Small businesses form the backbone of our economy, and the State Bank of India (SBI) understands that. That’s why they’ve come up with e-Mudra, a loan specifically designed to cater to the needs of small businesses. But what is e-Mudra exactly? Well, sit back, relax, and let me explain.

this loan is perfect for small business owners who are looking to expand their operations. In this blog, we will take a closer look at the SBI e-Mudra loan and what it has to offer.

We will cover everything from eligibility requirements, interest rates, and features to the step-by-step process of “SBI e mudra loan apply online 50000.” So, sit back, grab a cup of coffee, and let’s dive into the world of e-Mudra loans!

Why Should You consider SBI e-Mudra loan?

SBI e-Mudra loan is the perfect solution for all your financial needs. Here are some reasons why:

- Flexibility – With e-Mudra, you can choose the loan amount that suits your business’s requirements, whether it’s Rs. 50,000 or Rs. 10 lakhs.

- Easy Eligibility – SBI has made it easier than ever for small businesses to apply for loans. All you need is a viable business plan and proof of profits, and you’re good to go!

- Speed – With e-Mudra, you can say goodbye to long wait times and endless paperwork. The application process is quick and easy, and the loan is disbursed in no time.

- Helps Small Businesses Grow – Whether you need to upgrade your equipment or expand your business, e-Mudra has got you covered. With the loan, you can take your business to new heights, and who doesn’t love heights, right?

So, what are you waiting for? If you’re a small business owner, apply for e-Mudra today and watch your business soar!

Features of SBI e-Mudra Loan

Greetings folks, let’s dive into the details of the SBI e-Mudra loan. Are you ready to take your business to the next level? Then this is the place for you!

First off, you’ll be happy to know that the maximum loan amount you can get from e-Mudra is a whopping Rs. 10 lakhs! That’s a lot of cash to help you achieve your business goals, so listen up.

Catagories of SBI E mudra loan

The loan is split into three categories: Shishu, Kishore, and Tarun. Don’t worry, it’s not as confusing as it sounds. Let me break it down for you.

Shishu

This loan category is perfect for those just starting out with their businesses. The most you can borrow is Rs. 50,000. All you need to do is present a solid business plan and show how your business is going to make money. Think of it like a job interview with a bank. Impress them, and the money is yours!

Kishore

If you’re an established business looking to upgrade your equipment or expand, then Kishore is the loan category for you. You can borrow anywhere between Rs. 50,001 to Rs. 5,00,000. Just show the bank your profit margins, explain how the upgrades will improve your profits, and voila! You’re one step closer to a successful business.

Tarun

Finally, we have Tarun. This loan category is for established businesses looking to make big upgrades. You can borrow a minimum of Rs. 5,00,001 and a maximum of Rs. 10,00,000. You’ll need to prove your profits, show the need for upgrades, and explain how it’ll help your business grow. It’s like putting on your best suit and tie for a big job interview. Show the bank you mean business and you’ll get the loan!

| Loan Catagory | Amount |

|---|---|

| Shishu | Up to Rs. 50,000 |

| Kishore | Rs. 50,001 – Rs. 5,00,000 |

| Tarun | Rs. 5,00,001 – Rs. 10,00,000 |

So, there you have it folks, the different loan categories of SBI e-Mudra loan. I hope this helps you choose which category is right for you and your business.

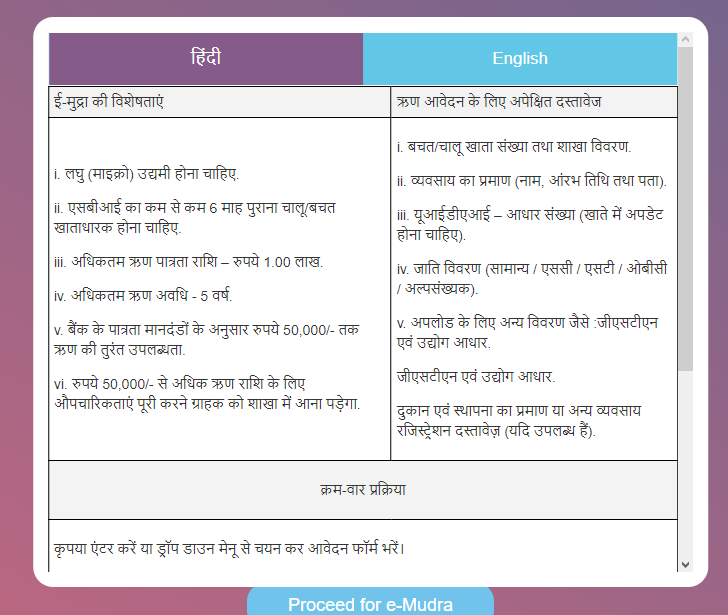

Documents Required for SBI e-Mudra loan

Are you ready to boost your small business to the next level with SBI’s e-Mudra loan? Great decision!

Before you hit the “apply now” button and start counting down the minutes until your loan is approved, there’s one more important step to take. you need to make sure you have all the necessary documents in place.

Don’t worry, it’s not as bad as it sounds. So let’s take a look at what you’ll need:

- Proof of identity: A government-issued photo ID, like your PAN card or Aadhaar card.

- Proof of address: A recent utility bill, like electricity or water, that has your name and address on it.

- Business registration: If you’re applying for a loan for your business, you’ll need to provide proof of business registration, such as a certificate of incorporation or a GST registration certificate.

- Financial statements: You’ll need to provide proof of income and profitability, such as your latest bank statement or balance sheet.

- Business plan: This is your chance to show SBI what you’re all about. Your business plan should include details of your business model, target market, and growth plans.

It’s not a lot of work, right? So gather your documents, take a deep breath, and hit that “submit” button. Good luck!

How to apply for SBI e-Mudra Loan Online : Step by Step Application Process

Are you ready to take your small business to the next level? Well, we have some good news for you!

You can now apply for a loan from the comfort of your own home. That’s right, folks! No more waiting in long lines at the bank, no more filling out endless pages of paperwork. With SBI’s e-Mudra loan, you can apply for a loan online.

Here’s a step-by-step guide to help you navigate the online loan application process:

- First things first, head on over to the SBI e-Mudra loan online portal and click the ‘Proceed for e-Mudra’ option.

- A popup will appear, displaying instructions in both Hindi and English. Skim through it and click ‘Ok’, it’s not like a pop quiz so take your time.

- You will now be redirected to a new page where you will be asked to choose a language to proceed. Select one and click ‘Proceed’.

- Enter your mobile number, SBI savings or current account number, and loan amount. Enter the Captcha and verify.

- Fill out the online SBI e-Mudra loan application form and upload the necessary documents.

- Accept the Terms and Conditions by e-signing, just like you do when you sign up for a new social media app.

- Provide your Aadhaar number to consent to the use of your Aadhaar for e-signing.

- You will now receive an OTP on your registered mobile phone number. Fill in the blanks and voila! You’ve finished your loan application.

If you’re looking for a more in-depth and comprehensive guide to the SBI e-Mudra loan application process, we recommend checking out this fantastic video tutorial by MyOnlineCA.

The creator walks you through the entire process, from start to finish, making it easy to understand and follow along.

Conclusion

In conclusion, SBI e-Mudra loan is the perfect financial solution for small businesses in India looking for a quick, efficient, and accessible loan. With a maximum loan value of up to Rs. 10 lakhs, there is something for everyone.

Whether you’re a new entrepreneur just starting out and need a Shishu loan, or an established business looking to expand with a Tarun loan, SBI has got you covered.

So why not take advantage of this fantastic opportunity today and give your business the financial boost it needs to grow and succeed?

Apply for e-Mudra loan and join the thousands of small businesses in India who have already benefited from this innovative and life-changing loan product.