If you’re in the market for a credit card, you’ve probably noticed that there are a lot of options out there. From cashback cards to travel cards, the choices can be overwhelming.

But what if I told you there’s a type of credit card that’s even better than all the rest? That’s right, I’m talking about lifetime free credit cards! These cards offer all the benefits of a traditional credit card, without any pesky annual fees.

And in this blog post, we’re going to take a closer look at the top 5 lifetime free credit cards in India for 2023

Top 5 Lifetime Free Credit Card

- OneCard Credit Card

- Amazon Pay ICICI Bank Credit Card

- Axis Bank My Zone Credit Card

- IDFC First Select Credit Card

- HSBC Visa Platinum Credit Card

All of these cards offer a range of benefits, including cashback, reward points, and discounts on dining, shopping, and travel.

And the best part?

There are no annual fees or hidden charges, making them a great option for anyone looking to save money while enjoying the perks of a credit card.

One Card Credit Card

Let’s start with the One Card Credit Card, which is one of the top lifetime free credit cards in India.

One of the best things about the OneCard Credit Card is that it has relaxed eligibility requirements, making it a great option for those who are new to credit or have a limited credit history. Even if you don’t have a credit score, you can still be approved for this card as long as you meet the other eligibility criteria.

But what if you’re not eligible for the OneCard Credit Card? Don’t worry, there’s still a way for you to get your hands on this fantastic card.

All you need to do is start a Fixed Deposit with one of the partner banks and get a OneCard issued against that deposit. This is a great option for those who may not have a strong credit history but still want to enjoy the benefits of a rewards credit card.

To apply for the One Card Credit Card, simply visit their website and fill in the application form. It’s that easy!

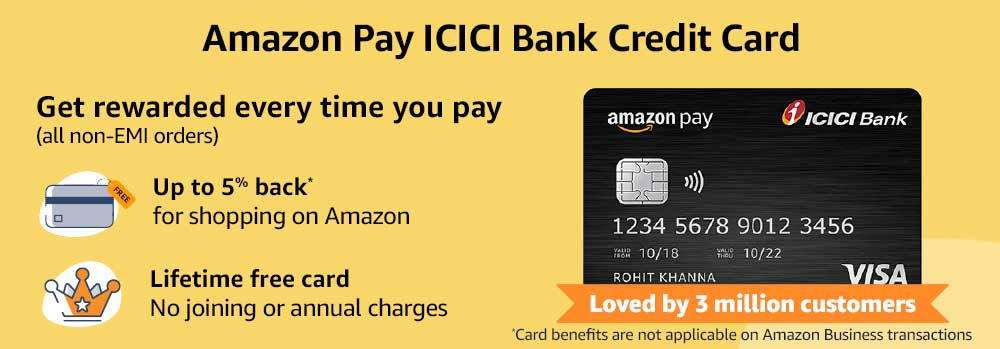

Amazon Pay ICICI Bank Credit Card

Next up, we have the Amazon Pay ICICI Bank Credit Card. If you’re an Amazon addict like me, this card is a no-brainer. Not only do you get rewards on all your Amazon spends, but you also get cashback on other categories like fuel, dining, and utility bills. And yes, you guessed it – no annual fees!

But wait, there’s more. This card also comes with a welcome offer of Rs. 750 cashback when you sign up, and free Amazon Prime membership for a year. So basically, you’re getting paid to shop. Sign me up!

To be eligible for the Amazon Pay ICICI Bank Credit Card, you need to have a minimum income of Rs. 20,000 per month, and a good credit score. To apply, simply visit the ICICI Bank website and fill in the application form.

Axis Bank My Zone Credit Card

Moving on to the Axis Bank My Zone Credit Card, which is perfect for all you movie and dining enthusiasts out there. This card offers cashback on all your dining and movie spends, as well as discounts on dining and entertainment across India. Plus, did I mention there are no annual fees?

To be eligible for the Axis Bank My Zone Credit Card, you need to have a minimum income of Rs. 20,000 per month, and a good credit score. To apply, simply visit the Axis Bank website and fill in the application form.

IDFC First Select Credit Card

If you’re looking for a credit card that offers a little bit of everything, the IDFC First Select Credit Card might just be the one for you. This card offers rewards on all your spends, as well as discounts on dining and movies. Plus, you get free lounge access at airports, and yes, you guessed it – no annual fees!

To be eligible for the IDFC First Select Credit Card, you need to have a minimum income of Rs. 25,000 per month, and a good credit score. To apply, simply visit the IDFC First Bank website and fill in the application form.

HSBC Visa Platinum Credit Card

Last but not least, we have the HSBC Visa Platinum Credit Card. This card is perfect for frequent travelers, as it offers free lounge access at airports, air miles on all your spends, and discounts on travel bookings. And of course, no annual fees!

To be eligible for the HSBC Visa Platinum Credit Card, you need to have a minimum income of Rs. 4,00,000 per annum, and a good credit score. To apply, simply visit the HSBC Bank website and fill in the application form.