Do you want to save money on your credit card bills and enjoy amazing rewards and offers?

If yes, then you need a lifetime free credit card in India.

A lifetime free credit card is a credit card that does not charge any annual fee or renewal fee for as long as you use it. This means you can save thousands of rupees every year and use that money for other things.

But that’s not all.

A lifetime free credit card also gives you other benefits such as cashback, reward points, discounts, vouchers, lounge access, fuel surcharge waiver and more. You can use these benefits to make your spending more rewarding and enjoyable.

Sounds good, right?

But how do you find the best lifetime free credit card in India 2023?

There are hundreds of credit cards available in the market, but not all of them are lifetime free. Some of them charge a hefty annual fee or have hidden charges that can eat into your savings.

That’s why we have done the research for you and found the 5 best lifetime free credit card in India 2023 that offer you the best value for money. These credit cards have no annual fees, no hidden charges and no worries.

In this article, we will tell you everything you need to know about these 5 best lifetime free credit card in India 2023 and how you can apply for them. So let’s get started.

IDFC FIRST Millenia Credit Card

The IDFC FIRST Millenia Credit Card is one of the best lifetime free credit card in India 2023 that offers you a whopping 10% cashback on your first transaction within 90 days of card issuance. This means you can get up to Rs.1000 back on your first purchase with this card.

Some of the features and benefits of this card are:

- 6% cashback on all your online spends and 3% cashback on all your offline spends with this card. There is no limit on how much cashback you can earn with this card. You can redeem your cashback as a statement credit or use it to pay your bills.

- No joining fee or annual fee for this card. You also get a low interest rate of 9% p.a. on revolving credit and EMI transactions.

- Free personal accident insurance cover of Rs.2 lakh.

- Low fees and charges compared to other credit cards. For example, the interest rate of this card is 9% p.a., while other credit cards charge up to 42% p.a.

If you want to apply for this card or learn more about it, click here.

AU Xcite Credit Card

The AU Xcite Credit Card is another best lifetime free credit card in India 2023 that offers you a generous 5% cashback on all your online shopping and bill payments. This means you can save money on your e-commerce purchases, mobile recharges, utility bills, OTT subscriptions and more.

Some of the features and benefits of this card are:

- 2% cashback on all your other spends with this card. There is no minimum transaction amount or maximum cashback limit for this card. You can redeem your cashback as a statement credit or use it to pay your bills.

- No joining fee or annual fee for this card. You also get complimentary airport lounge access twice every quarter at select domestic airports.

- Fuel surcharge waiver of up to Rs.100 per month.

- Low fees and charges compared to other credit cards. For example, the interest rate of this card is 18% p.a., while other credit cards charge up to 42% p.a.

If you want to apply for this card or learn more about it, click here.

AU LIT Credit Card

The AU LIT Credit Card is another best lifetime free credit card in India 2023 that offers you a stunning 10% cashback on all your entertainment and dining spends. This means you can save money on your movie tickets, streaming services, restaurants, cafes and more.

Some of the features and benefits of this card are:

- 5% cashback on all your fuel and grocery spends and 2% cashback on all your other spends with this card. There is no minimum transaction amount or maximum cashback limit for this card. You can redeem your cashback as a statement credit or use it to pay your bills.

- No joining fee or annual fee for this card. You also get complimentary movie tickets worth Rs.500 every month and dining vouchers worth Rs.500 every quarter.

- Fuel surcharge waiver of up to Rs.100 per month.

- Low fees and charges compared to other credit cards. For example, the interest rate of this card is 18% p.a., while other credit cards charge up to 42% p.a.

If you want to apply for this card or learn more about it, click here.

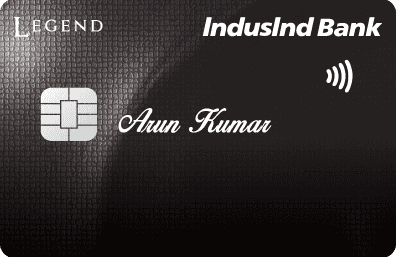

IndusInd Legend Credit Card

The IndusInd Legend Credit Card is another best lifetime free credit card in India 2023 that offers you a rewarding reward points program. You get 4 reward points per Rs.100 spent on weekdays and 8 reward points per Rs.100 spent on weekends with this card. You can redeem your reward points for a variety of options such as air miles, gift vouchers, merchandise, etc.

Some of the features and benefits of this card are:

- Complimentary golf lessons and green fee waiver at select golf courses across India with this card. You also get complimentary Priority Pass membership and domestic lounge access at select airports with this card.

- No joining fee or annual fee for this card. You also get a low interest rate of 15% p.a. on revolving credit and EMI transactions.

- Fuel surcharge waiver of up to Rs.250 per month.

- Low fees and charges compared to other credit cards. For example, the interest rate of this card is 15% p.a., while other credit cards charge up to 42% p.a.

If you want to apply for this card or learn more about it, click here.

HSBC Visa Platinum Credit Card

The HSBC Visa Platinum Credit Card is another best lifetime free credit card in India 2023 that offers you a massive 10% cashback on all your spends in the first 90 days up to Rs.3000 with this card.

This means you can get up to Rs.3000 back on your purchases with this card in the first three months.

Some of the features and benefits of this card are:

- 3X reward points on dining, hotels and telecom spends for the first year with this card. You also get 2 reward points per Rs.150 spent on all other categories with this card. You can redeem your reward points for a variety of options such as air miles, gift vouchers, merchandise, etc.

- No joining fee or annual fee for this card. You also get complimentary airport lounge access twice every year at select domestic airports with this card.

- Fuel surcharge waiver of up to Rs.250 per month.

- Low fees and charges compared to other credit cards. For example, the interest rate of this card is 18% p.a., while other credit cards charge up to 42% p.a.

If you want to apply for this card or learn more about it, click here.

Conclusion

So there you have it. The 5 best lifetime free credit cards in India 2023 that offer you no annual fees, no hidden charges and no worries.

These credit cards are designed to suit your lifestyle and spending habits and give you the best value for money. You can save money on your credit card bills and enjoy amazing rewards and offers with these credit cards.

But don’t wait too long.

These credit cards are in high demand and may not be available for long. So hurry up and apply for your preferred credit card today and enjoy the benefits of a lifetime free credit card in India 2023.

We hope you found this article helpful and informative. If you have any questions or feedback, please leave a comment below. We would love to hear from you.

Thank you for reading and happy saving!😊

FAQs

What is a lifetime free credit card?

A lifetime free credit card is a credit card that does not charge any annual fee or renewal fee for as long as you use it. This means you can save thousands of rupees every year and use that money for other things.

What are the benefits of a lifetime free credit card?

A lifetime free credit card also gives you other benefits such as cashback, reward points, discounts, vouchers, lounge access, fuel surcharge waiver and more. You can use these benefits to make your spending more rewarding and enjoyable.

How to apply for a lifetime free credit card in India 2023?

To apply for a lifetime free credit card in India 2023, you can click on the links provided in this article or visit the official websites of the respective banks or issuers. You will need to fill an online application form and submit the required documents such as identity proof, address proof, income proof, etc. You will also need to meet the eligibility criteria such as age, income, credit score, etc.

Which are the 5 best lifetime free credit card in India 2023?

The 5 best lifetime free credit cards in India 2023 are:

IDFC FIRST Millenia Credit Card

AU Xcite Credit Card

AU LIT Credit Card

IndusInd Legend Credit Card

HSBC Visa Platinum Credit Card

How to choose the best lifetime free credit card in India 2023 for me?

To choose the best lifetime free credit card in India 2023 for you, you need to consider your lifestyle and spending habits and compare the features and benefits of different credit cards. You can use the following factors to compare:

Cashback percentage and categories

Reward points rate and redemption options

Fees and charges

Interest rate

Complimentary offers and services

How to redeem cashback or reward points with a lifetime free credit card in India 2023?

To redeem cashback or reward points with a lifetime free credit card in India 2023, you need to log in to your online account or mobile app and check your balance. You can then choose to redeem your cashback as a statement credit or use it to pay your bills. You can also choose to redeem your reward points for a variety of options such as air miles, gift vouchers, merchandise, etc.

How to cancel a lifetime free credit card in India 2023?

To cancel a lifetime free credit card in India 2023, you need to contact the customer care of the respective bank or issuer and request for cancellation. You will need to clear any outstanding balance and pay any applicable charges before cancelling your card. You will also need to destroy your card physically and confirm the cancellation.