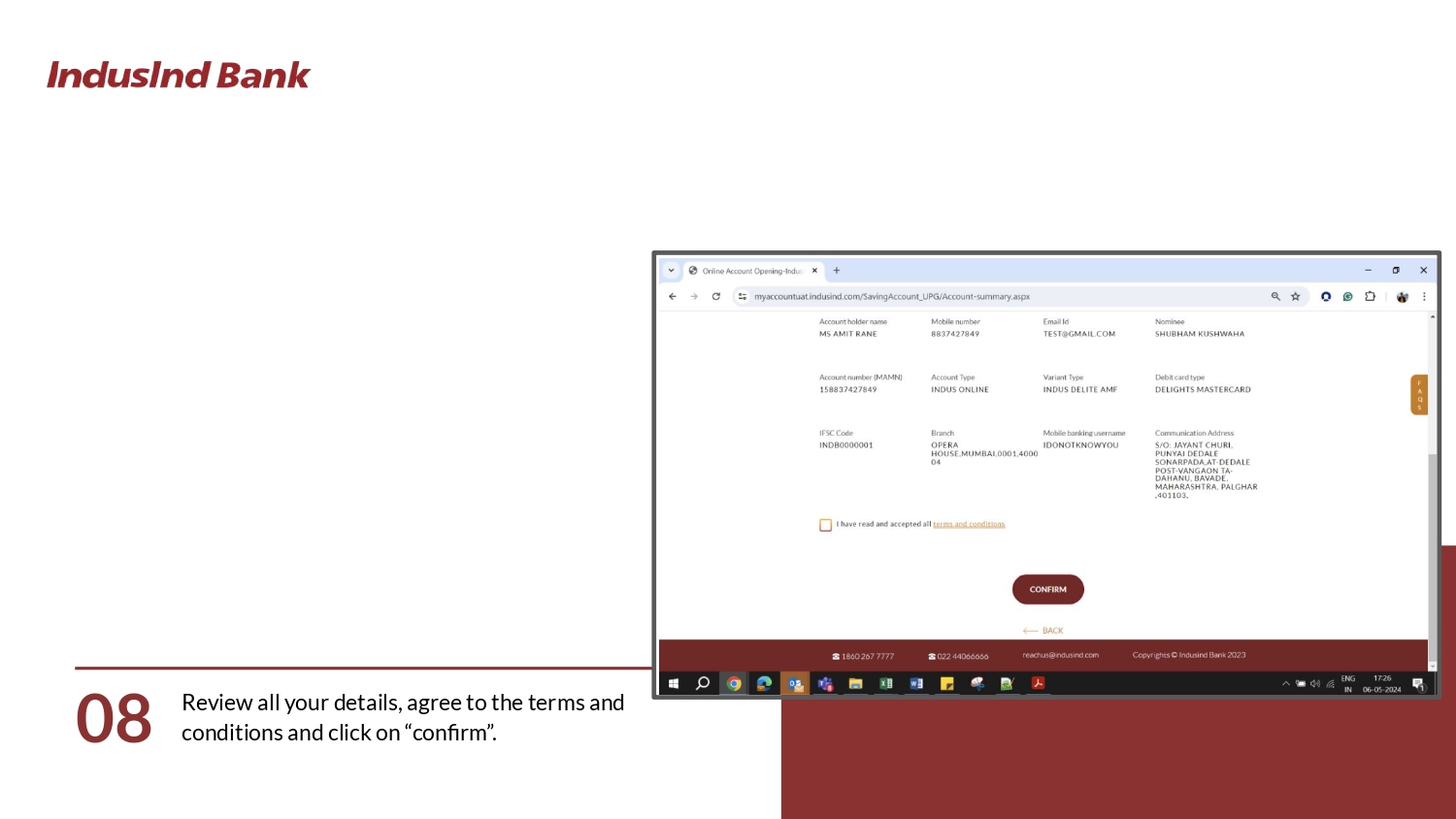

Step 8 : Review and Confirm

- Review all your details carefully.

- Agree to the terms and conditions and click on “Confirm”.

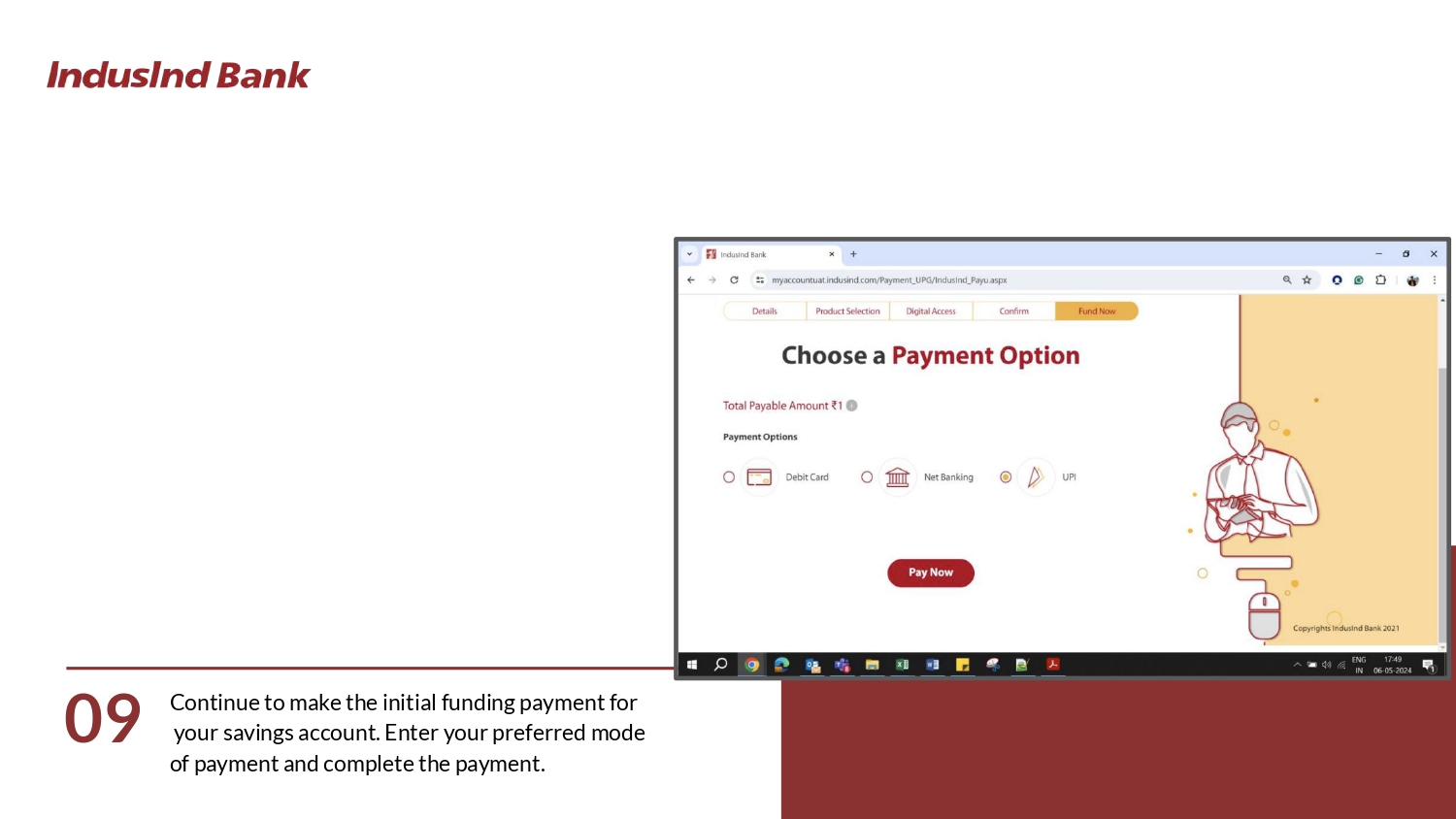

Step 9 : Initial Funding Payment

- Make the initial funding payment for your savings account.

- Choose your preferred mode of payment and complete the transaction.

Opening my IndusInd Bank zero balance account was smooth. I completed everything online in less than 20 minutes, from my couch!

Types of IndusInd Bank zero balance account

IndusInd Bank offers a variety of zero balance accounts tailored to meet different needs. Let’s break them down:

- This account comes in three flavors:

- Star: A pure zero balance account. No need to maintain a minimum balance.

- Super Star: Requires an initial funding of ₹25,000.

- Mega Star: Also requires an initial funding of ₹25,000.

Other Zero Balance Accounts

- Indus Privilege Savings Account: Offers a host of benefits, ideal for those who want more from their banking experience.

- Indus Maxima Savings Account: Designed for individuals looking for exclusive benefits and services.

Here’s a quick comparison:

| Account Type | Minimum Balance Requirement | Initial Funding |

|---|---|---|

| Star | Zero Balance | None |

| Super Star | Zero Balance | ₹25,000 |

| Mega Star | Zero Balance | ₹25,000 |

| Privilege | Zero Balance | None |

| Maxima | Zero Balance | None |

For anyone looking for flexibility and minimal requirements, the Indus Delite Star account is a stellar choice. It’s all about finding what fits best with your lifestyle and financial needs.

Key Features of IndusInd Bank zero balance account

Choosing an IndusInd Bank zero balance account is more than just about skipping the minimum balance hassle. Here’s what you get:

Online Banking Facilities

- Easily manage your account with a few clicks. Transfer money, check balances, and pay bills all online.

Free ATM Withdrawals

- No need to worry about ATM fees. Withdraw cash from any IndusInd Bank ATM without extra charges.

Mobile Banking App

- Banking on the go! Download the IndusInd Bank app and carry your bank in your pocket. It’s perfect for those who live a busy life.

Customer Support

- Got questions? IndusInd Bank provides robust customer support to help you with any issues. You can call, email, or even chat online.

Imagine being able to pay your rent, transfer funds to family, and check your account balance all while sipping coffee at your favorite cafe. That’s the convenience of IndusInd online account opening and banking.

Here’s a quick summary of the key features:

| Feature | Description |

|---|---|

| Online Banking | Manage your account online |

| Free ATM Withdrawals | No fees at IndusInd Bank ATMs |

| Mobile Banking App | Banking on your mobile device |

| Customer Support | Assistance whenever you need it |

Additional Services and Benefits of IndusInd Bank zero balance account

Having an IndusInd Bank zero balance account isn’t just about avoiding fees. It comes packed with extra perks that make banking a breeze.

Bill Payments and Transfers

- No more standing in line to pay your bills. With online banking, you can pay utilities, credit card bills, and more from your computer or phone.

Investment Options

- Looking to grow your savings? IndusInd Bank offers a range of investment options right at your fingertips. From fixed deposits to mutual funds, you have choices.

Insurance and Loan Facilities

- Need insurance? Want to apply for a loan? With an IndusInd Bank zero balance account, you have easy access to various insurance plans and loan products.

Example: Imagine this: You’re traveling for a work trip. Midway through your journey, you remember you forgot to pay your electricity bill. No problem. With the IndusInd mobile banking app, you can handle it right then and there. Plus, if your car breaks down, you can easily apply for a quick loan through your account.

Here’s a quick snapshot of additional benefits:

| Service/Benefit | Description |

|---|---|

| Bill Payments | Pay all your bills online |

| Transfers | Easy funds transfer, both domestic and international |

| Investment Options | Access to fixed deposits, mutual funds, etc. |

| Insurance Facilities | Various insurance products available |

| Loan Facilities | Quick access to personal, home, and car loans |

Comparison of IndusInd Bank zero balance account with Other Banks

When it comes to opening a zero balance account, IndusInd Bank stands out, but how does it compare with other banks? Let’s take a look.

Here’s a quick comparison table for clarity:

| Bank | Interest Rate | No Minimum Balance | Online Account Opening | Free ATM Withdrawals | Mobile Banking App |

|---|---|---|---|---|---|

| IndusInd Bank | 3.50% | Yes | Yes | Yes | Comprehensive |

| RBL Bank | 4.25% | Yes | Yes | Limited | Good |

| IDFC First Bank | 3.00% | Yes | Yes, some in person | Limited | Decent |

| YES Bank | 3.00% | Yes | Partial | Limited | Robust |

| Utkarsh Bank | 4.00% | Yes | Yes | Yes | Functional |

| AU Small Finance Bank | 3.50% | Yes | Yes | Limited | User-friendly |

| Kotak Mahindra Bank | 3.50% | Yes | Yes | Limited | Excellent |

| HDFC Bank | 3.00% | Yes | Yes, some in person | Limited | Comprehensive |

| Standard Chartered Bank | 2.75% | Yes | Partial | Limited | Basic |

| State Bank of India | 2.70% | Yes | Yes, some in person | Limited | Decent |

A friend recently compared these options and chose IndusInd Bank for the ease of fully online account opening and the unlimited free ATM withdrawals.

In conclusion, IndusInd Bank zero balance account offers a competitive mix of interest rates, online convenience, and robust mobile app features that stand out in the market.

Final Thoughts : Why Indusind Bank Zero Balance Account Opening Online is a Good Idea !

If you want an straightforward banking experience, with no complications involved consider creating an IndusInd Bank zero balance account via the internet.

Whether you’re a student, freelancer or just someone who appreciates the freedom to handle your finances flexibly this account allows you to bank according to your preferences. Without having to worry about keeping a balance.

Key Points to Remember;

- It’s open : to everyone since theres no minimum balance requirement.

- Stay connected : Manage your finances with ease using mobile and online banking wherever you go.

- Earning interest : on your savings helps your money grow over time without needing to maintain a balance.

Businesses can take advantage of accounts, with zero balances to provide flexibility to business proprietors. Ultimately opening a zero balance account, with IndusInd Bank online focuses on providing convenience transparency and user friendly banking services. With paperwork simplicity and various advantages it is a choice that, alignsWith the demands of modern fast paced living.

FAQs

What are the benefits of opening an IndusInd Bank zero balance account?

Opening an IndusInd Bank zero balance account offers several benefits including no minimum balance requirement, easy online account management, attractive interest rates, and access to various banking facilities without any maintenance fees. This account is designed for convenience and flexibility, making it ideal for students, professionals, and small business owners.

How can I open an IndusInd Bank zero balance account online?

To open an IndusInd Bank zero balance account online, visit the IndusInd Bank website and navigate to the account opening section. Select the zero balance account option, fill in your personal details, upload the required documents, complete the KYC process, and wait for verification. The entire process is simple and can be completed within 15-20 minutes.

Is there a minimum balance requirement for IndusInd Bank zero balance accounts?

No, there is no minimum balance requirement for IndusInd Bank zero balance accounts. This means you can enjoy the flexibility of maintaining any balance in your account without incurring any penalties or fees.

What interest rates do IndusInd Bank zero balance accounts offer?

IndusInd Bank zero balance accounts offer competitive interest rates as 3.5 to 4 % . For detailed information on the current interest rates, it’s best to check the official IndusInd Bank website or contact their customer service.

Can I manage my IndusInd Bank zero balance account through mobile banking?

Yes, you can easily manage your IndusInd Bank zero balance account through the IndusInd Bank mobile banking app. The app allows you to perform various banking tasks such as checking your balance, transferring funds, paying bills, and more, all from the convenience of your smartphone.

Are there any fees associated with IndusInd Bank zero balance accounts?

Generally, there are no maintenance fees associated with IndusInd Bank zero balance accounts. However, it is always advisable to review the account terms and conditions on the IndusInd Bank website or contact customer service for any specific charges related to certain transactions or services.

How do I convert my existing account to an IndusInd Bank zero balance account?

To convert your existing account to an IndusInd Bank zero balance account, you can visit your nearest IndusInd Bank branch or contact customer support for assistance. They will guide you through the process of converting your current account to a zero balance account.