If you’re looking for a quick and easy way to get cash, you may have heard of MoneyTap Instant Personal Loan. With its digital platform, you can apply for a loan, get approved and receive funds in a matter of minutes.

But what is it really like to use MoneyTap? In this MoneyTap review, we’ll take a closer look at the features, interest rates and overall experience of using MoneyTap Instant Personal Loan.

Whether you’re facing an unexpected expense or looking to make a big purchase, we’ll give you the information you need to decide if MoneyTap is the right choice for you.

So, if you’re in need of some extra cash and want a simple and convenient solution, read on for our MoneyTap Instant Personal Loan review.

How it works : Moneytap instant personal loans

MoneyTap Instant Personal Loan is all about making it easy for you to access funds when you need them. Whether you’re facing an unexpected expense or looking to make a big purchase, MoneyTap is here to help.

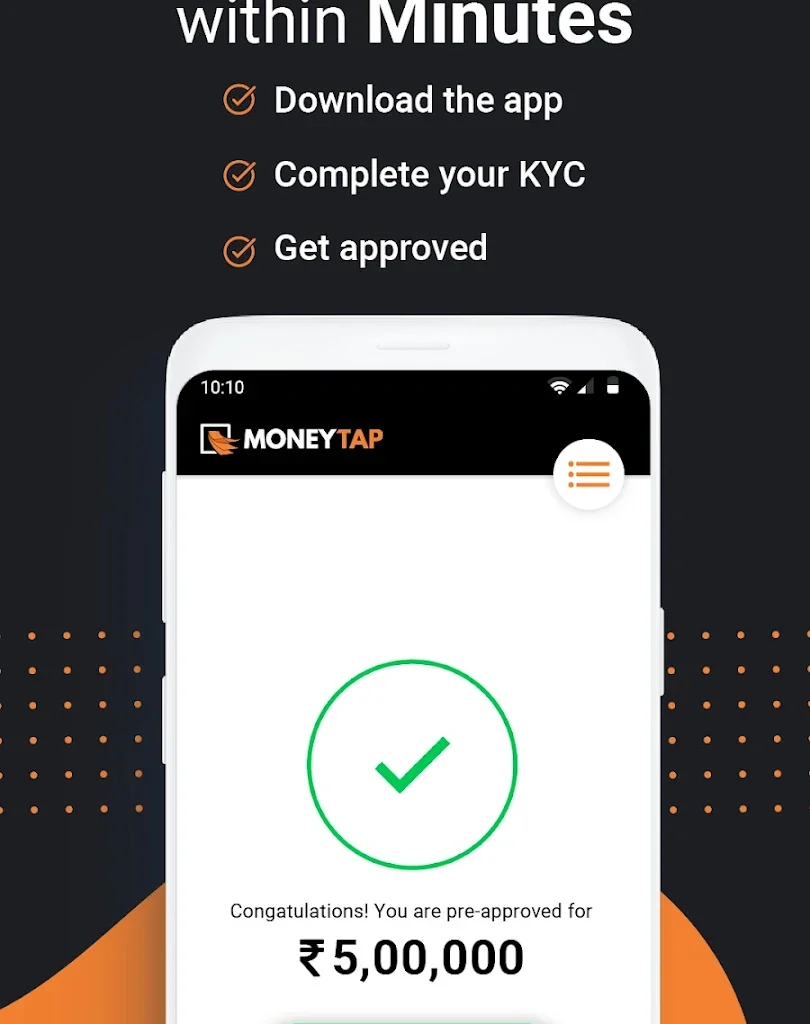

The loan application process is simple and can be completed entirely online, through the MoneyTap app or website. All you have to do is download the app, sign up by providing your personal and financial details, and you’re ready to go.

You can apply for a loan by choosing the amount and repayment period that works for you. Once you submit your application, you’ll get an instant loan eligibility decision.

If approved, you’ll have to complete a few more formalities like e-KYC and loan agreement, and then the money will be transferred to your account within minutes.

The best part? You can repay the loan in easy monthly instalments, on a schedule that works for you. No more waiting in long lines or dealing with mountains of paperwork, MoneyTap makes it easy to get the cash you need, when you need it.

Interest Rates of Moneytap

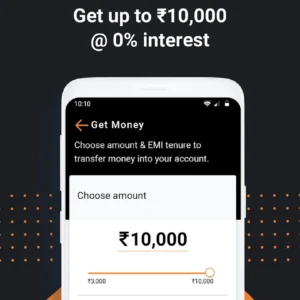

MoneyTap Instant Personal Loan offers competitive interest rates for borrowers.

Along with an interest rate, there is a nominal processing fee of 0.75-1% of the loan amount.

The interest rate can range from 12% to 24% per annum, depending on various factors such as credit score, loan amount, and loan term.

To get an exact interest rate, borrowers can use MoneyTap’s loan calculator or contact the customer care number.

Additionally, it’s important to note that MoneyTap is an NBFC (Non-Banking Financial Company) approved by Reserve Bank of India (RBI), providing easy and hassle-free personal loans through its credit line feature.

Eligibility Criteria of Moneytap Credit Line

- Should be either a salaried employee or a self-employed professional, such as a lawyer, doctor, or businessman.

- Should have a stable income, with a minimum monthly income of at least Rs. 15,000.

- Should be between the ages of 23 and 55

- If you’re a salaried employee, you should have been in your current job for at least 6 months and have an overall work experience of at least 2 years.

- If you’re self-employed, you should have been in your business for at least 3 years and have an overall work experience of at least 3 years.

To sum up, MoneyTap Instant Personal Loan is a great option for anyone looking for a personal loan with low salary, but before you apply, make sure you meet the above criteria.

Required Documents for Moneytap

When it comes to getting a loan with MoneyTap Instant Personal Loan, the process is quick and easy, but there are a few key documents you’ll need to have on hand. Here’s a list of what you’ll need to gather before you apply:

- A valid government-issued photo ID such as Aadhaar card, PAN card, or Voter ID

- Proof of income, like salary slips or bank statements, or ITR

- Bank account statements from the last 6 months

- Proof of address, like utility bills, passport or driving license

- PAN Card

- A few passport sized photographs

Think of it like a checklist, gather these documents before you apply.

MoneyTap has an in-app document verification feature where you can upload all the required documents. After successful verification, you will receive your loan approval.

Credit Line and Repayment of MoneyTap Instant Personal Loan

- Credit Line: The maximum credit limit offered by MoneyTap is up to INR 5 Lakhs.

- Repayment Tenure: The loan tenure can range from a minimum of 2 months to a maximum of 36 months, which can be decided by the borrower based on their convenience.

It’s important to note that the exact credit limit and repayment terms may vary based on the borrower’s individual circumstances. Borrowers should review the terms and conditions on MoneyTap’s website or contact MoneyTap customer service for more information.

Fees and Charges of Moneytap Credit Line

- One-time Line Setup Fee: Rs. 499 + GST

- Interest rate: The interest rate on MoneyTap loans ranges from 12%-24% per annum and can vary based on factors such as the loan amount, credit score, and loan tenure.

- Late payment fee: If a borrower misses a loan installment payment, they will be charged a late payment fee of 15% of the principal amount overdue.

- Prepayment fee: If a borrower chooses to pay off their loan before the end of the loan tenure, they will be charged a prepayment fee.

- Processing Fee: (Every time you withdraw money from the app, you are charged a nominal processing fee + GST only on the amount that you use.) 2% on the amount of cash transferred

It’s important to note that the fees and charges may vary based on the loan amount, loan tenure, and the borrower’s individual circumstances. Borrowers should review the fees and charges on MoneyTap’s website or contact MoneyTap customer service for more information.

Moneytap Customer Service

There are several ways to connect with MoneyTap’s customer service team:

- MoneyTap does not have a dedicated customer care number. However, there are still several ways to connect with their customer service team:

- Email: Borrowers can send an email to the MoneyTap customer service team on “hello@moneytap.com“, they will receive a response within 24 hours.

- Live chat: MoneyTap has a live chat feature on their website and app, where borrowers can speak to a customer service representative in real-time.

- Social Media: MoneyTap also have social media handles like Facebook, Twitter, Instagram, etc. where you can reach out to them for any assistance.

- FAQs: MoneyTap also have a FAQ section on their website which can be helpful for borrowers to clear their doubts or have a basic understanding about the loan process.

It’s important to note that for security reasons, MoneyTap may ask for personal information to verify the borrower’s identity when connecting with customer service.

1 thought on “MoneyTap Instant Personal Loan: Review, Features and Interest Rates”