Are you looking for a personal loan that offers low interest rates, flexible repayment options, and instant approval? If yes, then you have come to the right place.

In this article, I will tell you everything you need to know about L&T Finance Personal Loan, one of the best personal loan products in the market.

L&T Finance Personal Loan is designed to cater to the diverse and dynamic needs of individuals who need quick and easy financing for their personal purposes.

Whether you need money for medical emergency, education, wedding, travel, home renovation, debt consolidation, or any other reason, L&T Finance Personal Loan can help you fulfill your dreams.

L&T Finance Personal Loan Apply Online

To apply for L&T Finance Personal Loan online you can follow the steps below:

- Click here to visit [L&T Finance personal loan page] (We have partnered with Urban Money to cater L&T Finance Personal Loan)

- Step 1: Provide the Personal details, such as your Name, Mobile Number, Email ID, Pan, date of Birth and Pincode.

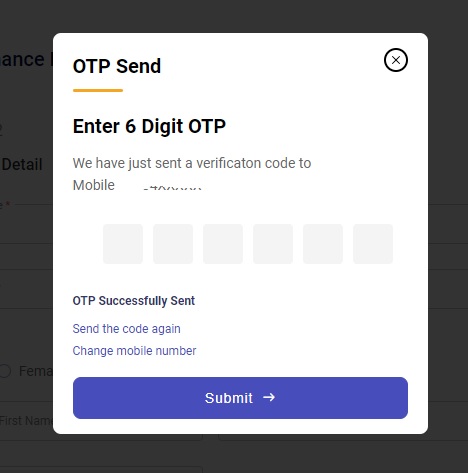

- Step 2: Enter the OTP recieved on your mobile number. If you are eligible, complete the online application form. Provide accurate and complete information, including contact information, employment details, income details, and any other information required.

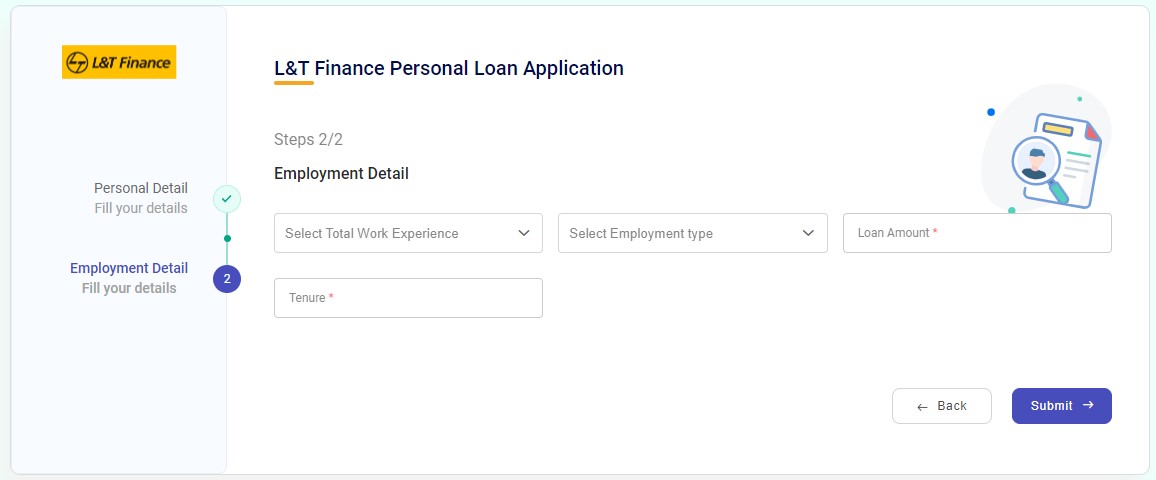

- Step 3: Enter employment details such as Work Experience, Salaried/Self Employed and enter loan amount and tenure your required.

- Step 4: Gather the necessary documents as specified by Urban Money. These may include proof of identity, address proof, income proof, bank statements, and any other supporting documents.

- Step 5: Scan or take clear photos of your documents and upload them securely through the Urban Money website or mobile app. Ensure the documents are legible and in the required format (PDF, JPEG, etc.).

- Step 6: Urban Money will review your loan application and documentation. They may contact you for any additional information or clarification if needed.

- Step 7: If your application meets the eligibility criteria and is approved, Urban Money will provide you with a loan offer via sms or email.

- Step 8: If you are satisfied with the loan offer, accept it by clicking on the link provided in the sms. The loan amount will be disbursed to your registered bank account upon acceptance.

The online application process for L&T Finance Personal Loan is simple and hassle-free. You can complete it within minutes from the comfort of your home or office. You don’t need to visit any branch or office of L&T Finance.

L&T Finance Personal Loan Interest Rate

One of the most important factors that you should consider before applying for a personal loan is the interest rate.

The current interest rates for L&T Finance Personal Loan is 12% to 24% per annum.

But how does the interest rate for L&T Finance Personal Loan compare with other personal loan providers in the market? Let’s take a look at some of them:

| Personal Loan Provider | Interest Rate |

|---|---|

| HDFC Bank | 10.75% – 21.30% |

| ICICI Bank | 11.25% – 22% |

| Bajaj Finserv | 12.99% – 16% |

| Axis Bank | 12% – 24% |

| Aditya Birla Capital | 13% – 24% |

As you can see from the table above, the interest rate for L&T Finance Personal Loan is competetive to most of the other personal loan providers.

Therefore, if you are looking for a personal loan that offers low interest rates, L&T Finance Personal Loan is the way to go.

L&T Finance Personal Loan Fees and Charges

| Fee/Charge | Personal Loan | Micro Loan |

|---|---|---|

| Processing fee | Up to 2% of the outstanding principal amount + taxes | 1% of the loan amount + taxes |

| Payment bounce charges | Rs 350 + taxes (if any) | Nil |

| Late payment interest | 3% per month on the overdue EMI | Nil |

| Part prepayment charges | Up to 5% of the prepaid amount + taxes (Part prepayment of around 25% is allowed twice per year) | Nil |

| Foreclosure charges | 5% of the outstanding principal amount + taxes | Nil |

| Annual maintenance charges | Nil | Nil |

| Legal/recovery charges | As applicable | As applicable |

| Duplicate NOC charges | Rs 250 + taxes | Rs 250 + taxes |

| Repayment swap charges (per swap) | Rs 500 + taxes | Rs 500 + taxes |

| SOA/RPS/FC letter & other documents charges | Nil | Nil |

L&T Finance Personal Loan Eligibility

Another important factor that you should consider before applying for a personal loan is the eligibility criteria. The eligibility criteria are the minimum requirements that you need to fulfill in order to qualify for a personal loan from L&T Finance.

The eligibility criteria for L&T Finance Personal Loan are as follows:

- You must be an Indian citizen and resident.

- You must be between 21 and 60 years of age.

- You must have a minimum monthly income of Rs. 25,000.

- You must have a good credit history and score of at least 650.

- You must have a stable source of income and employment.

- You must have max 2 inquiries in last month.

In addition to the eligibility criteria, you also need to submit some documents along with your application form. These documents are required to verify your identity, address, income, and other details.

Documents Required for L&T Finance Personal Loan

- Identity proof (Aadhaar card, PAN card, passport, etc.)

- Address proof (utility bill, rent agreement, etc.)

- Income proof (salary slip, bank statement, IT returns, etc.)

- Photographs

You need to submit these documents in a clear and legible format. You can either scan them or take photos of them and upload them through the online application process.

L&T Finance also offers some special eligibility criteria and offers for specific categories of borrowers, such as:

- Women: Women borrowers can avail lower interest rates and higher loan amounts from L&T Finance Personal Loan.

- Self-employed: Self-employed borrowers can avail L&T Personal Loan without any income proof if they have a good credit score and bank statement.

- Senior citizens: Senior citizens can avail L&T Personal Loan with a longer repayment tenure and lower processing fees.

Therefore, if you meet the eligibility criteria and have the required documents, you can easily apply for L&T Finance Personal Loan.

L&T Finance Personal Loan Contact Number

If you need any assistance or guidance in applying for L&T Finance Personal Loan, you can contact L&T Finance for more information or queries. You can reach them through their contact number or email id, which are:

Contact number: 1800-209-4747

Email id: customercare@ltfs.com

Benefits of L&T Finance Personal Loan

The last but not the least factor that you should consider before applying for a personal loan is the benefits.

Some of the benefits of L&T Finance Personal Loan are:

- Low interest rates: As we have seen earlier, L&T Finance Personal Loan offers low interest rates that help you save money on interest payments. You can also enjoy lower interest rates if you are a woman, self-employed, or senior citizen borrower.

- Flexible repayment options: L&T Finance Personal Loan allows you to choose a repayment tenure that suits your needs and budget. You can repay the loan in easy monthly installments (EMIs) ranging from 12 to 48 months. You can also prepay or foreclose the loan without any penalty charges after paying a certain number of EMIs.

- Minimal processing fees: L&T Finance Personal Loan charges a nominal processing fee of up to 2% of the loan amount. This fee covers the cost of processing your loan application and documentation. There are no hidden or extra charges involved in L&T Finance Personal Loan.

- No collateral, guarantor, or security required: L&T Finance Personal Loan is an unsecured loan, which means that you don’t need to pledge any collateral, guarantor, or security to avail the loan. This makes the loan process faster and easier for you.

- Simple and hassle-free online application process: As we have seen earlier, L&T Finance Personal Loan has a simple and hassle-free online application process that saves time and effort.

- Instant approval and disbursal of funds: L&T Finance Personal Loan provides instant approval and disbursal of funds within 24 hours of applying. You can get the money in your bank account as soon as your loan application is approved.

These are some of the benefits and advantages of choosing L&T Finance Personal Loan over other personal loan options.

Conclusion

To conclude, L&T Finance Personal Loan is one of the best personal loan products in the market that offers low interest rates, flexible repayment options, and instant approval and disbursal of funds. It is also easy to apply for L&T Finance Personal Loan online through Rapidloans.in in partnership with Urban Money.

If you are looking for a personal loan that meets your needs and expectations, you should definitely consider L&T Finance Personal Loan as your first choice.

So, what are you waiting for? Apply for L&T Finance Personal Loan today and get ready to fulfill your dreams.

FAQs

What is the minimum and maximum loan amount that I can avail from L&T Personal Loan?

The minimum loan amount that you can avail from L&T Finance Personal Loan is Rs. 50,000 and the maximum loan amount is Rs. 7,00,000. The actual loan amount that you can get depends on your eligibility criteria, such as your income, credit score, repayment capacity, etc.

What is the minimum and maximum repayment tenure that I can choose from L&T Finance Personal Loan?

The minimum repayment tenure that you can choose from L&T Finance Personal Loan is 12 months and the maximum repayment tenure is 48 months. You can select a tenure that suits your needs and budget.

How long does it take to get approval and disbursal of funds from L&T Finance Personal Loan?

It takes very little time to get approval and disbursal of funds from L&T Finance Personal Loan. Once you submit your online application form and documents, you will get an instant approval decision from Urban Money. If your application is approved, you will get a loan offer from Urban Money that will include details such as the loan amount, interest rate, repayment tenure, and any applicable fees or charges. If you accept the loan offer, the loan amount will be disbursed to your registered bank account within 24 hours of applying.

Can I prepay or foreclose my L&T Finance Personal Loan before the end of the tenure?

Yes, you can prepay or foreclose your L&T Finance Personal Loan before the end of the tenure without any penalty charges after paying a certain number of EMIs. For example, if you have a loan tenure of 24 months, you can prepay or foreclose your loan without any charges after paying 12 EMIs.

How can I contact L&T Finance for any queries or complaints regarding my personal loan?

You can contact L&T Finance for any queries or complaints regarding your personal loan through their customer care number or email id. Their customer care number is 1800-209-4747 and their email id is customercare@ltfs.com.