Are you looking for a personal loan to meet your financial needs? Do you want to get a loan at a competitive interest rate and flexible repayment options? If yes, then you might want to consider Tata Capital personal loan.

Tata Capital is one of the leading non-banking financial companies (NBFCs) in India that offers various types of loans, such as personal loan, car loan, education loan, etc.

Tata Capital personal loan is a multipurpose loan that can be used for any personal or professional need, such as home renovation, wedding, travel, medical emergency, debt consolidation, etc.

But before you apply for Tata Capital personal loan, you need to know its interest rate and how it compares with other lenders.

That’s why in this article, we will review Tata Capital personal loan and tell you how to get upto 35 lakh instantly at an interest rate of 10.99%. We will also cover the benefits, eligibility criteria, documents required, application process, and Tata Capital personal loan Interest Rate.

So, if you are interested in getting a personal loan from Tata Capital, read on to find out everything you need to know.

ALSO READ: Fullerton Personal Loan: Apply Instant Personal Loan Online up to 25 Lakh, Explore Interest Rates & Eligibility.

Benefits of Tata Capital Personal Loan

Tata Capital personal loan comes with many benefits that make it an attractive option for borrowers. Some of the benefits are:

- Flexible loan amount and tenure: You can borrow any amount from Rs. 75,000 to Rs. 35 lakh depending on your eligibility and requirement. You can also choose any tenure from 12 months to 72 months as per your convenience.

- Competitive interest rate and low processing fee: Tata Capital personal loan interest rate starts from 10.99% per annum and varies depending on your credit profile and loan parameters. The processing fee is also low at up to 2.75% of the loan amount plus GST.

- Minimal documentation and quick approval: You don’t need to submit any collateral or guarantor for Tata Capital personal loan. You just need to provide some basic documents such as identity proof, address proof, income proof, etc. The approval process is also fast and hassle-free.

- Multiple repayment options and prepayment facility: You can repay your Tata Capital personal loan in easy EMIs through ECS, NACH, or post-dated cheques. You can also prepay your loan partially or fully after paying 6 EMIs with a nominal prepayment fee of 4% of the outstanding principal plus GST.

- Online loan application and management: You can apply for Tata Capital personal loan online through its website or mobile app. You can also check your loan status, EMI schedule, repayment history, etc. online through the customer portal.

Here is a table that summarizes the benefits of Tata Capital personal loan:

| Benefit | Description |

|---|---|

| Loan amount | Rs. 75,000 to Rs. 35 lakh |

| Loan tenure | 12 months to 72 months |

| Interest rate | 10.99% to 19.00% per annum |

| Processing fee | Up to 2.75% of the loan amount plus GST |

| Documentation | Minimal and paperless |

| Approval | Quick and easy |

| Repayment | Flexible and convenient |

| Online | Application and management |

As you can see, Tata Capital personal loan offers many advantages that make it a suitable choice for your personal finance needs.

Eligibility Criteria for Tata Capital Personal Loan

To apply for Tata Capital personal loan, you need to meet some eligibility criteria that are based on your age, income, employment status, credit score, etc. The eligibility criteria are:

- Age limit: You should be between 21 to 58 years of age at the time of applying for the loan.

- Income requirement: You should have a minimum monthly income of Rs. 20,000 if you are salaried or Rs. 2 lakh if you are self-employed.

- Employment status: You should be working with a reputed organization or running a profitable business for at least 2 years.

- Credit score: You should have a minimum credit score of 650 or above with no defaults or delays in your credit history.

Documents Required for Tata Capital Personal Loan

Along with the eligibility criteria, you also need to submit some documents that verify your identity, address, income, etc. The documents required are:

- Identity proof: Any one of Aadhaar card, PAN card, passport, voter ID card, driving license, etc.

- Address proof: Any one of electricity bill, water bill, telephone bill, gas bill, rent agreement, etc.

- Income proof: For salaried – last 3 months salary slips and bank statements; for self-employed – last 2 years IT returns, balance sheet, profit and loss account, and bank statements.

- Loan application form: Filled and signed by the applicant with passport size photograph.

These are the basic eligibility criteria and documents required for Tata Capital personal loan. However, Tata Capital may ask for additional documents or information as per its discretion and policy.

How to Apply for Tata Capital Personal Loan Online

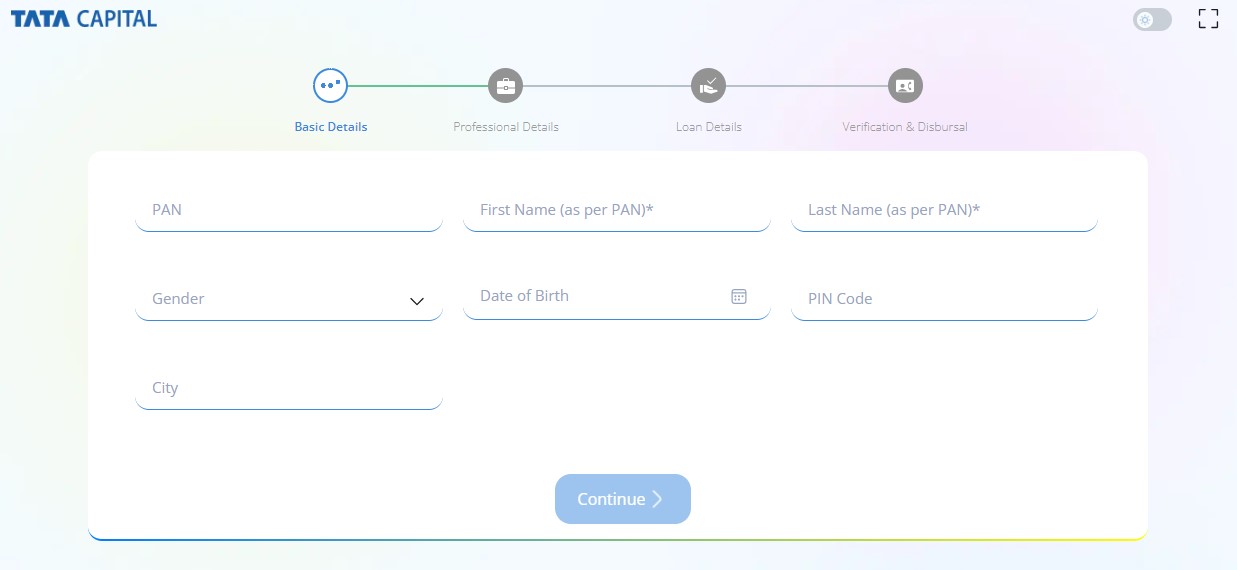

If you meet the eligibility criteria and have the documents ready, you can apply for Tata Capital personal loan online in a few simple steps. Here is how you can do it:

- Visit Tata Capital official website by CLICKING HERE

- Click on “Personal Loan” under the “Loans” menu and click on Apply Now button.

- Fill in the online application form with your personal and professional details, such as name, date of birth, gender, email, phone number, address, income, employer, etc.

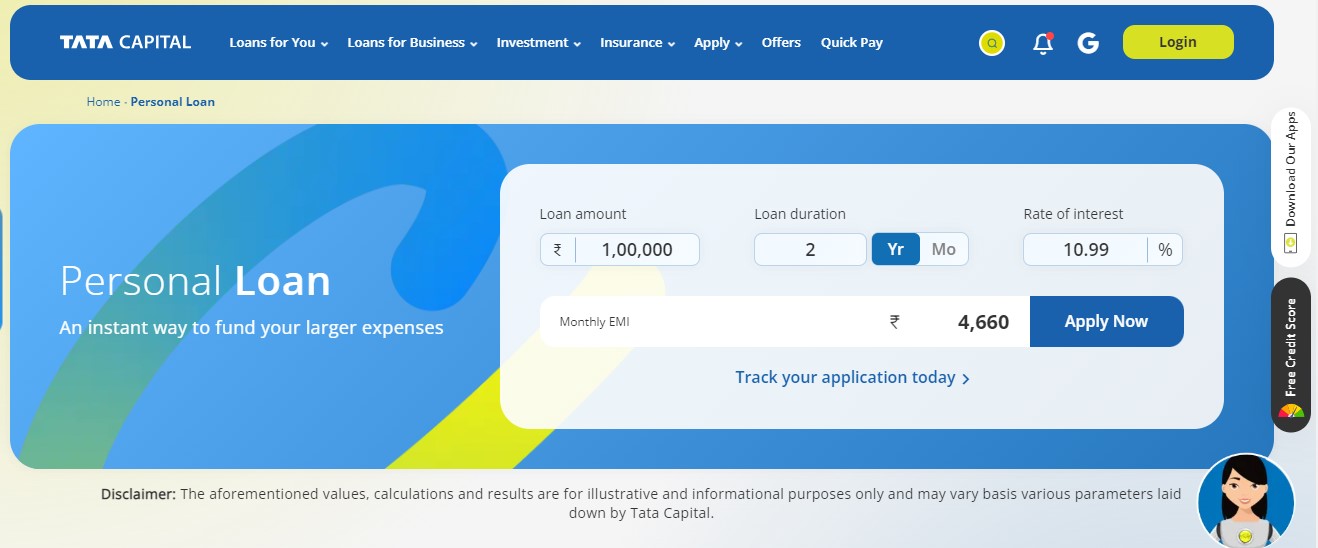

- Choose your desired loan amount and tenure from the available options. You can also use the EMI calculator to check your monthly installment and interest rate.

- Upload the required documents and submit the form. You will get an instant approval and a verification call from Tata Capital within a few minutes.

- Receive the loan amount in your bank account within 24 hours after completing the verification and signing the loan agreement.

That’s it! You have successfully applied for Tata Capital personal loan online and got upto 35 lakh instantly at an interest rate of 10.99%.

Tata Capital Personal Loan Interest Rate and Other Charges

One of the most important factors that you should consider before applying for a personal loan is the interest rate. The interest rate determines how much you have to pay back to the lender over the loan tenure. The lower the interest rate, the lower the EMI and the total interest cost.

Tata Capital personal loan interest rate is calculated based on various factors, such as:

- Loan amount and tenure: The higher the loan amount and the longer the tenure, the higher the interest rate may be. This is because the lender has to bear more risk and cost of lending a large amount for a long period.

- Income and repayment capacity: The higher your income and better your repayment capacity, the lower the interest rate may be. This is because the lender has more confidence in your ability to repay the loan on time and without default.

- Credit score and history: The higher your credit score and better your credit history, the lower the interest rate may be. This is because your credit score reflects your creditworthiness and past behavior as a borrower.

- Relationship with Tata Capital: If you are an existing customer or employee of Tata Capital, you may get a lower interest rate or special offers on your personal loan. This is because of your loyalty and trust with Tata Capital.

The current Tata Capital personal loan interest rate range is 10.99% to 19.00% per annum. However, this may vary depending on your individual profile and loan parameters.

You can check your exact interest rate by applying online or contacting Tata Capital customer care.

Apart from the interest rate, there are some other charges that you may have to pay for Tata Capital personal loan, such as:

- Processing fee: This is a one-time fee that is charged by Tata Capital for processing your loan application and disbursing the loan amount. The processing fee for Tata Capital personal loan is up to 2.75% of the loan amount plus GST.

- Prepayment fee: This is a fee that is charged by Tata Capital if you want to prepay your loan partially or fully before the end of the tenure. The prepayment fee for Tata Capital personal loan is 4% of the outstanding principal plus GST after paying 6 EMIs.

- Late payment fee: This is a fee that is charged by Tata Capital if you fail to pay your EMI on time or miss it altogether. The late payment fee for Tata Capital personal loan is 2% per month on overdue amount plus GST.

- Cheque bounce fee: This is a fee that is charged by Tata Capital if your cheque or ECS gets bounced due to insufficient funds or any other reason. The cheque bounce fee for Tata Capital personal loan is Rs. 450 per bounce plus GST.

As you can see, Tata Capital Personal Loan Interest Rate and other charges are reasonable and competitive compared to other lenders in the market.

Tata Capital Personal Loan Customer Care

If you have any queries, complaints, or feedback regarding Tata Capital personal loan, you can contact the customer care unit of the company through various channels, such as:

- Phone: You can call the customer care number 1860 267 6060 from Monday to Saturday between 9:00 a.m. and 8:00 p.m. (closed on Sundays and public holidays). This number is not toll-free and standard calling charges may apply.

- Email: You can send an email to customercare@tatacapital.com or contactus@tatacapital.com with your query or concern. You should mention your name, loan account number, contact details, and query details in the email.

- Online: You can visit the official website of Tata Capital and fill up the online form under the “Contact Us” section. You need to provide your name, mobile number, email ID, product type, loan account number, and query details in the form and submit it. You will get a response from the customer care team soon.

- Branch: You can visit the nearest branch of Tata Capital and talk to the loan officer or manager regarding your query or concern. You can locate the branch using the online branch locator tool on the website.

- WhatsApp: You can scan the QR code on the website or save the number 7506756060 on your phone and send a WhatsApp message to Tata Capital. You can get instant information about your loan status, EMI schedule, repayment history, etc. through this service.

These are the various ways you can contact Tata Capital personal loan customer care and get your issues resolved. You can also check out the FAQs section on the website for some common queries and answers.

Conclusion

Tata Capital personal loan is a good choice for anyone who wants to get a personal loan at a competitive interest rate and flexible repayment options.

Tata Capital personal loan offers many benefits, such as flexible loan amount and tenure, minimal documentation and quick approval, multiple repayment options and prepayment facility, online loan application and management, etc.

Tata Capital personal loan also has some eligibility criteria and documents required, such as age limit, income requirement, employment status, credit score, identity proof, address proof, income proof, etc.

Tata Capital personal loan interest rate starts from 10.99% per annum and varies depending on your credit profile and loan parameters. Tata Capital personal loan also has some other charges, such as processing fee, prepayment fee, late payment fee, cheque bounce fee, etc.

Tata Capital personal loan has received mixed customer reviews and ratings from various sources, such as Google reviews, Trustpilot reviews, Bankbazaar reviews, etc.

If you are interested in getting a personal loan from Tata Capital, you can apply online through its website or mobile app or contact its customer care for any queries or assistance.

We hope this article has helped you understand Tata Capital personal loan better and make an informed decision.

Apply for Tata Capital personal loan online today

get upto 35 lakh instantly at an interest rate of 10.99%.

FAQs

How much can I borrow from Tata Capital personal loan?

You can borrow from Rs. 75,000 to Rs. 35 lakh, depending on your eligibility and requirement.

What is the interest rate for Tata Capital personal loan?

The interest rate starts from 10.99% per annum and varies based on your credit profile and loan parameters. You can check your exact rate by applying online or contacting Tata Capital.

What are the eligibility criteria for Tata Capital personal loan?

You should be 21 to 58 years old, have a minimum income of Rs. 20,000 if salaried or Rs. 2 lakh if self-employed, be working or running a business for at least 2 years, and have a credit score of 650 or above with no defaults or delays.

What are the documents required for Tata Capital personal loan?

You need to submit identity proof, address proof, income proof, and loan application form. You can use Aadhaar card, PAN card, passport, etc. as identity proof; electricity bill, rent agreement, etc. as address proof; salary slips, bank statements, IT returns, etc. as income proof; and a filled and signed form with photo as loan application form.

How to apply for Tata Capital personal loan online?

You need to visit www.tatacapital.com and click on “Personal Loan”. Then you need to fill in the online form with your details, choose your loan amount and tenure, upload the documents and submit the form. You will get an instant approval and a verification call. You will receive the loan amount in your account within 24 hours.

How to check the status of Tata Capital personal loan?

You can check the status by calling 1860 267 6060, emailing customercare@tatacapital.com or contactus@tatacapital.com, visiting the nearest branch, or sending a WhatsApp message to 7506756060.

How to prepay or foreclose Tata Capital personal loan?

You can prepay or foreclose after paying 6 EMIs with a fee of 4% of the outstanding principal plus GST. You can prepay upto 25% without any fee or upto 50% with fee during a year. You can foreclose by paying the outstanding principal plus fee plus GST. You need to contact Tata Capital customer care or visit the nearest branch to start the process.