Do you need money urgently for your personal or business needs? Are you looking for a hassle-free and quick way to get a loan without any collateral or paperwork? If yes, then you should consider applying for Moneywide Personal Loan.

Moneywide is a leading fintech company that provides instant personal loans up to 3 lakh with minimal documentation and fast approval.

You can use Moneywide personal loan for any purpose, such as medical emergencies, home renovation, education, travel, wedding, debt consolidation, or business expansion.

Moneywide personal loan has many benefits over other traditional or online lenders. Some of the benefits are:

- Low interest rates: Moneywide personal loan has competitive interest rates that vary depending on your credit score, loan amount, and loan tenure. You can get a loan at an interest rate as low as 16% per annum.

- Flexible repayment options: You can choose your loan tenure from 3 to 24 months and pay back your loan in easy EMIs as per your convenience. You can also prepay or foreclose your loan without any extra charges or penalties.

- No hidden charges: Moneywide personal loan has no hidden charges and only charges a nominal processing fee and GST on the loan amount. You can see the exact fees and charges before applying for the loan.

- No collateral required: You do not need to pledge any asset or security to get Moneywide personal loan. Your credit score and income are enough to qualify you for the loan.

In this article, I will discuss the eligibility criteria, interest rates, fees and charges, benefits, and application process of Moneywide personal loan. By the end of this article, you will know how to get up to 3 lakh in minutes by applying online for Moneywide personal loan.

Eligibility Criteria for Moneywide Personal Loan

To apply for Moneywide personal loan, you need to meet the following eligibility criteria:

- You must be an Indian citizen

- You must be above 18 years of age

- You must have a monthly income of at least 25,000

- You must have a valid PAN card and Aadhaar card

- You must have a bank account with net banking facility

If you meet these criteria, you are eligible to apply for Moneywide personal loan.

Interest Rates of Moneywide Personal Loan

Moneywide personal loan has competitive interest rates that vary depending on your credit score, loan amount, and loan tenure. The higher your credit score, the lower your interest rate. The table below shows the interest rates for different loan amounts and tenures.

| Loan Amount | Loan Tenure | Interest Rate |

|---|---|---|

| 10,000 | 3 months | 24% |

| 50,000 | 6 months | 20% |

| 1 lakh | 12 months | 18% |

| 2 lakh | 24 months | 14% |

| 3 lakh | 36 months | 12% |

As you can see, the interest rate decreases as the loan amount and tenure increase. Therefore, you should choose your loan amount and tenure wisely to save on interest costs.

Fees and Charges for Moneywide Personal Loan

Moneywide personal loan has no hidden charges and only charges a nominal processing fee and GST on the loan amount. The table below shows the fees and charges for different loan amounts and tenures.

| Fee Type | Amount |

|---|---|

| Interest rate | 12% to 32% |

| Processing fee | 2.5% of the loan amount, ₹ 1,000* |

| Partpayment charges | 3% of the prepaid amount after 1st EMI |

| Foreclosure charges | 4% of the outstanding amount after 1st EMI |

*You can see that the processing fee is a fixed 2.5% of the loan amount, with a minimum of ₹ 1,000.

The GST is calculated at 18% of the processing fee. The partpayment and foreclosure charges are applicable only if you want to repay your loan before the due date.

ALSO READ: Navi Personal Loan Review: Benefits & features and How to Apply, Get a Quick and Easy Personal Loan Upto 20 Lakh with Navi App

Benefits of Moneywide Personal Loan

Moneywide personal loan has many advantages over other traditional or online lenders. Some of the benefits are:

- Instant approval and disbursal: You can get your loan approved and credited to your bank account within minutes after submitting your application. You do not have to wait for days or weeks to get your money.

- Minimal documentation: You only need to upload your PAN card and Aadhaar card as proof of identity and income. No need to submit any other documents or paperwork. You can complete the entire process online without visiting any branch or office.

- Flexible repayment: You can choose your loan tenure from 3 to 24 months and pay back your loan in easy EMIs as per your convenience. You can also prepay or foreclose your loan without any extra charges or penalties.

- No collateral: You do not need to pledge any asset or security to get Moneywide personal loan. Your credit score and income are enough to qualify you for the loan. You do not have to worry about losing your property or valuables in case of default.

Moneywide personal loan is a convenient and affordable option for your urgent financial needs. You can use it for any purpose, such as medical emergencies, home renovation, education, travel, wedding, debt consolidation, or business expansion.

How to Apply for Moneywide Personal Loan

To apply for Moneywide personal loan, you need to follow these steps:

- CLICK HERE or Below apply button to visit personalised page for Moneywide personal loan.

- Enter mobile and email and click apply, You will be redirected to google play store.

- Download the Moneywide instant loan app from Google Play Store or App Store.

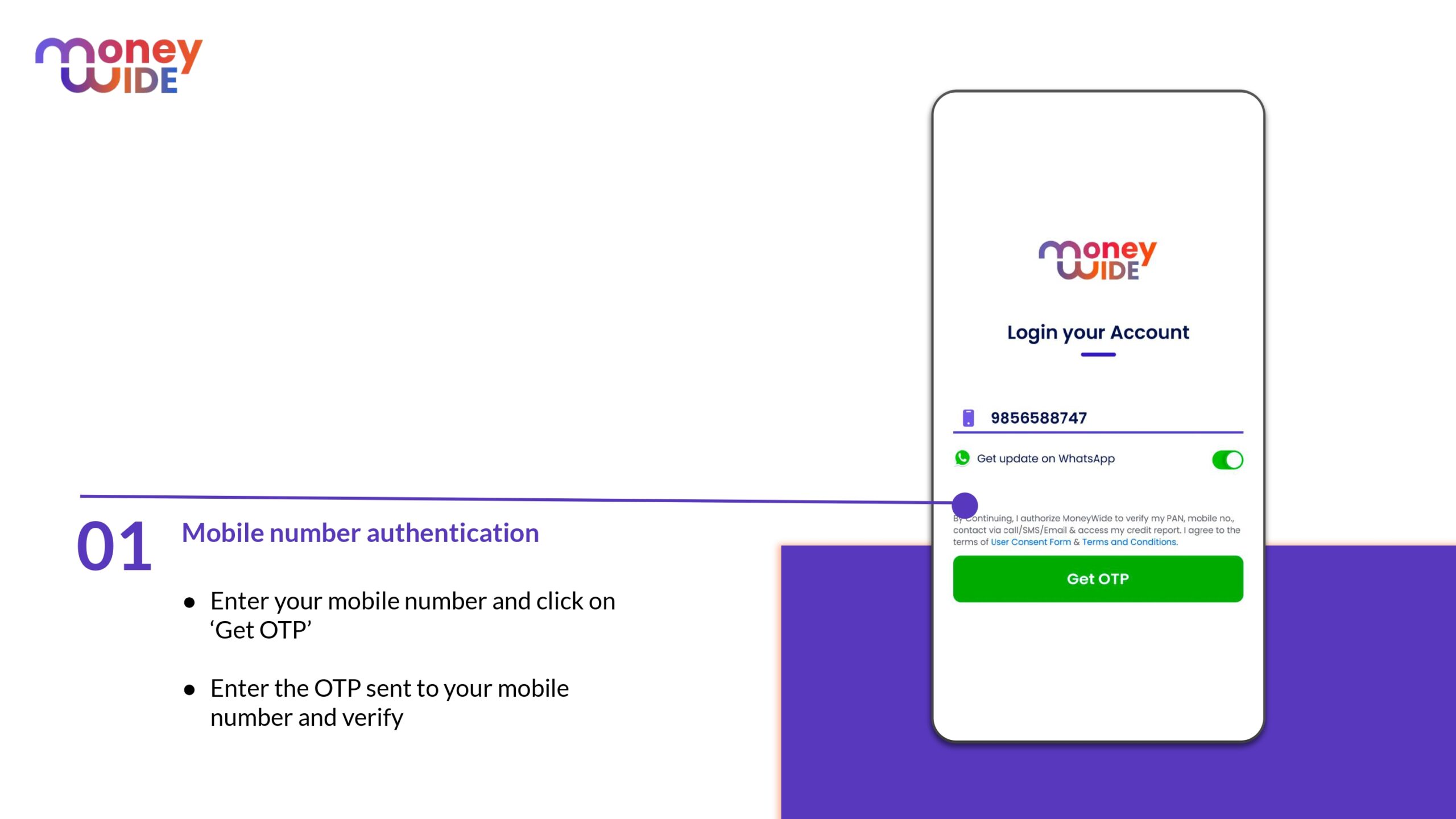

- Register with your mobile number and verify it with an OTP.

- Fill in your personal and financial details and upload the required documents.

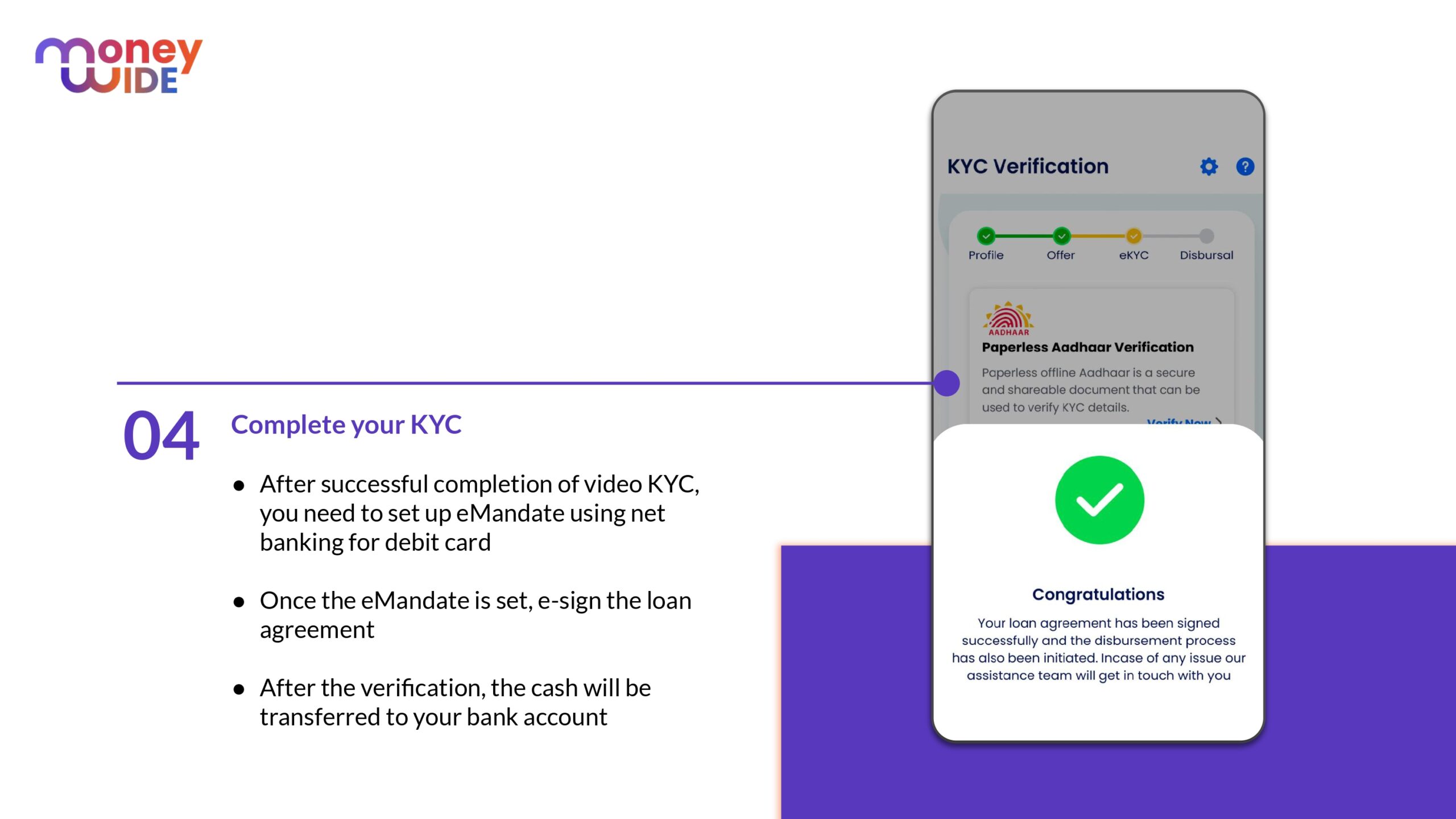

- Choose your desired loan amount and tenure and move to complete the KYC.

- Complete aadhaar based KYC and submit your application.

- Get instant approval and disbursal of funds in your bank account within minutes.

Need money fast?

Apply for Moneywide Personal Loan today and get instant approval and disbursal of up to Rs. 3 lakhs at attractive interest rates and zero hidden charges

The application process is simple and fast. You can get your loan in minutes without any hassle.

What is the customer care number for Moneywide?

If you have any queries or complaints or need assistance with Moneywide personal loan, you can contact their customer care number at +91-9911862226 The customer care executives are available 24/7 to help you with any issues or doubts.

Conclusion

Moneywide personal loan is a convenient and affordable option for your urgent financial needs. You can get up to 3 lakh in minutes by applying online with minimal documentation and fast approval. You can also enjoy low interest rates, flexible repayment options, no hidden charges, and no collateral required.

If you are interested in Moneywide personal loan, you can download the app now and get started or call +91-9911862226 for any queries. Moneywide customer care number is available 24/7 to assist you with any doubts or issues.

Don’t let your financial worries stop you from achieving your goals. Apply for Moneywide personal loan today and get the money you need in minutes.

FAQs

What is Moneywide Personal Loan?

Moneywide is a digital lending platform that offers instant personal loans up to Rs. 3 lakhs without any branch visits, at affordable interest rates and zero hidden charges. The entire process takes less than 5 minutes for approval and instant disbursal. You can also apply using the Moneywide app for a quick loan process with minimum documentation, part-payment and foreclosure.

What are the eligibility criteria for Moneywide Personal Loan?

To apply for Moneywide, you must meet the following eligibility criteria:

You must be between 21 to 55 years of age.

You must have a net monthly income of Rs. 20,000 and above.

You must have a current work experience of 2 months and above.

You must have a total work experience of minimum 2 years.

You must have a credit score of 650 or above.

What are the documents required for Moneywide Personal Loan?

It requires minimum KYC and income documents for a loan. You need to provide your PAN card, Aadhaar card, bank statement and salary slip as proof of identity, address and income.

How can I apply for Moneywide Personal Loan?

You can apply for Moneywide Personal Loan online or by downloading the Moneywide app from Google Play Store. You need to fill the application form online, get instant approval, complete e-KYC and verification, and get funds in your account.

How much loan amount can I get from Moneywide Personal Loan?

You can get a loan amount ranging from Rs. 20,000 to Rs. 3 lakhs from Moneywide Personal Loan, depending on your eligibility and credit profile. Moneywide also offers new to credit personal loans for customers who do not have a credit history, up to Rs. 1 lakh.

What are the interest rates and charges for Moneywide Personal Loan?

The interest rates for Moneywide Personal Loan vary from 18% to 35%, depending on your loan amount, tenure and credit score. The processing fees are 3.75% to 4% of the loan amount. The foreclosure charges are 4% of the outstanding principal amount.

How can I repay my Moneywide Personal Loan?

You can repay your Moneywide Personal Loan through the app or web login using various modes such as UPI, debit card, net banking or wallet. You can also use the EMI calculator to determine your repayment amounts and interest charges. You can also avail the facility of part-payment or foreclosure after paying the first EMI.