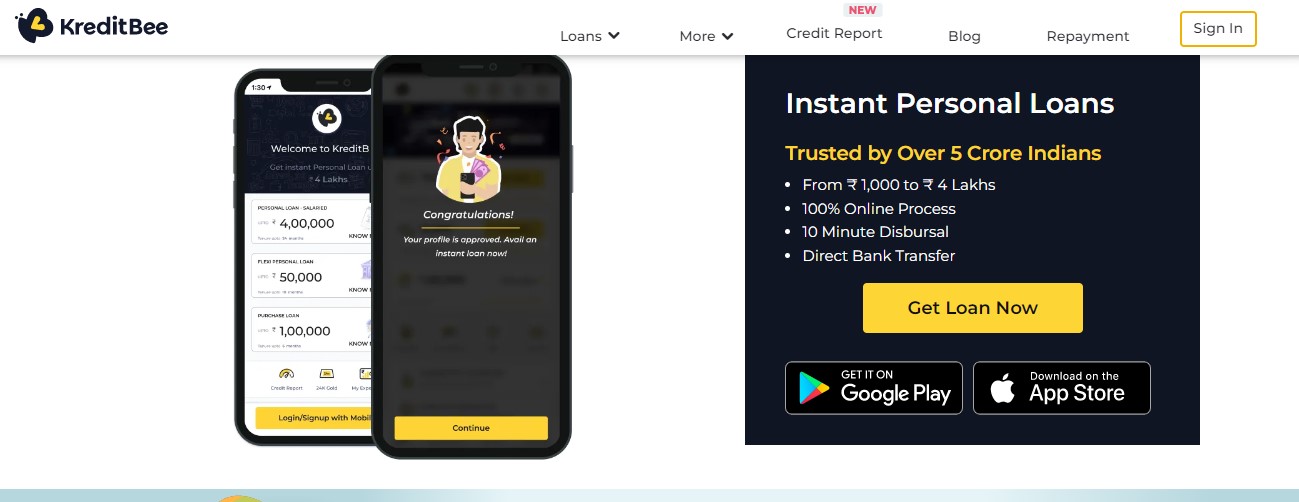

Are you in need of quick and hassle-free personal loans? Look no further than KreditBee. This digital lending platform offers instant personal loans with minimal documentation requirements.

Personal loans can come in handy when you need funds for unexpected expenses, emergencies, or major purchases. They can also help consolidate debts or improve credit scores.

In this article, we’ll delve into the specifics of KreditBee personal loan offerings, including eligibility criteria, interest rates, and frequently asked questions. So, let’s get started!

In this article, you’ll learn:

- The eligibility criteria for KreditBee personal loans

- The interest rates and fees associated with KreditBee loans

- How to apply for a loan with KreditBee

- Answers to frequently asked questions about KreditBee personal loans.

KreditBee Personal Loan Eligibility

Are you wondering if you’re eligible for a KreditBee personal loan? Here’s what you need to know:

Eligibility Criteria

- You must be a citizen of India

- You must be between 21 and 60 years old

- You must have a monthly income of at least Rs. 15,000

- You must have a valid proof of identity, such as an Aadhaar card or passport

Required Documentation

To apply for a KreditBee personal loan, you’ll need to provide the following documents:

- PAN Card

- Aadhaar Card or passport

- A selfie

- A bank statement

Tips for Improving Eligibility

If you don’t meet the eligibility criteria, there are steps you can take to improve your chances of getting approved for a KreditBee personal loan:

- Improve your credit score by paying off existing debts and bills on time

- Increase your income by taking on a side job or freelance work

- Apply with a co-applicant who meets the eligibility criteria

By meeting the eligibility criteria and providing the required documentation, you can increase your chances of getting approved for a KreditBee personal loan.

KreditBee Personal Loan Interest Rates and Fees

When considering a personal loan, it’s essential to understand the interest rates and fees associated with borrowing from KreditBee. Here’s a breakdown of what to expect:

Interest Rates

KreditBee’s interest rates for personal loans range from 18% to 29.95%, depending on various factors such as the loan amount, tenure, credit score, and income.

Processing Fees and Charges

KreditBee charges processing fees for personal loans based on the loan type and amount. Here’s a breakdown of the processing fees:

- For Flexi Personal Loans: Rs 85 to Rs 1,250

- For Personal Loans for Salaried (for loan amount from Rs 10,000 to Rs 3 lakh): Rs 500 to up to 6% of loan amount

- For Online Purchase Loan/E-Voucher Loan: Up to 5% of the loan amount

Additionally, KreditBee charges convenience fees for different payment methods, including bank transfer, net banking, debit card, UPI, and wallet/prepaid. Here are the convenience fees for each method:

- Bank transfer: Nil (borrower’s bank may levy charges for NEFT/IMPS transfer)

- Net banking: Rs 6 to Rs 15 per transaction (depending on the borrower’s bank)

- Debit Card: Less than Rs 2,000: Nil, Above Rs 2,000: 0.90%

- UPI: Rs 5 to Rs 11 per transaction (depending on the borrower’s bank)

- Wallet/Prepaid: Up to 1.90% (depending on the wallet chosen for payment)

Penalty Charges

KreditBee also charges penalty fees for various scenarios. Here’s a breakdown of the penalty charges:

- Penalty Charges for Auto Debit: Rs 100

- Late Payment Charges:

- Flexi Personal Loan:

- For a 2-month loan of Rs 1,000 to Rs 10,000: One-time overdue charge of Rs 10 to Rs 200

- Per day penalty charge: Rs 5 to Rs 75 for every overdue instalment

- Personal Loan for Salaried:

- For a 15-month loan (loan amount of Rs 10,000 to Rs 3 lakh): One-time overdue charge of Rs 500

- Per day penalty charge: 0.15% of the principal amount for every overdue instalment

- Online Purchase Loan/E-Voucher Loan:

- One-time overdue charge: Rs 500

- Per day penalty charge: 0.2% of the principal amount for every overdue instalment

- Flexi Personal Loan:

It’s essential to factor in these fees and charges when calculating the total cost of your loan from KreditBee.

How to Apply for a KreditBee Personal Loan ?

Applying for a personal loan with KreditBee is a straightforward process. Here’s what you need to know:

- Visit the KreditBee website or download the app: To apply for a personal loan, visit the KreditBee website or download the app from the Google Play Store by clicking here.

- Choose your loan amount and tenure: Decide on the loan amount and tenure that suits your needs. KreditBee offers personal loans ranging from Rs.1,000 to Rs.2 lakh with tenures of up to 15 months.

- Submit your documents: To complete your application, you’ll need to upload a few documents, such as your Aadhaar card and PAN card. KreditBee may also require additional documents based on your loan amount and eligibility.

- Wait for approval: Once you’ve submitted your application and documents, KreditBee will review your application and notify you of its decision within a few minutes.

- Receive your funds: If your application is approved, KreditBee will disburse the funds directly to your bank account within a few hours.

Keep in mind that meeting KreditBee’s eligibility criteria and submitting accurate and complete information are essential for a successful application. Additionally, ensure that you have a good credit score and a stable income to increase your chances of approval.

KreditBee Personal Loan Customer Care

In case you have any queries or concerns regarding KreditBee personal loans, their customer care team is available to assist you. Here are the ways to get in touch:

- Call on 080-4429-2200 (call charges may apply)

- Send an email to help@kreditbee.in

- Send a letter to 3rd Floor, No.100, The Royal Stone Tech Park, Benninganahalli, K.R.Puram, Bengaluru, India – 560016

Don’t hesitate to reach out to their customer care team for any assistance you may need.

Conclusion

In conclusion, KreditBee personal loans can be a helpful option for those who need quick access to funds.

To recap, we covered the eligibility criteria, interest rates, fees, application process, and FAQs related to KreditBee personal loans. Remember to check your eligibility and understand the terms and conditions before applying for a loan.

If you are considering a personal loan from KreditBee, our recommendation is to compare the rates and terms with other lenders to make an informed decision.

Additionally, it’s important to have a repayment plan in place to avoid any penalties or negative impact on your credit score.

Overall, KreditBee can be a great option for those in need of a personal loan. If you have any further questions, feel free to check out their website or contact their customer support for assistance.

Click Here to Get Started

Ready to apply for a KreditBee personal loan?

FAQS

How much can I borrow from KreditBee?

You can borrow up to Rs. 3 lakhs for personal loans and up to Rs. 1 lakh for online purchase and e-voucher loans.

What is the repayment period for KreditBee personal loans?

The repayment period for KreditBee personal loans ranges from 2 months to 15 months.

What are the eligibility criteria for KreditBee personal loans?

The eligibility criteria for KreditBee personal loans include being an Indian citizen, being between 21-56 years old, having a monthly income of at least Rs. 15,000, and having a good credit score.

How quickly can I receive funds from KreditBee?

If your application is approved, you can receive funds from KreditBee within 15 minutes.

Can I prepay my KreditBee personal loan?

Yes, you can prepay your KreditBee personal loan at any time without any additional charges.

What happens if I miss a payment for my KreditBee personal loan?

If you miss a payment, KreditBee will charge you a penalty fee based on the loan amount and tenure. It’s important to make payments on time to avoid these charges.

Can I apply for a KreditBee personal loan if I have a low credit score?

KreditBee requires a good credit score for personal loan applications, so it may be difficult to get approved with a low score.

What documents do I need to apply for a KreditBee personal loan?

You will need to provide a government-issued ID, proof of income, and bank statements as part of your application.

What fees and charges do I need to be aware of with KreditBee personal loans?

KreditBee charges processing fees, convenience fees, and penalty fees for late payments. Be sure to read the terms and conditions carefully before applying.

How can I contact KreditBee customer care?

You can reach KreditBee customer care by calling 080-4429-2200, sending an email to help@kreditbee.in, or sending a letter to their address in Bengaluru, India.

Hi

Ashutosh Sir

How Are You

Have A Nice Day

Hi, Gaurav/Aditya 😛

I am good.

and thanks