As one of the leading providers of personal loans in India, Hero Fincorp offers a range of loan options with competitive interest rates and flexible repayment terms.

In this article, we will explore Hero Fincorp personal loan Interest Rates, eligibility criteria, required documentation, and application process.

So, whether you need funds for a medical emergency, home renovation, or travel expenses, read on to find out how Hero Fincorp can help you fulfill your financial needs.

Hero Fincorp Personal Loan Types

Hero Fincorp offers different types of personal loans to cater to the needs of various borrowers. Here are the types of personal loans offered by Hero Fincorp:

- Wedding Loan: Hero Fincorp’s Wedding Loan is designed to cover the expenses associated with a wedding. The loan amount can range from INR 1 lakh to INR 15 lakhs, with a repayment tenure of up to 60 months.

- Travel Loan: Hero Fincorp’s Travel Loan is ideal for those who want to explore the world or go on a vacation. The loan amount can range from INR 1 lakh to INR 15 lakhs, with a repayment tenure of up to 60 months.

- Medical Loan: Hero Fincorp’s Medical Loan is designed to cover medical expenses such as surgery, hospitalization, and treatment costs. The loan amount can range from INR 1 lakh to INR 20 lakhs, with a repayment tenure of up to 60 months.

- Home Renovation Loan: Hero Fincorp’s Home Renovation Loan is ideal for those who want to renovate their home. The loan amount can range from INR 1 lakh to INR 15 lakhs, with a repayment tenure of up to 60 months.

- Debt Consolidation Loan: Hero Fincorp’s Debt Consolidation Loan is designed to help borrowers consolidate their existing debts. The loan amount can range from INR 1 lakh to INR 15 lakhs, with a repayment tenure of up to 60 months.

Hero Fincorp Personal Loan Interest Rates

Hero Fincorp offers personal loans with competitive interest rates that vary based on the applicant’s profile and loan amount.

As of March 2023, Hero Fincorp Personal Loan Interest Rates range from 11.50% to 19.99% per annum. The interest rate depends on factors such as credit score, loan amount, repayment tenure, and employment type.

Hero Fincorp also charges a processing fee ranging from 1% to 2% of the loan amount.

The interest rate and processing fee are subject to change at the discretion of the lender. Overall, Hero Fincorp personal loan interest rates are relatively competitive compared to other lenders in India.

Fees and Other Charges comes with Hero Fincorp Personal Loan

| Fees & Charges | Details |

|---|---|

| Interest Rate | Starting at 11.50% p.a. |

| Processing Fee | Up to 2.5% of the loan amount |

| Prepayment Charges | Up to 4% of the outstanding principal amount |

| Foreclosure Charges | Up to 5% of the outstanding principal amount |

| Late Payment Penalty | 2% per month on the outstanding EMI amount |

| Cheque Bounce Charges | Rs. 750 per bounce |

| Statement of Account | Rs. 500 per request |

| CIBIL Report Charges | Rs. 50 per report |

| Legal Charges | At actuals |

| Stamp Duty and other charges | As per applicable laws and regulations |

Hero Fincorp Personal Loan Eligibility Criteria

To avail a personal loan from Hero Fincorp, the borrower must meet certain eligibility criteria. Here are the eligibility criteria for availing a personal loan from Hero Fincorp:

- Age: The borrower must be between 21 and 58 years of age.

- Occupation: The borrower must be either salaried or self-employed.

- Work experience: The borrower must have a minimum work experience of 2 years.

- Monthly income: The minimum monthly income for salaried individuals is INR 15,000, and for self-employed individuals, it is INR 25,000.

Documentation Required for Hero Fincorp Personal Loan

When applying for a personal loan from Hero Fincorp, you will need to submit certain documents. Here’s a list of the basic documents needed for both salaried and self-employed individuals:

- Identity proof (Aadhaar card, PAN card, passport, or voter ID)

- Address proof (Aadhaar card, passport, or utility bills)

- Income proof (salary slips or income tax returns)

- Bank statements for the last 3-6 months

Additionally, salaried individuals may need to submit:

- Employment certificate or offer letter

- Form 16 or income tax returns

And self-employed individuals may need to submit:

- Business proof (such as business registration certificate or GST certificate)

- Proof of business existence (such as trade license or shop establishment certificate)

- Business financials (such as balance sheet and profit and loss statement)

Make sure you have these documents handy when applying for a personal loan from Hero Fincorp.

How to Apply for Hero Fincorp Personal Loan ?

- Install the Hero Fincorp app By Clicking Here.

- Enter you name and Email Address then click on apply and you will be redirected to Play Store to download the app.

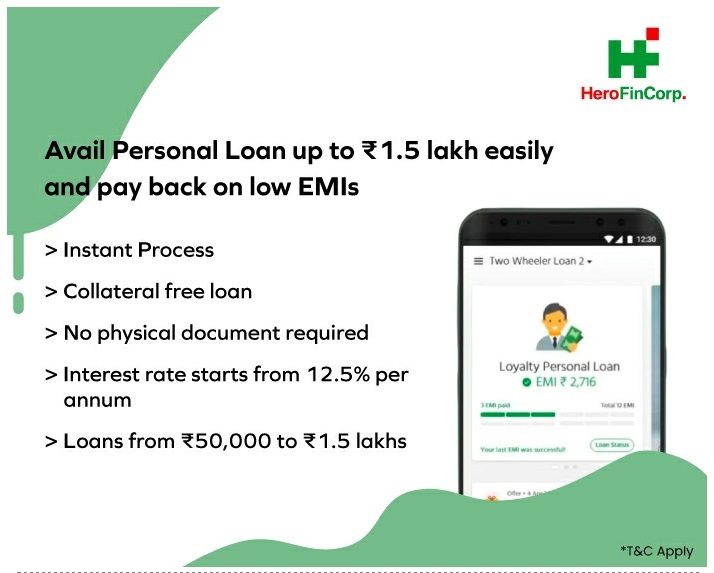

- Choose your desired loan amount, up to a maximum of INR 1.5 lakhs, and your preferred EMI.

- Enter your basic personal details, such as your name, income, purpose of the loan, and PAN card number.

- Complete the KYC (know your customer) process, which typically involves submitting a photo ID and address proof.

- Input your bank account details where you want the loan amount to be credited.

- Wait for real-time approval of your loan application.

- Digitally sign the eMandate and loan agreement.

- Once your loan is approved, the amount will be credited to your bank account.

In addition to these steps, it’s important to ensure that you meet the eligibility criteria and have all the necessary documents before applying for a personal loan with Hero Fincorp.

Final Words

Overall, Hero Fincorp Personal Loan can be a good option for those looking for a quick and easy loan without the need for collateral or guarantor. However, it is important to carefully consider the eligibility criteria, interest rates, and fees before applying for a loan.

FAQS (Frequently Asked Questions)

What is the minimum and maximum loan amount offered by Hero Fincorp for personal loans?

The minimum loan amount offered is Rs. 50,000, while the maximum loan amount can go up to Rs. 20 lakhs.

What is the repayment tenure for personal loans from Hero Fincorp?

The minimum loan amount offered is Rs. 50,000, while the maximum loan amount can go up to Rs. 20 lakhs

What is the minimum age requirement to apply for a personal loan from Hero Fincorp?

The minimum age requirement for salaried individuals is 21 years, while it is 25 years for self-employed individuals.

How long does it take for Hero Fincorp to approve a personal loan application?

Hero Fincorp typically approves personal loan applications within 24 to 48 hours of receiving all the required documents.

What is the processing fee charged by Hero Fincorp for personal loans?

Hero Fincorp charges a processing fee of up to 2.5% of the loan amount, subject to a minimum of Rs. 1,999.

Can I prepay my personal loan from Hero Fincorp? Are there any charges for prepayment?

Yes, you can prepay your personal loan from Hero Fincorp. There are no prepayment charges for loans up to Rs. 25,000. For loans above Rs. 25,000, a prepayment charge of 5% of the outstanding principal is applicable.

What is the maximum loan amount that I can get based on my monthly income?

The maximum loan amount that you can get depends on various factors, including your monthly income, credit score, and other eligibility criteria.

What is the interest rate charged by Hero Fincorp for personal loans?

The interest rate for personal loans from Hero Fincorp starts from 11.50% p.a.

What are the documents required for self-employed individuals to apply for a personal loan from Hero Fincorp?

Self-employed individuals are required to submit a few additional documents compared to salaried individuals. The list of documents includes proof of business existence, business address proof, and audited financial statements of the business.

Can I apply for a Hero Fincorp personal loan online?

Yes, Hero Fincorp provides an online application facility for personal loans. You can visit the official website of Hero Fincorp and fill in the required details to apply for a personal loan.