Are you tired of juggling multiple credit cards with various rewards and features? Look no further, as Bajaj Finserv RBL Bank Supercard is here to simplify your financial life. This card packs a punch with its cashback rewards, interest-free credit and global acceptance, making it the perfect companion for all your financial needs. From students to professionals and even retirees, Bajaj RBL Supercard is the ultimate guide to managing your finances and reaching your financial goals. In this guide, we’ll dive into the exciting features and benefits of Bajaj RBL Supercard and show you how easy it is to apply for one. Say goodbye to the hassle of multiple cards and hello to the convenience of Bajaj RBL Supercard.

What is Bajaj Finserv RBL Bank Super Card?

Bajaj Finserv RBL Bank Super Card is a credit card offered by Bajaj Finserv in partnership with RBL Bank. The card is designed to provide users with a wide range of benefits, including cashback rewards, interest-free credit, and global acceptance.

It also offers features such as contactless payments and customized spending limits to make transactions more convenient and secure. The card also offers insurance coverage, SMS and email alerts, 24/7 customer service and zero liability on lost card.

The card is designed to help users manage their expenses and achieve their financial goals. The eligibility criteria, required documents, and application process for the Bajaj Finserv RBL Bank Super Card may vary

Key Features and Benefits of Bajaj Finserv RBL Bank Super Card

The Bajaj Finserv RBL Bank Super Card is a financial powerhouse that offers a plethora of features and benefits to its users. With this card in your wallet, you’ll have the power to take control of your finances in a whole new way.

Features :

- Easy EMI Conversion: The Bajaj Finserv SuperCard is the ultimate shopping companion, packed with a host of features that will make your spending experience a breeze. Imagine, converting your purchases into easy-to-manage EMIs without any hassle.

- Interest-free credit: Take advantage of interest-free cash withdrawals up to 50 days, giving you the financial flexibility to make the big purchases you’ve been dreaming of.

- Pay with points: With the option to redeem your reward points to pay for EMIs, you’ll be able to treat yourself to more without breaking the bank.

- Airport lounge access: If you love to travel, you’ll love the complimentary airport lounge access, up to eight times a year with Bajaj Finserv RBL Bank Super Card.

- Emergency Personal Loan: In case of emergency, the SuperCard offers a unique feature of converting your available cash limit into a personal loan for three months with zero processing fee and a competitive interest rate.

- Cashback on down payment: With SuperCard, you can save big as well. Get 5% cashback on down payments made at Bajaj Finserv partner stores.

- Annual savings: You can potentially save up to Rs. 5,000+ annually when shopping with the card.

- Free movie tickets: To make your leisure time even more enjoyable, get 1+1 movie tickets on BookMyShow with the SuperCard. With all these features, Bajaj Finserv SuperCard is the ultimate shopping companion.

Benefits :

- Financial flexibility: From managing your expenses to achieving your financial goals, this card is designed to give you the power to take control of your finances.

- Convenience and ease of use: With this card, transactions are more convenient and easy than ever before.

- Increased security: Advanced security features protect you from fraud and unauthorized transactions, giving you peace of mind.

- Customization options: Personalize the design of your card and set custom spending limits that work for you.

- 24/7 customer service and zero liability on lost card: With 24/7 customer service and zero liability on lost card, you can rest easy knowing you’re always taken care of.

- Insurance coverage, SMS and email alerts: From insurance coverage to SMS and email alerts, this card is designed to keep you informed and protected.

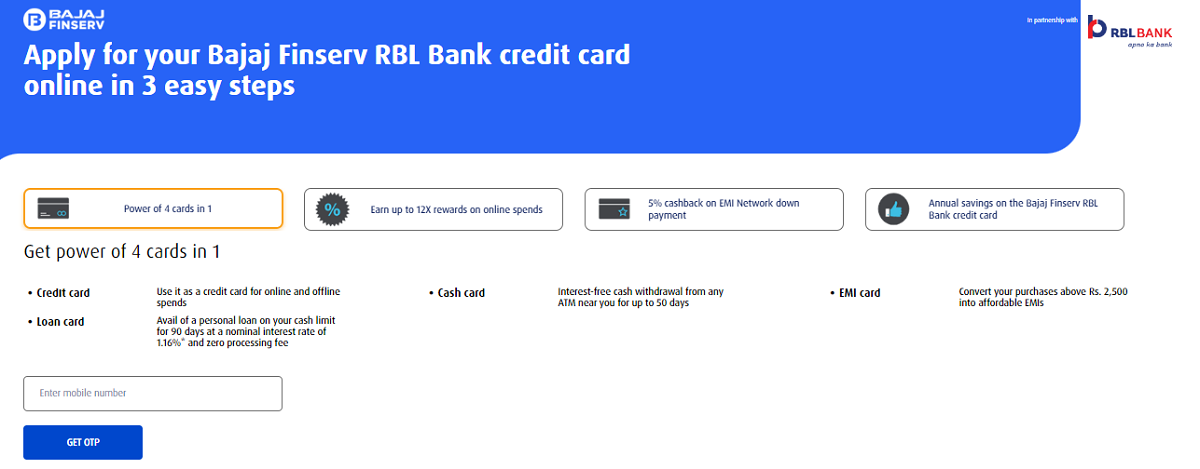

How to Apply for Bajaj Finserv RBL Bank Super Card

Applying for a Bajaj Finserv RBL Bank Super Card is a simple process that can be completed quickly and easily.

The application process begins with an online form that requires you to enter your mobile number and verify that by OTP verification. You can either CLICK HERE or go to Official website of Bajaj Finserv RBL Bank SuperCard to apply.

After Mobile OTP verification, You have to fill other details such as Gender, Full Name, Pan Card Number, Date of birth, Current Address and Email Id to proceed further.

Choose Employment Status as Salaried/Self Employed and submit the application.

After submitting your application, If your card is approved, You will be redirected to VKYC page or the process can go offline where you will receive a call from bank after submitting the application for biometric KYC.

Once you have applied and your application has been approved, you will receive your RBL Bajaj Finserv Super Card within 7-10 working days. The card comes with a welcome kit containing your card, user manual, and other important documents.

Fees and Charges of Bajaj Finserv RBL Bank Super Card

| Annual Membership Fee | Rs. 499 |

| Add-on Card Fee NIL | NIL |

| Finance charges (Retail purchases and Cash | APR upto 3.99% p.m. (upto 47.88% p.a.) |

| Cash Advance Transaction Fee | 2.5% of the cash amount (Minimum Rs. 100) Wef. July, 01, 2020 : 2.5% of the cash amount (Min. Rs. 500) |

| Overdue Penalty / Late Payment Fee | 15% of Total amount due (Min Rs. 50, Max Rs. 1000) Wef. July 3, 2021: 15% of Total Amount Due (Min Rs. 50, Max Rs. 1500) |

| Over Limit Penalty | Rs. 600 |

| Charge Slip Retrieval / Copy Fee | Rs. 100 |

| Card Replacement (Lost/Stolen / Reissue/any other replacement) | NIL |

| Duplicate Statement Fee | NIL |

| Cheque Return / Dishonour Fee Auto debit Reversal-Bank Account out of funds | Rs. 500 |

| Cash Payment at branches | Rs 250 / cash deposit transaction done at RBL branch and Bajaj Finserv branch Effective 1st June’2018 |

| Surcharge on Purchase / Cancellation of Railway Tickets | IRCTC Service charges * + Payment Gateway. Transaction charge [Upto 1.8% of (ticket amount +IRCTC service charge). Refer IRCTC website for details |

| Fuel Transaction Charge-for transaction made at petrol pumps to purchase fuel | 1% Surcharge on Fuel transaction value or Rs. 10, whichever is higher |

| Foreign Currency Transaction | 3.50% |

| Reward Redemption Fees | A Reward redemption fee of Rs. 99+GST will be levied on all redemptions made on Bajaj Finserv RBL Bank SuperCards w.e.f. June 01, 2019. T&C Apply |

Eligibility criteria of Bajaj Finserv RBL Bank Super Card

If you’re looking to apply for a credit card that’s easy to get your hands on, Bajaj Finserv has got you covered! With their SuperCard, you’ll only need to tick off a few simple requirements:

- Age between 25 to 65 years,

- A steady flow of income,

- A sparkling credit score of 750 or higher,

- A residential address that falls within Bajaj Finserv’s SuperCard coverage area,

- And last but not least, you must be an existing Bajaj Finserv customer and Bajaj Finserv EMI Network cardholder or Mobikwik user.

Simple, right? Apply now and sail through the application process with ease!

1 thought on “Unlock the Power of Bajaj Finserv RBL Bank Supercard: Features, Benefits, and How to Apply”